Worshiping False Profits?

Tonight's offering for your acceptance, submitted by a Naybob of IT, and we approve this message.

Cathal Rabitte posted Why the UK economy was a car crash even before Brexit. Some modified excerpts...

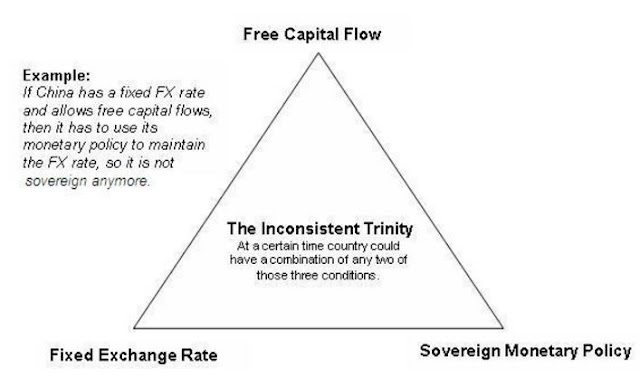

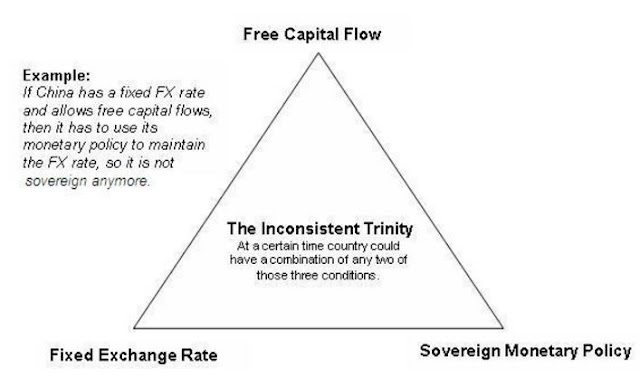

Much like the graphic above demonstrates, where sovereign monetary policy, fixed exchange rates and free capital flows are concerned, as Meatloaf said, "don't be sad, two out of three ain't bad."

To be fair, the blame for this unholy mess cannot wholly be laid upon central bankers. One can however, put the blame on the HOLY TRINITY of policy making:

CORPORATE: outsourcing to labor at the margin, tax and ecological regulation avoidance, lower benefits, union and pension busting resulting in: trade deficits, a surfeit of buybacks and dividends, a dearth of capex, wage suppression, lower real median household income, lower real spending and a lack of a sustainable economic base.

A surfeit of quarterly and annual bonus have magnified short term goals in the board room and executive management, at the cost of long term economic sustainability.

GOVERNMENT: irresponsible, biased to special interests, divisive and polarizing legislative gridlock resulting in deficit budgets, draconian fiscal austerity measures, bringing government spending on much needed animal spirits, education, health and social welfare to a standstill.

When an insular electorate fails to hold their elected representatives culpable and liable, passing the buck and kicking the can become the national past time.

MONETARY: artificial suppression of rates through QE, ZIRP, NIRP and IOER (interest on excess reserves), resulting in: distortion of asset markets, disabling of true price discovery, creation of serial asset bubbles, banking disintermediation, corporate disincentive to invest in economically beneficial activity as opposed to financialism and asset shuffling, extreme reductions in transactional velocity and cessation of monetary flows.

Asset based inflation benefits the few and is counter productive, whereas wage based inflation benefits the many. Remember, your spending is someone's income, and it can only be called capitalism, if capital is freely flowing.

All of the above policy making decisions pander to systemic sponsors, shareholders and constituency. Stemming from an insular electorate which seeks instant gratification at every turn, this short term thinking worships one thing: FALSE PROFITS.

In order for any recovery to occur: True price discovery must be restored. Capital must be encouraged to flow to durable economic investment. A durable economic base must be rebuilt replete with real jobs, real pay, benefits, pensions and wage based inflation.

Time is the threat, exhaustion, pap and socio-economic ruin the inevitable consequence. We must stop treating the holy trinity of policy making like passing fads, and stop worshiping false profits.

Cathal Rabitte posted Why the UK economy was a car crash even before Brexit. Some modified excerpts...

"ZIRP and monetary policy have crippled..... corporate sector isn’t investing in growth... cannot forever rely on low interest rates, property bubbles and equity withdrawal... the current account deficit... growth is happening in crap industries with crap productivity... wage repression."The above modified description could encapsulate: the global mess central banks have created through monetary policy based upon false macroeconomic doctrine, falsity in econometrics, and cannot or seemingly refuse to negotiate their way out of... viz. as painful as that may be to their sponsors and constituency, do the right thing.

Much like the graphic above demonstrates, where sovereign monetary policy, fixed exchange rates and free capital flows are concerned, as Meatloaf said, "don't be sad, two out of three ain't bad."

To be fair, the blame for this unholy mess cannot wholly be laid upon central bankers. One can however, put the blame on the HOLY TRINITY of policy making:

CORPORATE: outsourcing to labor at the margin, tax and ecological regulation avoidance, lower benefits, union and pension busting resulting in: trade deficits, a surfeit of buybacks and dividends, a dearth of capex, wage suppression, lower real median household income, lower real spending and a lack of a sustainable economic base.

A surfeit of quarterly and annual bonus have magnified short term goals in the board room and executive management, at the cost of long term economic sustainability.

GOVERNMENT: irresponsible, biased to special interests, divisive and polarizing legislative gridlock resulting in deficit budgets, draconian fiscal austerity measures, bringing government spending on much needed animal spirits, education, health and social welfare to a standstill.

When an insular electorate fails to hold their elected representatives culpable and liable, passing the buck and kicking the can become the national past time.

MONETARY: artificial suppression of rates through QE, ZIRP, NIRP and IOER (interest on excess reserves), resulting in: distortion of asset markets, disabling of true price discovery, creation of serial asset bubbles, banking disintermediation, corporate disincentive to invest in economically beneficial activity as opposed to financialism and asset shuffling, extreme reductions in transactional velocity and cessation of monetary flows.

Asset based inflation benefits the few and is counter productive, whereas wage based inflation benefits the many. Remember, your spending is someone's income, and it can only be called capitalism, if capital is freely flowing.

All of the above policy making decisions pander to systemic sponsors, shareholders and constituency. Stemming from an insular electorate which seeks instant gratification at every turn, this short term thinking worships one thing: FALSE PROFITS.

In order for any recovery to occur: True price discovery must be restored. Capital must be encouraged to flow to durable economic investment. A durable economic base must be rebuilt replete with real jobs, real pay, benefits, pensions and wage based inflation.

Time is the threat, exhaustion, pap and socio-economic ruin the inevitable consequence. We must stop treating the holy trinity of policy making like passing fads, and stop worshiping false profits.

Comments