Round - O - Blog

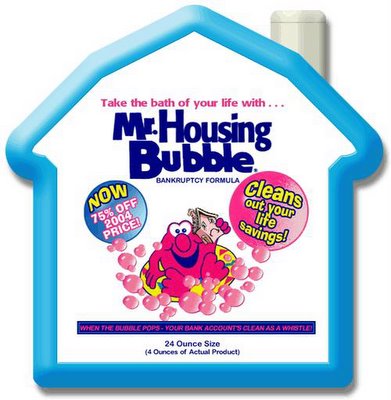

Alternative Mr. Bubble found at Housing Crash

Prudent Investor has this gem on GM and too many derivatives in the hands of too few.

Michael Panzner's latest on a potential derivatives meltdown is a must read. We enjoy Mr. Panzner's viewpoints.

Econbrowser has a good one titled China GDP Statistics which validates one of our positions, the numbers coming out of China make the Fed's GDP, CPI & PPI numbers look squeaky clean.

Even Jim Jubak jumps in on why China is the big danger for deflation.

A tip o the hat to Dr. David Altig at Macroblog for his PCE inflation post.

Rather than reporting a drop in PCE and inflation, Dr. Altig comments "using my preferred measure of PCE core, the conclusion really is inescapable -- the underlying rate of inflation is simply not budging."

We salute him for NOT being a member of S.L.A.P. (Statistical Liars & Academic Prostitutes)

MSN real estate is trumpeting that maybe this is the time to buy foreclosures... and Mish Shedlock comments in his GET analysis..

Kash correlates Barry Ritholtz's "secular view" of interest rates with the Angry Bear's inflation rate in which you can clearly see the oil price shocks and their historical effect on inflation.

Comments