Fed Rate Cut & CPI Fraud "Benefits"

Its a day of benefits and a tribute to the Carpenters, or perhaps I'm still stuck in Room 1408?

Sung to the Carpenter's, We've Only Just Begun... Bill Gross at PIMCO:

"We’ve only begun to see the pain from rising mortgage payments. There are $1 trillion worth of sub-primes, Alt-A's (self-certified) and basically garbage loans."

Gross expects some $250 Billion in defaults. But the Fed thinks "pre-emptive" cuts will save the day by engineering a softer landing. Who benefits from these Fed cuts?

Follow the money... 50 bps Fed funds cut Sept 18, 6 weeks ago, 25 bps Fed funds cut Oct 31st, 6 days ago.

In addition to a total of 75 bps in Fed Discount Window cuts and acceptance of almost any form of collateral, for the banks and Wall Street.

Today, Dollar index at all time low; $ hits record low vs Euro; gold at 27 year high; crude Oil hits all time high over $97.

Since the Sept 18th twin 50bps cuts: ten year bond yields are down 2.5% from 4.46% to 4.34%, while mortgage prices are the same.

The cost of insuring corporate debt has tripled, the dollar is down 5% vs the Euro, gold is up 14% and crude oil is up 20%.

Stagflation of consumable and pump prices has gone through the roof since the cuts.

The banks are borrowing more money at the discount window while the Fed pumps more into the system ($41 Billion last week) ...

Due to the cost of CDO & swaps tripling and rising loan loss & reserve requirements...

Due to escalation of non performing loans (defaults) and downgrades of the mark to fantasy investments they hold.

But who are the banks really borrowing from? You and I, not the Fed.

The money comes from depositors, that being the public. Then goes back to the banks at lower short term rates...

and is then lent back long to the public, at higher rates through mortgages and credit cards.

All to fix the banks balance sheets and help THEM out of the mess they and the FED created. Ty Andros at Finanical Sense in a must read rant:

"Housing is not going to be fixed by lowering rates, and the homeowners will not be saved either. This is only a rescue of WALL STREET and the BIG banks.

I applauded when Hank Paulson was named Treasury Secretary, after the amiable dunces before him.

(You should have danced the "Hanky Skanky" sung to Aerosmith's Dude, Looks Like A Lady.)

As H. L. Mencken said: I have gotten it good and hard as what I wished for is turning into a “monster” of government manipulation and corporatism run riot over the economy."

Every time I see him on the TV screen I shake my head as I “think” I see the horns of the devil rising out of his forehead.

The absurdity of the Fed preemptively addressing problems BEFORE they are real shows what ACADEMIC economists can do; it’s all theory and has no basis in reality!"

Half a Big Mac...

IndyMac cut its dividend in half, eliminated more than 1,500 jobs and increased reserves for bad loans by 47%...

and reported a loss five times bigger than the company forecast in September.

The $202.7 million loss vs a gain of $86.2 million a year earlier, was IndyMac's first loss in over 8 years.

IndyMac was the largest Alt-A home lender in the U.S. in 2006.

Indymac stock's 72% decline this year compares with a 54% drop for Bloomberg's index of 31 mortgage real estate trusts and a 65% slide for Countrywide.

IndyMac last reported a loss in Q4 of 1998, after hedge fund LTCM imploded and Russia defaulted on government bonds, helping to spark a global liquidity crisis.

Fact or Bullshit? ... Fed Head Mishkin: "Changes in price indexes without food and energy provide a clearer picture of underlying inflation pressures.

If the monetary authorities react to headline inflation numbers, they run the risk of responding to merely temporary fluctuations."

Alrighty then, but it would be nice if Fed decisions were based on factual or realistic numbers.

The Fed's preferred inflation measure, the PCE index, minus food and energy, rose 1.8% in the 12 months to August.

The CPI consumer price index, minus food and energy, rose 2.1% for the 12 months that ended in September. Adding food and fuel, the index rose 2.8% for the period.

The Nattering One has often chided about the mythical "core" where food and energy don't exist.

Utilizing a time proven method, (place a leading ONE on dubious goverment numbers), our crack team of bullshit analysts estimates stagflation at 13%.

But Boy! are we conservative... Barry Ritholtz's The Big Picture:

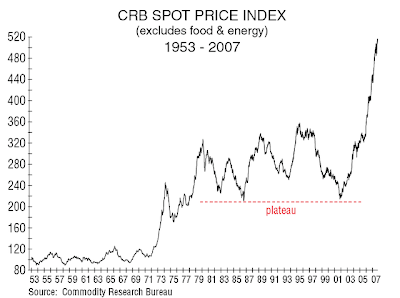

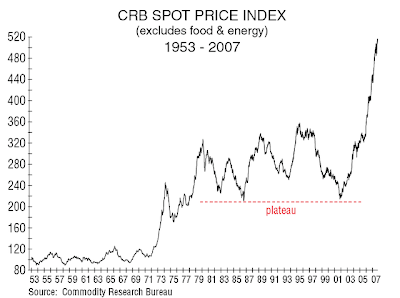

"putting aside the absurdity of ignoring food and energy for a moment, lets take a long term look at price increases WITHOUT food and energy."

The chart above shows us that since 2000, the CRB spot index for commodities less food & energy has gone up 150%. Thats an annual rate of 19% per year.

Ritholtz rants: "Its amazing that some people -- apparently suffering from blunt head trauma -- still take the 1-2% core readings seriously."

Barry then points to his groin (Hoboken-like) with a fisted thumb, and growls: "I got your yer god-damned core right here."

More validation from The Economist: November 1st Commodity Price Index, based on the US dollar, percentage change year over year:

All items +16.6%; Food +32.3%; Non Food Agriculturals +27%. That's right, read it again, ALL ITEMS +16.6%.

GDP +4% minus 17% inflation rate equals 13% negative GDP. Its official, we are not in a recession, we have been and are still in, a double digit depression.

Sung to the Carpenter's, We've Only Just Begun... Bill Gross at PIMCO:

"We’ve only begun to see the pain from rising mortgage payments. There are $1 trillion worth of sub-primes, Alt-A's (self-certified) and basically garbage loans."

Gross expects some $250 Billion in defaults. But the Fed thinks "pre-emptive" cuts will save the day by engineering a softer landing. Who benefits from these Fed cuts?

Follow the money... 50 bps Fed funds cut Sept 18, 6 weeks ago, 25 bps Fed funds cut Oct 31st, 6 days ago.

In addition to a total of 75 bps in Fed Discount Window cuts and acceptance of almost any form of collateral, for the banks and Wall Street.

Today, Dollar index at all time low; $ hits record low vs Euro; gold at 27 year high; crude Oil hits all time high over $97.

Since the Sept 18th twin 50bps cuts: ten year bond yields are down 2.5% from 4.46% to 4.34%, while mortgage prices are the same.

The cost of insuring corporate debt has tripled, the dollar is down 5% vs the Euro, gold is up 14% and crude oil is up 20%.

Stagflation of consumable and pump prices has gone through the roof since the cuts.

The banks are borrowing more money at the discount window while the Fed pumps more into the system ($41 Billion last week) ...

Due to the cost of CDO & swaps tripling and rising loan loss & reserve requirements...

Due to escalation of non performing loans (defaults) and downgrades of the mark to fantasy investments they hold.

But who are the banks really borrowing from? You and I, not the Fed.

The money comes from depositors, that being the public. Then goes back to the banks at lower short term rates...

and is then lent back long to the public, at higher rates through mortgages and credit cards.

All to fix the banks balance sheets and help THEM out of the mess they and the FED created. Ty Andros at Finanical Sense in a must read rant:

"Housing is not going to be fixed by lowering rates, and the homeowners will not be saved either. This is only a rescue of WALL STREET and the BIG banks.

I applauded when Hank Paulson was named Treasury Secretary, after the amiable dunces before him.

(You should have danced the "Hanky Skanky" sung to Aerosmith's Dude, Looks Like A Lady.)

As H. L. Mencken said: I have gotten it good and hard as what I wished for is turning into a “monster” of government manipulation and corporatism run riot over the economy."

Every time I see him on the TV screen I shake my head as I “think” I see the horns of the devil rising out of his forehead.

The absurdity of the Fed preemptively addressing problems BEFORE they are real shows what ACADEMIC economists can do; it’s all theory and has no basis in reality!"

Half a Big Mac...

IndyMac cut its dividend in half, eliminated more than 1,500 jobs and increased reserves for bad loans by 47%...

and reported a loss five times bigger than the company forecast in September.

The $202.7 million loss vs a gain of $86.2 million a year earlier, was IndyMac's first loss in over 8 years.

IndyMac was the largest Alt-A home lender in the U.S. in 2006.

Indymac stock's 72% decline this year compares with a 54% drop for Bloomberg's index of 31 mortgage real estate trusts and a 65% slide for Countrywide.

IndyMac last reported a loss in Q4 of 1998, after hedge fund LTCM imploded and Russia defaulted on government bonds, helping to spark a global liquidity crisis.

Fact or Bullshit? ... Fed Head Mishkin: "Changes in price indexes without food and energy provide a clearer picture of underlying inflation pressures.

If the monetary authorities react to headline inflation numbers, they run the risk of responding to merely temporary fluctuations."

Alrighty then, but it would be nice if Fed decisions were based on factual or realistic numbers.

The Fed's preferred inflation measure, the PCE index, minus food and energy, rose 1.8% in the 12 months to August.

The CPI consumer price index, minus food and energy, rose 2.1% for the 12 months that ended in September. Adding food and fuel, the index rose 2.8% for the period.

The Nattering One has often chided about the mythical "core" where food and energy don't exist.

Utilizing a time proven method, (place a leading ONE on dubious goverment numbers), our crack team of bullshit analysts estimates stagflation at 13%.

But Boy! are we conservative... Barry Ritholtz's The Big Picture:

"putting aside the absurdity of ignoring food and energy for a moment, lets take a long term look at price increases WITHOUT food and energy."

The chart above shows us that since 2000, the CRB spot index for commodities less food & energy has gone up 150%. Thats an annual rate of 19% per year.

Ritholtz rants: "Its amazing that some people -- apparently suffering from blunt head trauma -- still take the 1-2% core readings seriously."

Barry then points to his groin (Hoboken-like) with a fisted thumb, and growls: "I got your yer god-damned core right here."

More validation from The Economist: November 1st Commodity Price Index, based on the US dollar, percentage change year over year:

All items +16.6%; Food +32.3%; Non Food Agriculturals +27%. That's right, read it again, ALL ITEMS +16.6%.

GDP +4% minus 17% inflation rate equals 13% negative GDP. Its official, we are not in a recession, we have been and are still in, a double digit depression.

Comments