Bull Economy 2

Summary

Discussion of the potential effects on equity, bond, commodity, capital and asset markets regarding:

Inventories to sales; imports and exports; and manufacturing new orders.

Industrial production; and industrial production and S&P 500.

Real GDP; and final summation.

Continuing our journey from Bull Economy Part 1, we ferret out more "robust bull" economic indicators.

From Martin at Macronomics: "Government bonds are always correlated to nominal GDP growth, regardless if you look at it using "old GDP data" or "new GDP data." So, if indeed GDP growth will continue to lag, then you should not expect yields to rise anytime soon making our US long bonds exposure still compelling regardless of what some sell-side pundits are telling you. From a "risk-reversal" perspective, we think, the current sizable "short positioning" from the "Leveraged crowd," offers a good contrarian punt, given the "weaker" outlook as of late of the US economy."

Discussion of the potential effects on equity, bond, commodity, capital and asset markets regarding:

Inventories to sales; imports and exports; and manufacturing new orders.

Industrial production; and industrial production and S&P 500.

Real GDP; and final summation.

Continuing our journey from Bull Economy Part 1, we ferret out more "robust bull" economic indicators.

From Martin at Macronomics: "Government bonds are always correlated to nominal GDP growth, regardless if you look at it using "old GDP data" or "new GDP data." So, if indeed GDP growth will continue to lag, then you should not expect yields to rise anytime soon making our US long bonds exposure still compelling regardless of what some sell-side pundits are telling you. From a "risk-reversal" perspective, we think, the current sizable "short positioning" from the "Leveraged crowd," offers a good contrarian punt, given the "weaker" outlook as of late of the US economy."

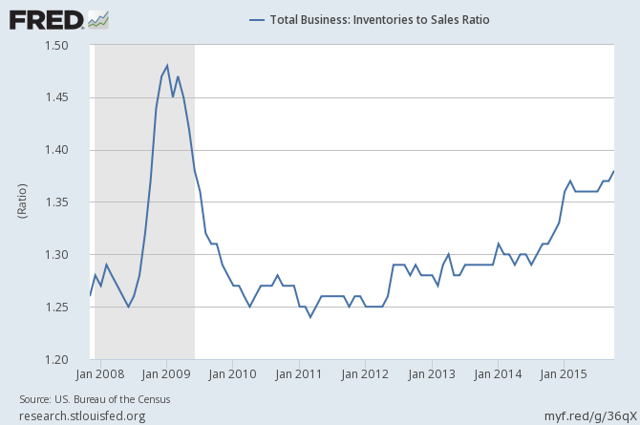

Rising Inventories to Sales?

Above, note since 2011, inventory to sales ratios have spiked from 1.25% to 1.375%, demonstrating that inventory is backing up, not due to overproduction, but due to declining demand. Declining real wages, income and spending is the cause. Lacking sales, restock orders and production will decline, leading to layoffs and further declines in income and spending, resulting in further contraction in imports and exports.

Above, note since 2011, inventory to sales ratios have spiked from 1.25% to 1.375%, demonstrating that inventory is backing up, not due to overproduction, but due to declining demand. Declining real wages, income and spending is the cause. Lacking sales, restock orders and production will decline, leading to layoffs and further declines in income and spending, resulting in further contraction in imports and exports.

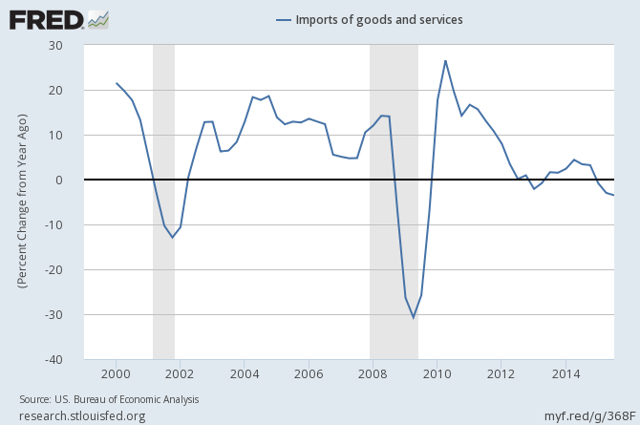

Decline in Imports and Exports?

Above, note since Q2 2010, YoY growth in imports of all goods and services has contracted from 26% to -3.5%.

This missive was published as an exclusive to Seeking Alpha. To access the ENTIRE text for FREE on Seeking Alpha, please click here. The Nattering One does not receive remuneration if you register, only satisfaction.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Above, note since Q2 2010, YoY growth in imports of all goods and services has contracted from 26% to -3.5%.

This missive was published as an exclusive to Seeking Alpha. To access the ENTIRE text for FREE on Seeking Alpha, please click here. The Nattering One does not receive remuneration if you register, only satisfaction.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Comments