Run On Yuan?

Summary

Discussion of the potential effects on equity, bond, commodity, capital and asset markets regarding:

Offshore Hibor; PBOC RMB Intervention.

Forward Dollar Swaps; Eurodollars.

The Dollar Short; But It's Different This Time?

Offshore Hibor

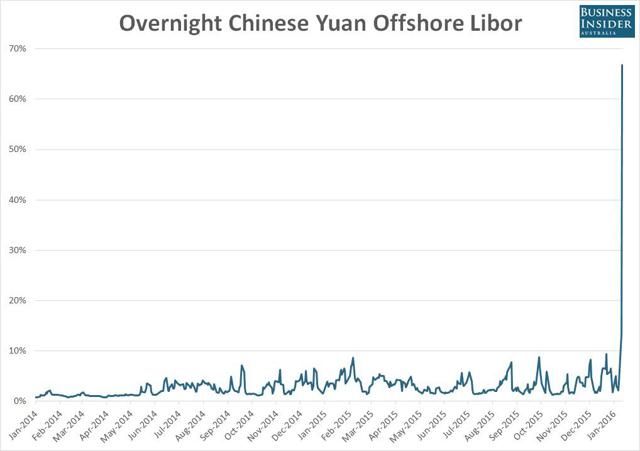

Above note, Chinese offshore HIBOR rates exploded from 4% last Friday to 13% on Monday, to 66.8% on 01/12/16, (NOT A TYPO. that is sixty six percent) then fell back to 8.31% on 01/13/2016. A dealer at a European bank in Shanghai told Reuters...

"The market suspects that the PBOC is possibly using major state banks to directly drain yuan liquidity in offshore markets," a dealer at a European bank in Shanghai told Reuters. The dealer described the strength of the central bank's actions as being of "nuclear-weapon" level strength. "Its actions are comparable to steps taken by other central banks when they previously fought against international speculators, such as George Soros"

AND THE FLAG IS UP!!! And SOROS isn't whom you need to be afraid of, it's the KING, as in KING DOLLAR whom we have Nattered about at length. The PBOC intervened to discourage speculators from shorting the RMB and close the nearly 2% gap between onshore CNY and offshore CNH.

PBOC RMB Intervention

The PBOC (through their proxies) have been selling dollars into the spot market, (dollar float up, dollar down) and they have been buying RMB with the proceeds (RMB float down, RMB up) and that is what is keeping KING DOLLAR trapped in his cage, temporarily as he is banging loudly on the cage door.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Comments