In The Toilet?

Summary

Discussion of the potential effects on equity, bond, commodity, capital and asset markets regarding:

Average weekly earnings; wage growth; personal consumption expenditures.

Personal savings; total revolving credit; employment taxes.

Monetary, stock market and economic correlations.

We always aim to please. Our wish is that those providing the econometric numbers would please aim. We tire of cleaning this macroeconomic latrine which is usually backed up with "happy days are here again, get happy" MSM narrative on an almost daily basis.

"Looking for signs that four QEs actually provided enough economic boostcomes up empty in wages and earnings (and so everything thereafter, too; wages to inflation to recovery). To expect otherwise is to deny reality since robust wages and employment don't ever accompany a manufacturing recession and relatively heightened economic uncertainty. A dearth of actual wage growth, however, is perfectly consistent with the overall economic picture." - Jeffrey P. Snider

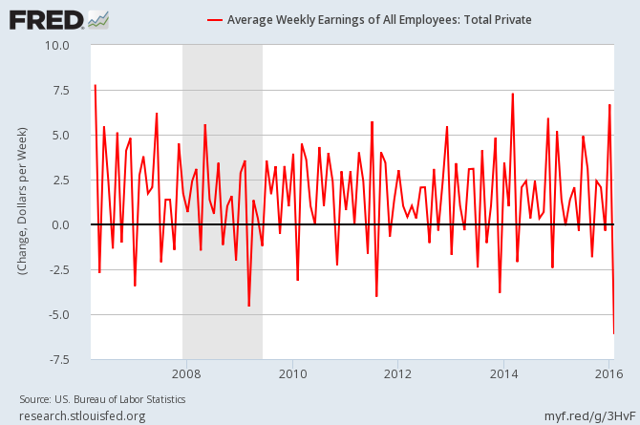

Average Weekly Earnings

Above note, lifting the lid and seat off of "burgeoning wage" theories, the largest decline in weekly wages (-$6.11) in the brief 10-year history of the series.

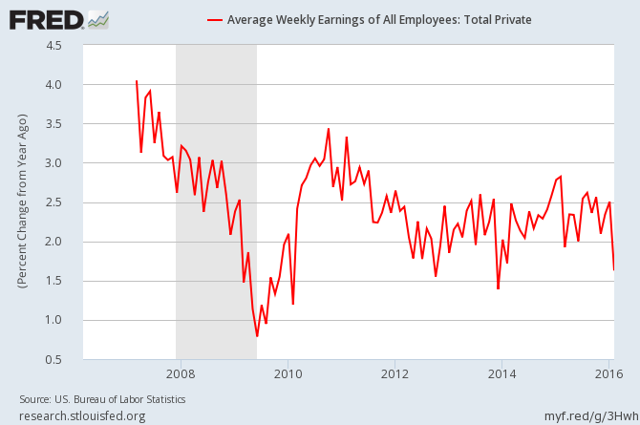

Above note, since the crisis the Yoy growth in wages hit its fifth lowest point as the overall trend in wages can be seen to be anything but "burgeoning."

Wiping off the perimeter of the monetary policy makers target, we observe if one were to inflation adjust these numbers at just the absurdly low "advertised" rate of under 2%, then the "experts'" aim is quite off, as the nexus is closer to ZERO growth on all counts. Just a bit outside wouldn't you say?

Elbow deep in the business end, scrubbing with vigor we find what the MSM narrative deems as "the best jobs market in years", having been innegative wage growth five times, including at present. Odiferous indeed.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Comments