Teva - Fiddler Made A Goof?

Discussion, critique and analysis of the potential impacts on equity, bond, commodity, capital and asset markets regarding the following:

Fiddler on the Roof is a musical with music by Jerry Bock, lyrics by Sheldon Harnick, and book by Joseph Stein, set in the Pale of Settlement of Imperial Russia in 1905. It is based on Tevye and his Daughters (or Tevye the Dairyman) and other tales by Sholem Aleichem.

The original Broadway production of the show, which opened in 1964, had the first musical theatre run in history to surpass 3,000 performances. Fiddler held the record for the longest-running Broadway musical for almost 10 years until Grease surpassed its run.

It remains Broadway's sixteenth longest-running show in history. The production was extraordinarily profitable and highly acclaimed. It won nine Tony Awards, including Best Musical, score, book, direction and choreography.

It spawned five Broadway revivals and a highly successful 1971 film adaptation (Norman Jewison, who is not Jewish), and the show has enjoyed enduring international popularity. Source Wiki.

Sholom Aleichem's (a Russian Mark Twain) story centers on Tevye, the milkman, the father of five daughters (seven in the books), and his attempts to maintain his Jewish religious and cultural traditions as outside influences encroach upon the family's lives.

Topol (not the toothpaste you knuckleheads, Chaim) has become iconic in his portrayal of Tevye, a man caught between tradition, changing politics and growing anti-Semitic sentiment which threatens his family, their village and livelihood.

Fiddler honestly depicts what it means to be human. It contains love, faith, family, friendship, humour, violence, hate, prejudice, change, vulnerability, joy, community, anger... a little bit of everything.

In the end, this is a story about trying to maintain strong cultural traditions and identity in the face of a continually changing world, partially fueled by the youth, that doesn't necessarily share the culture's values or self assessment of worth.

- Last Time Out; Fiddler on the Roof; US Generic Drug Market

- TEVA Actavis Deal; Unfortunate Events; Teva and Allergan Q2 results

- Miscalculations; Tradition and Valuation

Last Time Out?

"At the end of the day, with the Amazons, Facebook's, Teslas, Chipotle's and Sino's, what advice can we give about perceived and so called book values? Common sense, like what P said, and if one wants to gamble and can afford to take a potential loss, then fine. At least one is a big boy and knows what they are potentially getting into." Of Chipotle, Sino-Global, Valuation And Glengarry Glen Ross?

In Platform Value:The Fall? we Nattered about Ackman's "value" folly with Valeant. Seems that perhaps Teva's former management and some investors, rather than concentrating on the business end, in their zealous overjoy of the Actavis acquisition might have been dancin and singin like a...

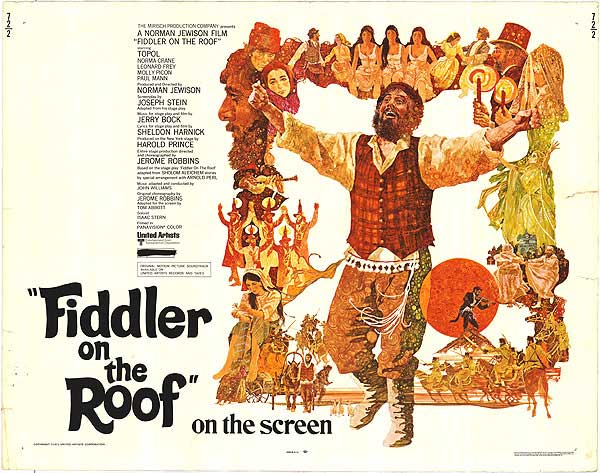

Fiddler On The Roof?

Courtesy of Movie Poster.com

The original Broadway production of the show, which opened in 1964, had the first musical theatre run in history to surpass 3,000 performances. Fiddler held the record for the longest-running Broadway musical for almost 10 years until Grease surpassed its run.

It remains Broadway's sixteenth longest-running show in history. The production was extraordinarily profitable and highly acclaimed. It won nine Tony Awards, including Best Musical, score, book, direction and choreography.

It spawned five Broadway revivals and a highly successful 1971 film adaptation (Norman Jewison, who is not Jewish), and the show has enjoyed enduring international popularity. Source Wiki.

Sholom Aleichem's (a Russian Mark Twain) story centers on Tevye, the milkman, the father of five daughters (seven in the books), and his attempts to maintain his Jewish religious and cultural traditions as outside influences encroach upon the family's lives.

Topol (not the toothpaste you knuckleheads, Chaim) has become iconic in his portrayal of Tevye, a man caught between tradition, changing politics and growing anti-Semitic sentiment which threatens his family, their village and livelihood.

Fiddler honestly depicts what it means to be human. It contains love, faith, family, friendship, humour, violence, hate, prejudice, change, vulnerability, joy, community, anger... a little bit of everything.

In the end, this is a story about trying to maintain strong cultural traditions and identity in the face of a continually changing world, partially fueled by the youth, that doesn't necessarily share the culture's values or self assessment of worth.

We feel this apopros in tonights discussion of outside influences changing traditions, strong willed participants, potential evictions and assessment of value or worth...

GENERIC Information?

Although plenty of analysts are saying the same things at $17 as they said at $50 and $75, this August TEVA Pharmaceuticals (TEVA) has taken a plunge into the rapids with shorts on.

Many investors and analysts act surprised, yet, exerting due diligence regarding the generic drug market revealed the following well in advance.

Although plenty of analysts are saying the same things at $17 as they said at $50 and $75, this August TEVA Pharmaceuticals (TEVA) has taken a plunge into the rapids with shorts on.

Many investors and analysts act surprised, yet, exerting due diligence regarding the generic drug market revealed the following well in advance.

On October 1, 2013 Actavis acquired Irish pharmaceutical company Warner Chilcott plc (previously known as Galen and had acquired PNG's drug unit) in a stock-for-stock transaction valued at approximately $8.5B. The combination created a company with approximately $10B in anticipated combined annual 2013 revenue, and the 3rd largest U.S. specialty pharmaceutical company

On July 1, 2014 Actavis announced that it had completed its acquisition of Forest Laboratories (who previously acquired, Furiex Pharmaceuticals Inc and Aptalis Pharma) in a cash and equity transaction valued at approximately $25B.

On March 17, 2015, Actavis, plc completed the acquisition of Allergan, inc in a cash and equity transaction valued at approximately $70.5B. The combination created a $23B diversified global pharmaceutical company with commercial reach across 100 countries.

This missive was published as an exclusive to Seeking Alpha. To access the ENTIRE text for FREE on Seeking Alpha, please click here. The Nattering One does not receive remuneration if you register, only satisfaction.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Comments