Divergence in Quantitative Tightening and Dollar Assets?

Continuing from Reasons For A Market Free Fall? More reasons for a stock market free fall??? As Nattered Jan 29 8:44AM Brother P, Your AM rant is not good, it's EXCELLENT. Food for your Nasdaq talk...

P's AM Rant Jan 29 5:06AM

Much like the Oil Cartel (OPEC) benefits from cutting supply and making oil more scarce and Crypto Currency purveyors keep their supplies limited to jack up the prices - the Corporate Cartel reduces the supply of stock AND they themselves begin buying their stock – as if it's valuable at any price. The higher the market goes, the more they buy – what can possibly go wrong?

Like any meth addict, they are now hopelessly hooked on buybacks and simply can't stop. People consistently overpaying for housing led to the housing crisis that tanked the Global Economy in 2008 and now, Corporations are binge-buying their own overpriced stock with all the free, artificially low-interest money that has been floating around in order to bail people out of the housing collapse. Isn't it obvious that this is only going to lead to a stock price collapse down the road???

This doesn't seem wrong to you? Do you really think this can just keep going on and on and the markets will go higher and higher and we'll pay 40, 50, 60 times earnings and nothing bad will happen? The global GDP simply can't possibly grow fast enough to keep up with market valuations.

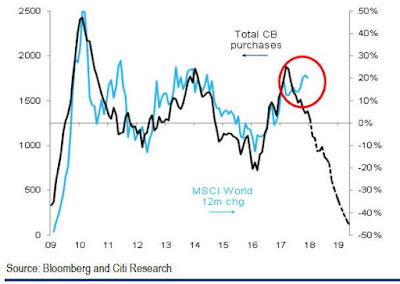

[Above] Huge disconnect as Central Bank buying tapers off and stocks stage a massive rally to start the year: It's like no one believes there's no Santa Clause.

It illustrates the $2Tn "taper" that is about to take place and is, in fact, taking place right now and projected to accellerate rapidly into 2019 at which point (gasp!) Central Banks will become net sellers of assets and there is NO WAY that doesn't depress prices, even with a theoretical $2Tn being repatriated from overseas accounts on the Corporate side.

Our Natterings - Again, NOT good, EXCELLENT. And now I will try to explain the "divergence" or counter intuitive that your rant brings to mind.

Two things: as the dollar weakens, it makes imports more expensive and exports cheaper, leading to some moderation of our trade balance deficit. Where does that extra money get invested?

In addition, a weaker dollar alleviates stress in EM and foreign held USD denominated debt servicing. Where does that extra money get invested?

Now, add in the curtailment of QE or quantitative tightening by the FED, Santa stops buying, more bonds floating. The stage is set, then...

Net foreign direct investment (the healthy kind) in US economic activity has declined. So again, where did those aforementioned excess dollar servicing flows go over the last year?

Depending upon who is doing the investing, those flows have gravitated towards and chased yield. Some in the form of EM equities, HY bonds and foreign REITS. Some in safe haven in the form of US based treasuries, agency debt, HY corp issuance, and equities.

Foreign private accounts, while decreasing UST holdings, have increased their holdings of equities and corp bonds. Meanwhile, foreign central banks and EM's, have increased their holdings of UST's.

The bottom line is our net foreign liability position has increased. If spreads widen, and or equities sell off, viz. those assets lose their attractiveness, what happens if the foreigners begin to liquidate? Food for thought. For more information on the above, see Martin at Macronomics excellent post: Macro and Credit - Iconic Memory.

Again, our theme for the week is Reasons For A Market Dip or Free Fall? Regarding the central bank taper aka QT (quantitative tightening), in tomorrow's missive Minutia and History Repeating? we will redux our many prescient Natterings from mid 2017 on this not so trivial and very CENTRAL topic. Stay tuned, no flippin.

P's AM Rant Jan 29 5:06AM

Much like the Oil Cartel (OPEC) benefits from cutting supply and making oil more scarce and Crypto Currency purveyors keep their supplies limited to jack up the prices - the Corporate Cartel reduces the supply of stock AND they themselves begin buying their stock – as if it's valuable at any price. The higher the market goes, the more they buy – what can possibly go wrong?

Like any meth addict, they are now hopelessly hooked on buybacks and simply can't stop. People consistently overpaying for housing led to the housing crisis that tanked the Global Economy in 2008 and now, Corporations are binge-buying their own overpriced stock with all the free, artificially low-interest money that has been floating around in order to bail people out of the housing collapse. Isn't it obvious that this is only going to lead to a stock price collapse down the road???

This doesn't seem wrong to you? Do you really think this can just keep going on and on and the markets will go higher and higher and we'll pay 40, 50, 60 times earnings and nothing bad will happen? The global GDP simply can't possibly grow fast enough to keep up with market valuations.

[Above] Huge disconnect as Central Bank buying tapers off and stocks stage a massive rally to start the year: It's like no one believes there's no Santa Clause.

It illustrates the $2Tn "taper" that is about to take place and is, in fact, taking place right now and projected to accellerate rapidly into 2019 at which point (gasp!) Central Banks will become net sellers of assets and there is NO WAY that doesn't depress prices, even with a theoretical $2Tn being repatriated from overseas accounts on the Corporate side.

Our Natterings - Again, NOT good, EXCELLENT. And now I will try to explain the "divergence" or counter intuitive that your rant brings to mind.

Two things: as the dollar weakens, it makes imports more expensive and exports cheaper, leading to some moderation of our trade balance deficit. Where does that extra money get invested?

In addition, a weaker dollar alleviates stress in EM and foreign held USD denominated debt servicing. Where does that extra money get invested?

Now, add in the curtailment of QE or quantitative tightening by the FED, Santa stops buying, more bonds floating. The stage is set, then...

Net foreign direct investment (the healthy kind) in US economic activity has declined. So again, where did those aforementioned excess dollar servicing flows go over the last year?

Depending upon who is doing the investing, those flows have gravitated towards and chased yield. Some in the form of EM equities, HY bonds and foreign REITS. Some in safe haven in the form of US based treasuries, agency debt, HY corp issuance, and equities.

Foreign private accounts, while decreasing UST holdings, have increased their holdings of equities and corp bonds. Meanwhile, foreign central banks and EM's, have increased their holdings of UST's.

The bottom line is our net foreign liability position has increased. If spreads widen, and or equities sell off, viz. those assets lose their attractiveness, what happens if the foreigners begin to liquidate? Food for thought. For more information on the above, see Martin at Macronomics excellent post: Macro and Credit - Iconic Memory.

Again, our theme for the week is Reasons For A Market Dip or Free Fall? Regarding the central bank taper aka QT (quantitative tightening), in tomorrow's missive Minutia and History Repeating? we will redux our many prescient Natterings from mid 2017 on this not so trivial and very CENTRAL topic. Stay tuned, no flippin.

Comments