Libor and Reserves?

Following up on Libor Squeeze? Is the recent spike in LIBOR lending rates a result of credit concern or other market forces?

Follow the money, every USD transferred by UST, ICE and CME (counterparties), MMF's, domestic and foreign banks, directly to the Fed is one less dollar of reserves that can be used for interbank trades and arbitrage, as opposed to the Fed which does not.

Above, less trading means, less arbitrage, liquidity, lending, debits, credits, assets, liabilities, more need for repo and O/N liquidity services. Pre 2008 transfers $80B now total $700B in Fed liabilities which are "ensconced in the system".

The amount of reserves held by banks at the Fed (JP Morgan has the most) determines the amount of USD that banks can FX swap based on OIS (overnight interest swap) into other currencies (JPY, RMB, EUR, etc) in the form of reserves at other central banks, without having to sell or repo something first.

Thus, FX swaps are no longer IBDD or deposit swaps, and have transmogrified into reserve swaps. There are many factors which have driven this shift in market making, long story short viz. Basel-III Jan 2015; MMF reform 2016; and the 2018 budget and tax reform.

Ceteris paribus, when reserve levels rise at the Fed, bank system reserve levels get drained and bank deposits decline. When those Fed "swap lines" or reserve balances are tapped or maxed out, alternative sources of funds must be found. Something else has to be sold or repo-ed to transact or settle the FX swap, which comes at a cost.

Declining market liquidity, "system" reserves, increased repo demand and forced liquidation, all translate into higher repo, Libor costs and a widening with OIS. Ill-liquidity is the issue especially around quarter end, think balance sheet constraints and turn premium, the clockwork like spikes in repo vol, rate and fails confirm this.

Fewer dollars and FX swaps can mean less borrowed dollars, higher dollar. Draining reserves in exchange for swap liabilities is sterilization. The above form of reserve sterilization through swap liabilities has a counterpart, reverse sterilization through Treasury draw down.

Above, when the UST ran down its Fed balance in 2017 to pay creditors, corps, employees and UI benefits, large banks received a liquidity injection. In effect a reverse sterilization, more liquidity for lending, buying assets, FX swaps, more borrowed dollars, lower dollar.

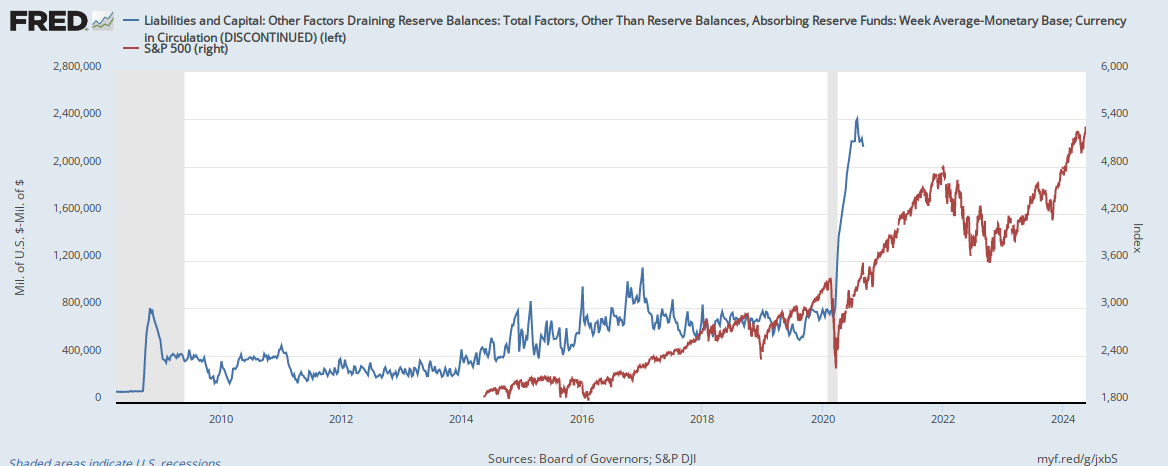

Above, it would seem that buying assets, equities, and lending for buybacks occurred. However, alleviation of repo stress did not translate into lower repo (especially around quarter end) or Libor costs. Also note the SP500 divergence after Dec 2017. Possible causes?

"Repatriation" from a tax perspective, X-currency base erosion, and the anti abuse tax (BEAT) are forcing banks to fund in three month CD and CP markets and fund less via FX swaps. Thus any benefit from the reverse sterilization, was offset by recent budget and tax legislation.

Formerly off shored surplus USD stashed in $300B of term UST held by corps, will be sold, higher bond float, lower price, higher yield, more dollars, lower dollar. Since those profits bought UST, they are already in USD, what repatriation? DOH!!

As opposed to common belief based in false doctrine, the tax cuts on "repatriated" dollars will drive dollar and bond prices lower, while pushing cost of loan funds higher.

Adding insult to injury, due to budget induced higher deficits, UST reserve cash balances at the Fed will further widen repo and Libor. To support those deficits increasing UST issuance will also come into play. Rinse and repeat.

Last but not least, as the Fed raises and balance sheet taper ramps up, with the FOMC reinvesting less we will see further widening on repo and Libor. But me thinks there is more to this story than meets the eye... More to come in Reserves, RRP and The Libor Squeeze? Stay tuned, no flippin.

Suggested reading:

Completely Full Of It The Disappearance of Interbank Lending

Cross Currency Basis - RIP

Global Money Notes #10

Global Money Notes #11

The FOMC is trying to claim that LIBOR is up because T-bill rates are; the latter are monetary equivalents. Bill rates are higher because of, purportedly, tax reform and the Trump budget. In other words, a heavier supply of bills at auction would lead to rising bill yields and therefore as money equivalents other money market rates would move up, too, including LIBOR. That's crap. Liquidations in multiple markets, spread out globally, led to a rising LIBOR spread which indicates, surprise, rising liquidity risk. Budget deficits? Come on. Seriously. - Jeffrey P. SniderWe concur with Snider, it's a liquidity issue and here's why. IBDD (inter bank demand deposits) are no longer the grease, liquid reserves parked at the Fed are. Fed overnight reverse repo or liquidity services have become a necessity for market making.

Follow the money, every USD transferred by UST, ICE and CME (counterparties), MMF's, domestic and foreign banks, directly to the Fed is one less dollar of reserves that can be used for interbank trades and arbitrage, as opposed to the Fed which does not.

Above, less trading means, less arbitrage, liquidity, lending, debits, credits, assets, liabilities, more need for repo and O/N liquidity services. Pre 2008 transfers $80B now total $700B in Fed liabilities which are "ensconced in the system".

The amount of reserves held by banks at the Fed (JP Morgan has the most) determines the amount of USD that banks can FX swap based on OIS (overnight interest swap) into other currencies (JPY, RMB, EUR, etc) in the form of reserves at other central banks, without having to sell or repo something first.

Thus, FX swaps are no longer IBDD or deposit swaps, and have transmogrified into reserve swaps. There are many factors which have driven this shift in market making, long story short viz. Basel-III Jan 2015; MMF reform 2016; and the 2018 budget and tax reform.

Ceteris paribus, when reserve levels rise at the Fed, bank system reserve levels get drained and bank deposits decline. When those Fed "swap lines" or reserve balances are tapped or maxed out, alternative sources of funds must be found. Something else has to be sold or repo-ed to transact or settle the FX swap, which comes at a cost.

Declining market liquidity, "system" reserves, increased repo demand and forced liquidation, all translate into higher repo, Libor costs and a widening with OIS. Ill-liquidity is the issue especially around quarter end, think balance sheet constraints and turn premium, the clockwork like spikes in repo vol, rate and fails confirm this.

Fewer dollars and FX swaps can mean less borrowed dollars, higher dollar. Draining reserves in exchange for swap liabilities is sterilization. The above form of reserve sterilization through swap liabilities has a counterpart, reverse sterilization through Treasury draw down.

Above, when the UST ran down its Fed balance in 2017 to pay creditors, corps, employees and UI benefits, large banks received a liquidity injection. In effect a reverse sterilization, more liquidity for lending, buying assets, FX swaps, more borrowed dollars, lower dollar.

Above, it would seem that buying assets, equities, and lending for buybacks occurred. However, alleviation of repo stress did not translate into lower repo (especially around quarter end) or Libor costs. Also note the SP500 divergence after Dec 2017. Possible causes?

"Repatriation" from a tax perspective, X-currency base erosion, and the anti abuse tax (BEAT) are forcing banks to fund in three month CD and CP markets and fund less via FX swaps. Thus any benefit from the reverse sterilization, was offset by recent budget and tax legislation.

Formerly off shored surplus USD stashed in $300B of term UST held by corps, will be sold, higher bond float, lower price, higher yield, more dollars, lower dollar. Since those profits bought UST, they are already in USD, what repatriation? DOH!!

As opposed to common belief based in false doctrine, the tax cuts on "repatriated" dollars will drive dollar and bond prices lower, while pushing cost of loan funds higher.

Adding insult to injury, due to budget induced higher deficits, UST reserve cash balances at the Fed will further widen repo and Libor. To support those deficits increasing UST issuance will also come into play. Rinse and repeat.

Last but not least, as the Fed raises and balance sheet taper ramps up, with the FOMC reinvesting less we will see further widening on repo and Libor. But me thinks there is more to this story than meets the eye... More to come in Reserves, RRP and The Libor Squeeze? Stay tuned, no flippin.

Suggested reading:

Completely Full Of It The Disappearance of Interbank Lending

Cross Currency Basis - RIP

Global Money Notes #10

Global Money Notes #11

Comments