What ME Worry?

What happens when self interest, short term thinking, and speculation in housing and stock markets run amok for decades? Aside from the resulting twin deficits (budget and trade), perhaps we should discuss the resulting private and public investment deficit?

Our title, inspired by a not wholly unrelated comment by one of our mentors (Trutta), takes license from Alfred E. Neuman, and much like Mad Magazine's mascot parodies the disconnect between the stock, housing market and real economic conditions.

Our economy is a two legged dog, services is one leg and unfortunately, the other leg (house flipping) viz. capitalized consumption (taking out a mortgage) does not constitute true economic investment for the future, and only generates transfer payments.

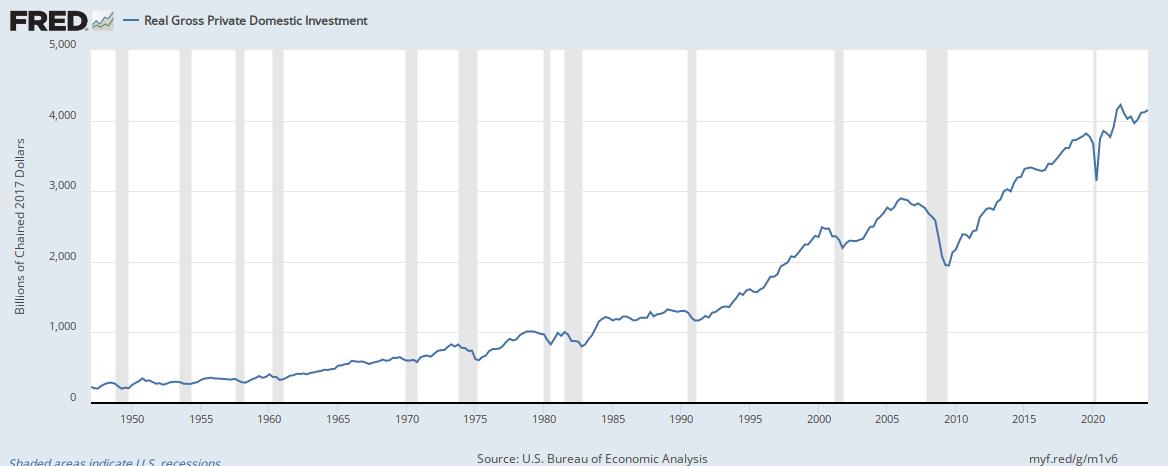

Real Gross Private Domestic Investment seemingly on the rise... all is well? Upon further review...

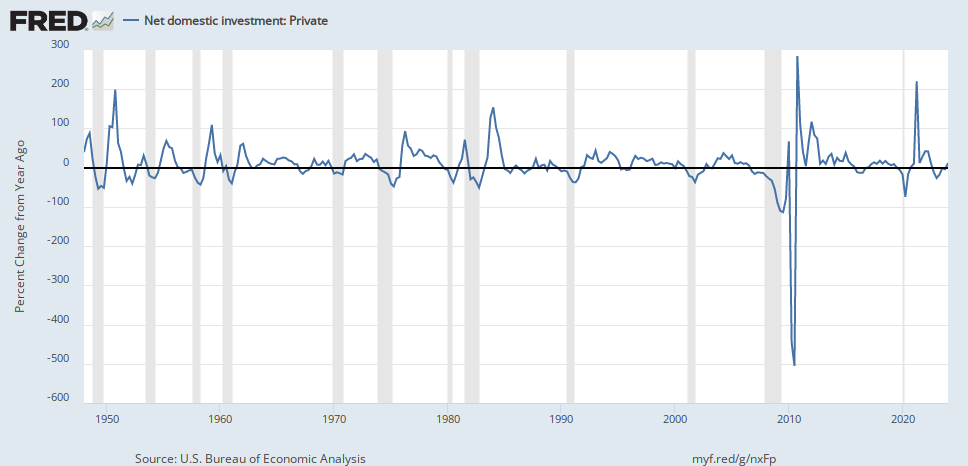

As one can see below, an inverted yield curve or negative 10yr - 1yr spread isn't the only recession indicator.

Since 1950, a negative Yoy ROC in net private domestic investment has either immediately or within a four year span, preceded each and every economic recession.

In fact, all of 2015 was spent in negative territory, and of late as opposed to 1950 and 1984 (peak of civilization) said priority appears to be low in Yoy ROC.

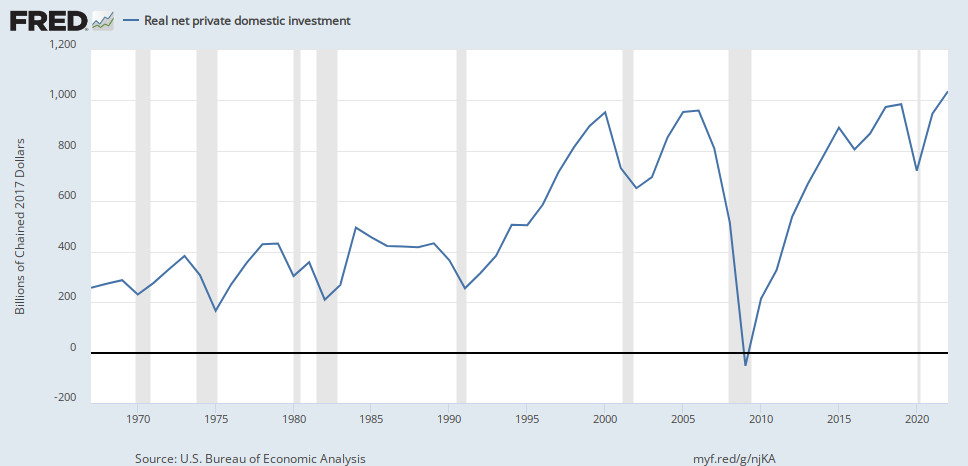

Real net private domestic investment, confirmed to be sad on a net basis (less deprec.), as in lower than 1998 levels...

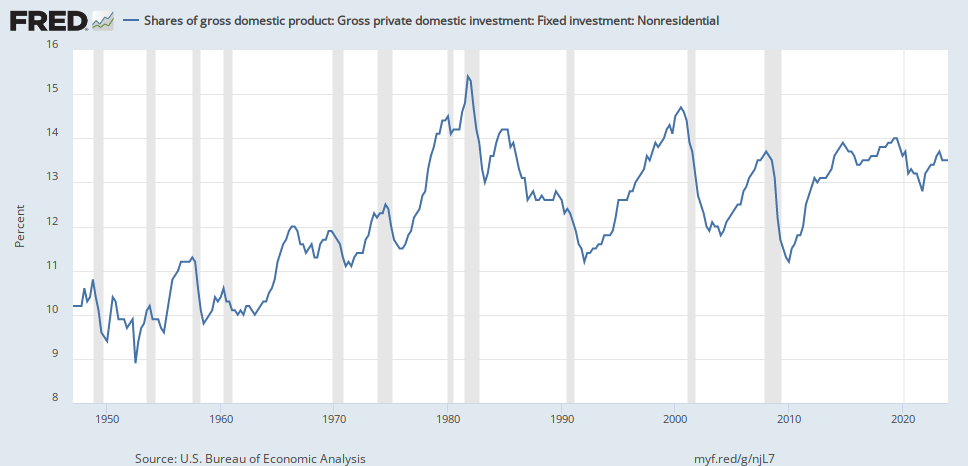

Fixed investment EX-residential (excluding housing) confirmed to be pathetic, peaked in Q4 1981, declining since and currently below the 1978 level, 40 years...

What ME Worry??? Ponder this, $1.1 Trillion in 2018 alone for stock buybacks, which produced ZERO GDP/PCE say otherwise. In fact, in Q2 and Q3 2018, SP500 companies spent more money buying back their own shares than on capital investment.

Investing more in your own stock than real future economic endeavor? When government, corporate and monetary policies all fall into a trap viz. misallocation of capital, whatever happens or could go wrong? Above, we have demonstrated some of the consequences. There's got to be an answer? As Dr. Zaius warned Taylor about the Forbidden Zone...

Recommended reading: America’s biggest economic problem: Nobody is investing for tomorrow; The Truth Is Out There?

Our title, inspired by a not wholly unrelated comment by one of our mentors (Trutta), takes license from Alfred E. Neuman, and much like Mad Magazine's mascot parodies the disconnect between the stock, housing market and real economic conditions.

Our economy is a two legged dog, services is one leg and unfortunately, the other leg (house flipping) viz. capitalized consumption (taking out a mortgage) does not constitute true economic investment for the future, and only generates transfer payments.

Real Gross Private Domestic Investment seemingly on the rise... all is well? Upon further review...

As one can see below, an inverted yield curve or negative 10yr - 1yr spread isn't the only recession indicator.

Since 1950, a negative Yoy ROC in net private domestic investment has either immediately or within a four year span, preceded each and every economic recession.

In fact, all of 2015 was spent in negative territory, and of late as opposed to 1950 and 1984 (peak of civilization) said priority appears to be low in Yoy ROC.

Real net private domestic investment, confirmed to be sad on a net basis (less deprec.), as in lower than 1998 levels...

Fixed investment EX-residential (excluding housing) confirmed to be pathetic, peaked in Q4 1981, declining since and currently below the 1978 level, 40 years...

What ME Worry??? Ponder this, $1.1 Trillion in 2018 alone for stock buybacks, which produced ZERO GDP/PCE say otherwise. In fact, in Q2 and Q3 2018, SP500 companies spent more money buying back their own shares than on capital investment.

Investing more in your own stock than real future economic endeavor? When government, corporate and monetary policies all fall into a trap viz. misallocation of capital, whatever happens or could go wrong? Above, we have demonstrated some of the consequences. There's got to be an answer? As Dr. Zaius warned Taylor about the Forbidden Zone...

Don't look for it, Taylor. You may not like what you find.What ME Worry??? More to come in I Want To Believe?, stay tuned, no flippin.

Recommended reading: America’s biggest economic problem: Nobody is investing for tomorrow; The Truth Is Out There?

Comments