Jamie's Cryin Wolf?

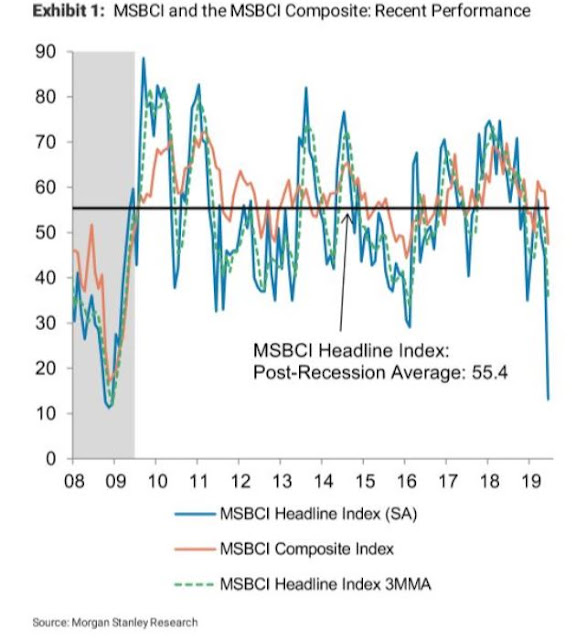

The Morgan Stanley Business Conditions Index fell by 32 points in June, to a level of 13 from a level of 45 in May. This drop is the largest one-month decline on record.

The economy added just 75,000 jobs in May, according to the Labor Department... The manufacturing subindex business conditions fell sharply to zero... while marking the lowest level for the subindex on record. The services subindex also fell to 18 from 35.Above, Morgan Stanley's economic indicator drops to an all time low. Moving West... competitor JPMorganChase CEO Jamie Dimon has been warning for the last year, that bond yields are going to explode?

05/08/2018 10 yr bond = 2.95% - Jamie Warns (watch all the videos):

"You can easily deal with 4 percent bonds and I think people should be prepared for that.”08/06/18 - Jamie Doubles Down:

“You better be prepared to deal with rates 5 percent or higher - it’s a higher probability than most people think.”05/08/2019 10 yr = 2.45% for -50bps - Jamie Wonders?

The current level of around 2.4 to 2.5 percent “is extraordinarily low"... Central banks’ purchases of government debt “had to have an effect on the 10-year” yield."06/21/2019 10yr = 2.06% for another -39bps

Those central bank purchases "had" to have an effect? A rate "conundrum" only to the confused and usually followed by another question... "who's buying all those UST's?" Answer? Not just central banks...

JPMorgan Assets in Billions from 10Q... Liquidity Risk Management; Assets and liabilities measured at fair value on a recurring basis; Trading Assets + Available For Sale Securities

UST HQLA:Securities Cash

Mar Q12018: 67.922 180.765 358.257 (pg38;82)

Dec Q42018: 115.238 232.201 297.069 (pg96;164)

Mar Q12019: 161.477 303,249 216.787 (pg37;75)

Jun Q22019: 172.204 317,439 219.838 (pg49;86)

Since Jamie's May 2018 warning: a 30% decline in the 10 year yield, a 40% decrease in cash holdings; an increase of 75% in HQLA securities; and an increase of 155% in UST holdings. Do as I say, not as I do? and perhaps Jamie's Cryin Wolf?

More to come in The Lazarus Fed: Immaculate Misconception? Stay tuned, no flippin.

Recommended Reading: Jeffrey Snider - JP Morgan’s Jamie Dimon Warns Again On UST’s

Comments