ACA BK, SCA Downgrade, Ambac & MBIA Bailout, A Journey To The Dark Side

Guarantor Bailout... 1st guarantor ACA went BK (#2 in our Trifecta), 2nd Ambac downgraded to AA, today...

Security Capital Assurance, hobbled by deterioration in its financial guarantee portfolio,

lost its AAA bond insurer grade at Fitch Ratings, throwing the rankings of at least $154.2 billion of securities in doubt.

New York State Insurance Superintendent Eric Dinallo said a bond insurer bailout is complicated and "any effective plan will take some time to finalize,"

Stuck in the Pipeline... $230 billion backlog of high-yield, high-risk debt, $160 billion of leveraged loans and $70 billion of junk bonds.

MSN's Jon Markman on "A Bad Market? You Ain't Seen Nothin"

"the skirmishes we've seen so far might be little more than a prelude to a deeper, harsher, longer decline than most yet perceive possible.

And in a very postmodern twist, it is beginning to look like unexpected consequences of an investment instrument...

designed to mitigate risk could turn out to be the nuclear option that bombs the globe into the financial equivalent of World War III."

Bernard Connolly, chief global strategist at AIG in London, goes further.

"The global capitalist system is now at risk of collapsing; it could not easily withstand a stock market crash coming after an implosion of the credit bubble.

We hate the idea of extensive government intervention. But it is going to come."

The Nattering One muses... Some people we know are in dire need of some tough love and here it is.

Markman is on the money, "You Ain't Seen Nothin" and Connoly is spot on, "the global capitalist system is now at risk of collapsing".

Those who think we have weathered the storm or bottomed, and the situation is stablised, are in for a very rude surprise.

These are the same people that were blinded by the glitter while assets (real estate, etc.) rose to unjustified and unsupportable heights.

These are also the same people that still can't fathom or appreciate the wherefore or why of how things went sour,

and are ready to latch on to any hopeful tether (cheerleading media propaganda) thrown their way. Ready to plumb new depths?

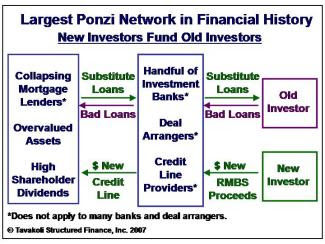

CDO & CDS expert Janet Tavakoli calls it "the worlds largest ponzi network"...

In which, the monoline insurers sold $20 Trillion in CDS credit default swap to insure CDO collateralized debt obligations (leveraged bundles of ABS asset backed securities).

The banks, brokers, lenders and all holders of ABCP, ABS, MBS, CDO, CDS will be faced with capital shortages

as they bring $1.5 Trillion in off balance sheet debt (hidden in SIV & misclassified through chicanery) onto the books.

Then the defaults hit on the dubious debt, then the insurers get downgraded, go bankrupt or refuse to pay,

creating further write downs and larger than anticipated losses, creating further need to shore up capital reserves (increasing reserve requirements).

Example, last week, Merill Lynch wrote down $3.1 billion of credit default swaps they had purchased from now BK bond insurer ACA Capital.

Don't worry, be happy, not only is Merill out the $3.1 billion in CDS premiums they paid, they are now buck naked on the underlying CDO exposure.

Merrill better hope that CDO doesn't get downgraded or default, lest they go BK.

Markman's guru Satyajit Das estimates for 2008, another $200 billion in new capital needed while the banks suffer another $100 billion in actual losses.

"The hole is bigger than they or their investors expected, and they're still digging."

Throw in global real estate (the underlying asset in most of these debt instruments) prices reverting to the mean, due to unsupportable prices,

negative wage growth, and a collapsing economy. The $150 Billion stimulus plan? Like spitting into a tidal wave.

At bottom? Near bottom? No way, no how, not even close. As Yoda would say, just starting our journey to the dark side are we.

Security Capital Assurance, hobbled by deterioration in its financial guarantee portfolio,

lost its AAA bond insurer grade at Fitch Ratings, throwing the rankings of at least $154.2 billion of securities in doubt.

New York State Insurance Superintendent Eric Dinallo said a bond insurer bailout is complicated and "any effective plan will take some time to finalize,"

Stuck in the Pipeline... $230 billion backlog of high-yield, high-risk debt, $160 billion of leveraged loans and $70 billion of junk bonds.

MSN's Jon Markman on "A Bad Market? You Ain't Seen Nothin"

"the skirmishes we've seen so far might be little more than a prelude to a deeper, harsher, longer decline than most yet perceive possible.

And in a very postmodern twist, it is beginning to look like unexpected consequences of an investment instrument...

designed to mitigate risk could turn out to be the nuclear option that bombs the globe into the financial equivalent of World War III."

Bernard Connolly, chief global strategist at AIG in London, goes further.

"The global capitalist system is now at risk of collapsing; it could not easily withstand a stock market crash coming after an implosion of the credit bubble.

We hate the idea of extensive government intervention. But it is going to come."

The Nattering One muses... Some people we know are in dire need of some tough love and here it is.

Markman is on the money, "You Ain't Seen Nothin" and Connoly is spot on, "the global capitalist system is now at risk of collapsing".

Those who think we have weathered the storm or bottomed, and the situation is stablised, are in for a very rude surprise.

These are the same people that were blinded by the glitter while assets (real estate, etc.) rose to unjustified and unsupportable heights.

These are also the same people that still can't fathom or appreciate the wherefore or why of how things went sour,

and are ready to latch on to any hopeful tether (cheerleading media propaganda) thrown their way. Ready to plumb new depths?

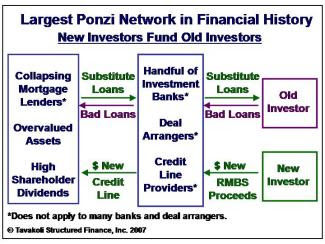

CDO & CDS expert Janet Tavakoli calls it "the worlds largest ponzi network"...

In which, the monoline insurers sold $20 Trillion in CDS credit default swap to insure CDO collateralized debt obligations (leveraged bundles of ABS asset backed securities).

The banks, brokers, lenders and all holders of ABCP, ABS, MBS, CDO, CDS will be faced with capital shortages

as they bring $1.5 Trillion in off balance sheet debt (hidden in SIV & misclassified through chicanery) onto the books.

Then the defaults hit on the dubious debt, then the insurers get downgraded, go bankrupt or refuse to pay,

creating further write downs and larger than anticipated losses, creating further need to shore up capital reserves (increasing reserve requirements).

Example, last week, Merill Lynch wrote down $3.1 billion of credit default swaps they had purchased from now BK bond insurer ACA Capital.

Don't worry, be happy, not only is Merill out the $3.1 billion in CDS premiums they paid, they are now buck naked on the underlying CDO exposure.

Merrill better hope that CDO doesn't get downgraded or default, lest they go BK.

Markman's guru Satyajit Das estimates for 2008, another $200 billion in new capital needed while the banks suffer another $100 billion in actual losses.

"The hole is bigger than they or their investors expected, and they're still digging."

Throw in global real estate (the underlying asset in most of these debt instruments) prices reverting to the mean, due to unsupportable prices,

negative wage growth, and a collapsing economy. The $150 Billion stimulus plan? Like spitting into a tidal wave.

At bottom? Near bottom? No way, no how, not even close. As Yoda would say, just starting our journey to the dark side are we.

Comments