Is The Market Ready to Fall? Part 2

Along with the breakdown in commodities, we are keeping an eye on the small cap, mid cap and high yield junk, all of which have been telegraphing the large cap downswing since March - July 2014.

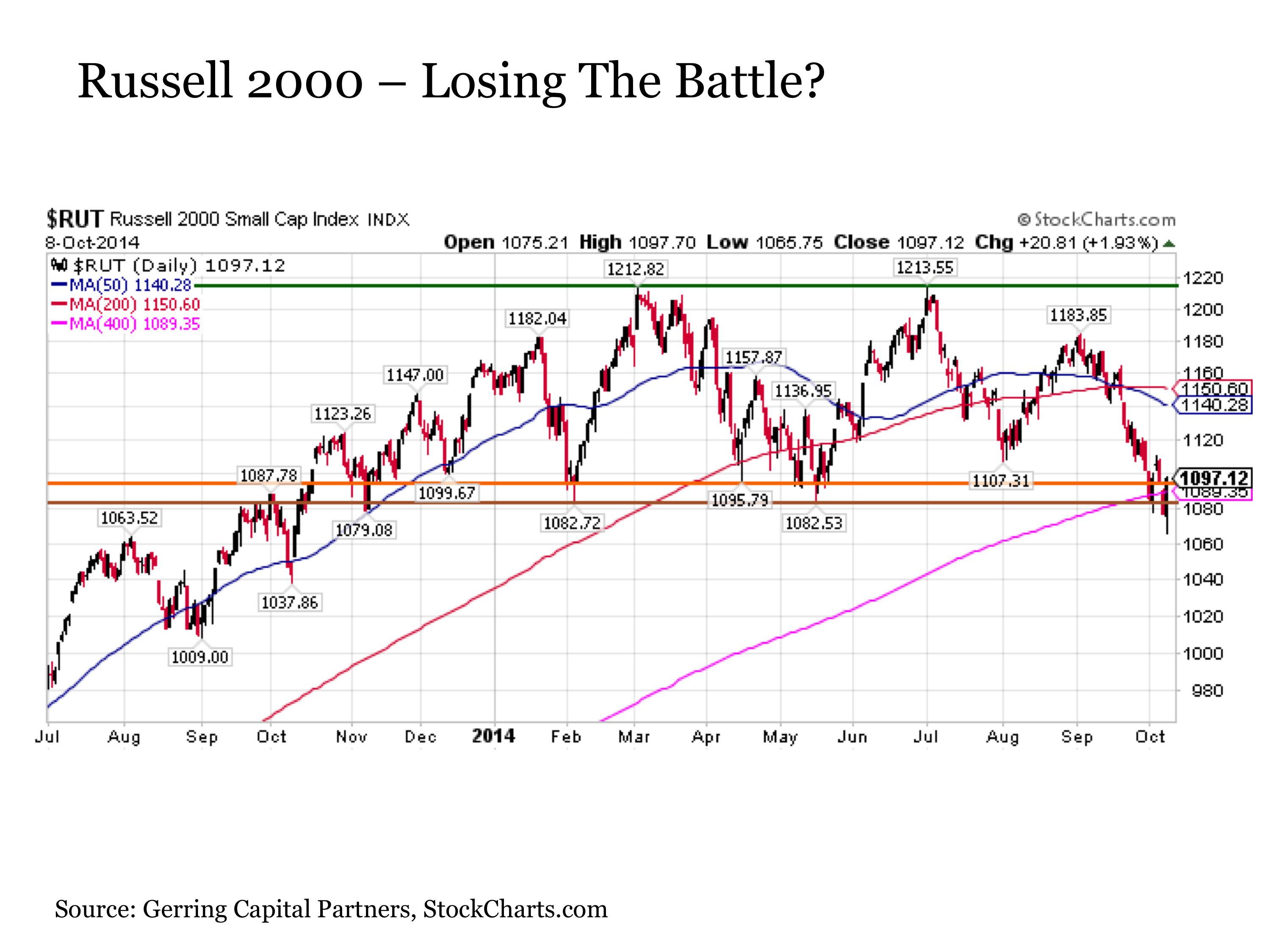

Eric Parnell echos our sentiments: One leading indicator, the Russell 2000 Index has been in the process of setting a double top since the beginning of 2014.

R2K set its first peak at the beginning of March, then sold off through the middle of May, finding support at its previous closing low 1093 and intraday low at 1082, making these important neckline support levels.

R2K went on to rally, revisiting the March peak at the beginning of July. Since then R2K has been falling and over the last few days, sliced through and closed below the neckline support levels at both 1093 and 1082.

In the process, R2K also broke below long term support at the 400DMA (daily moving average). More bad news, the SP400 index has mimicked the R2K as mid caps are suffering the same double top.

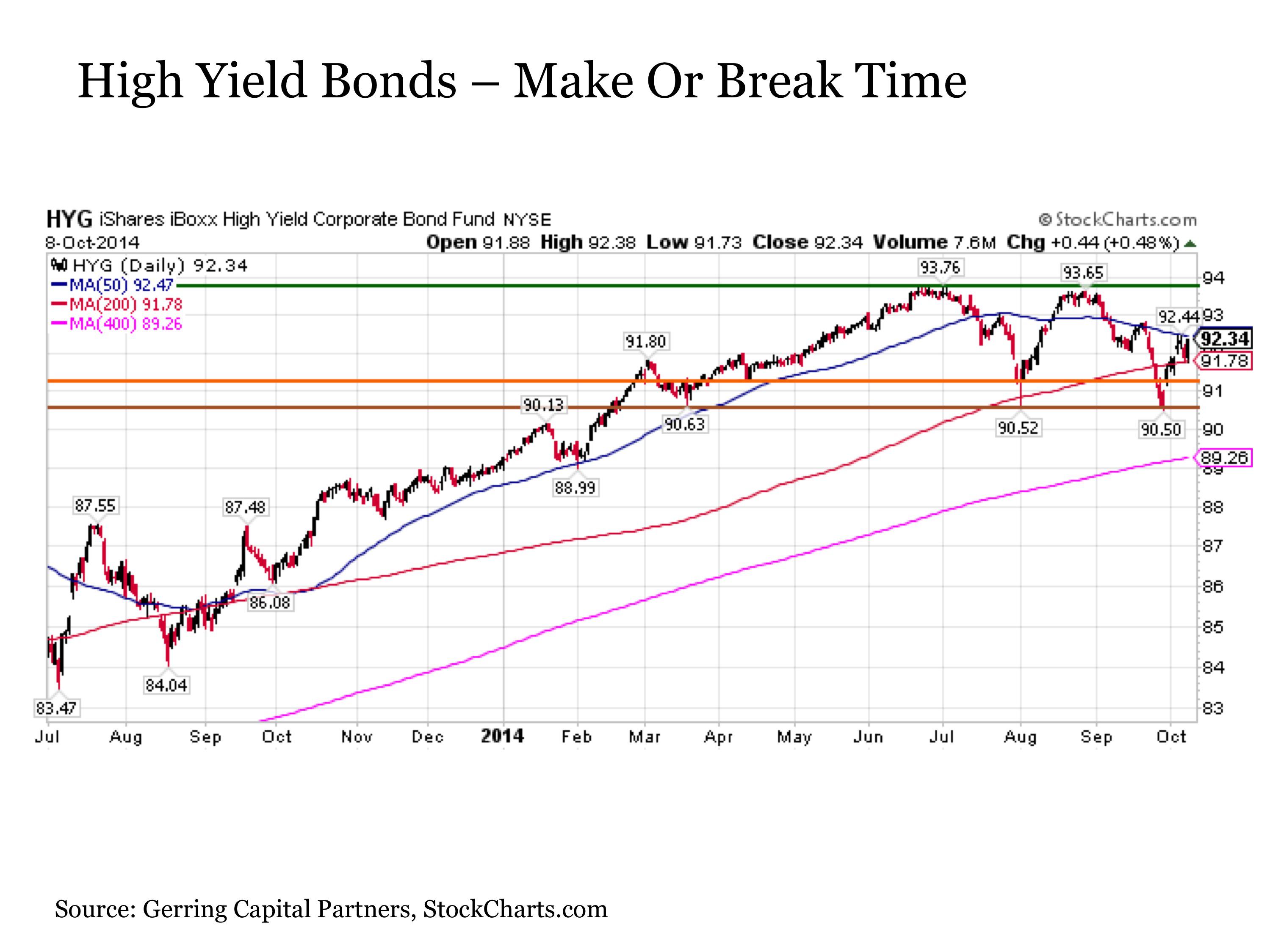

Following small and mid cap stocks, high yield bonds are showing signs of a double top. After hitting a second top end of August, high yield bonds have downtrended striking upward resistance at the 50DMA. The market as measured by the iShares iBoxx High Yield Corporate Bond Fund HYG managed to close below its 91.23 neckline support level in recent days.

Eric Parnell echos our sentiments: One leading indicator, the Russell 2000 Index has been in the process of setting a double top since the beginning of 2014.

R2K set its first peak at the beginning of March, then sold off through the middle of May, finding support at its previous closing low 1093 and intraday low at 1082, making these important neckline support levels.

R2K went on to rally, revisiting the March peak at the beginning of July. Since then R2K has been falling and over the last few days, sliced through and closed below the neckline support levels at both 1093 and 1082.

In the process, R2K also broke below long term support at the 400DMA (daily moving average). More bad news, the SP400 index has mimicked the R2K as mid caps are suffering the same double top.

Following small and mid cap stocks, high yield bonds are showing signs of a double top. After hitting a second top end of August, high yield bonds have downtrended striking upward resistance at the 50DMA. The market as measured by the iShares iBoxx High Yield Corporate Bond Fund HYG managed to close below its 91.23 neckline support level in recent days.

Comments