Perversion and Misallocation Of Capital

Amidst all the insanity, some lucidity from Salmo Trutta here , here and here:

The composition of commercial bank credit has changed. Credit standards have risen along with capital adequacy requirements. This has spurred the demand for zero-risk weighted assets (contrary to the Fed’s stated objective of incenting the purchase of riskier assets).

What's wrong is that economists: don't know that aggregate monetary demand is measured by monetary flows (MVt), not nominal-gDp; don’t know the difference between the supply of money & the supply of loan funds; between means-of-payment money & liquid assets; between financial intermediaries & money creating depository institutions; don’t recognize that interest rates are the price of loan-funds, not the price of money; don't recognize that the price of money is represented by the price level; don't realize that inflation is the most important factor determining interest rates, operating as it does through both the demand for and the supply of loan-funds.

There's no mis-understanding about rates. Debt monetization took a disproportionate volume of securities off the market. This was in spite of contrary forces that increased wholesale funding costs (borrowing costs)...

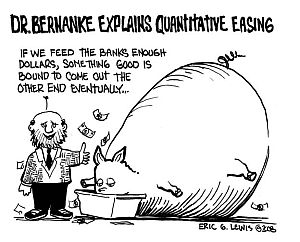

Monetary policy became contradictory and perverse, encouraging financial investment (activating portfolio rebalancing), and not income generating investment, or real-investment (new plant and equipment, etc.). I.e., Fed policy elicited income redistribution in reverse ("wealth effect" - sic)."

To follow up on his 2010 smash hit animation regarding The Fed and QE, in 2012 Omid Malekan made a hilarious follow up animation regarding CPI Fraud and the side effects of QE.

From Omid Malekan's November 2010 SLATE interview:

MALEKAN: The problem, really, is that monetary policy is now removed from people in general. People like Bernanke don't have to get elected. There's a disconnect between them and the people their decisions are affecting.

SLATE: Is there anyone you think should take Bernanke's job?

MALEKAN: You know, I'm not sure. I'd just like to see new people talking about new ideas. We haven't had much of that in a long time. Our economic establishment is all made of up the same people who have been there for years. Obama's Treasury Secretary was head of the New York Fed under Bush!

SLATE: Another way of asking that: What economic thinkers do you believe we should be paying attention to?

MALEKAN: To be honest I'm down on the idea of "economic thinkers" in general. The economic profession of which Bernanke is one of the leading thinkers has been so wrong about so many things. It'd be better for them and for us if they had less confidence in their ability. What did they see coming? Did they see the subprime crisis coming?

SLATE: What are they missing now?

MALEKAN: I'm in real estate, so I'm close to the problem, and the problem is that people don't have enough access to capital at any interest rates. It's not a money supply problem. If all we had to do to create jobs was print money, we'd all have jobs right now.

The Nattering One muses... Spot on, I could not say it any better and if we were calling the shots, Salmo Trutta AKA Mr. Brown Trout, would be the Chairman of The Fed.

Comments

Demand is always paramount in successful business planning and commitment decisions. If sufficient demand is not expected to exist, it matters not what the expected costs will be. "Sufficient" demand, of course, covers all costs plus and expected after tax profit margin.

Supply-siders approach the demand side of the equation on a "trickle down" basis; build the plants and produce the goods, and demand will take care of itself. Supply creates its own demand.

Unfortunately, we do not live in that kind of world. The proposition is simple. An economy such as ours which is geared to mass production requires concomitant mass consumption. Payrolls must be sufficient to buy the goods and services produced - at the asked prices.

Only in the frictionless world created by the mathematical model builders are the asked prices in equilibrium with consumer spendable income. In the real world, there is always a purchasing power deficiency gap of varying proportions. This is just another way of saying that to have high levels of production and employment, we need not only a vastly more competitive price structure, we also need a steady but slightly inflationary monetary policy (prices increase c. 2-3 percent annually), and a tax policy that contains some elements of compulsory income redistribution - downward.