Chasing The Bag

From WilliamBanzai7 @ Zero Hedge...

We've Nattered before about the perversion or misallocation of capital into corporate buybacks, here are some lucid points from IIargi, The Imminent Demise of the American Economy:

I think that what we're looking at here is the imminent demise of the corporate world, and therefore the financial world, and the entire US economy as we know it.

Companies need to invest their earnings into projects that will generate profits, into the development of products and services that they can sell to the world out there. If they instead use their earnings to buy back their own shares, they're on a fast track to oblivion, because they can't keep on buying their own shares over and over again.

Much of what they buy back shares with is borrowed money. Ultra low rates, what can go wrong, right? Well, here's what can: these allegedly rich firms are loading up on debt. While their productive qualities, for lack of a better term, get thrown out with the bathwater.

So at the exact same moment that the companies dilute their value through huge increases in their debt obligations, they get investors to buy huge amounts of additional debt, backed by, yeah, what exactly after a while? Backed by the fact that their shares are supposed to represent a certain value, ONLY because they've used their capital, and then leveraged some, to lift those same shares. Keep that up and nobody ever has to work anymore?!

It's not just the companies themselves that buy their own stock, we know the major central banks, the Fed, Bank of Japan, and People's Bank of China, also have substantial US stock portfolios. And 50% of US public pension funds are now holding the same US stocks. Everyone puts lipstick on the US corporate pig.

Standard & Poor's 500 really love their shareholders. Maybe too much. They're poised to spend $914 billion on share buybacks and dividends this year, or about 95% of earnings... Money returned to stock owners exceeded profits in the first quarter and may again in the third. The proportion of cash flow used for repurchases has almost doubled over the last decade while it's slipped for capital investments… "You can only go so far with financial engineering before you actually have to have a business with real growth," Chris Bouffard at Mutual Fund Store.

Excluding the recession years 2001 and 2008, dividends and stock buybacks have represented, on average, 85% of corporate earnings since 1998. CEOs have increased the proportion of cash flow allocated to stock buybacks to more than 30%, almost double where it was in 2002, data from Barclays show. During the same period, the portion used for capital spending has fallen to about 40% from more than 50%.

The reluctance to raise capital investment has left companies with the oldest plants and equipment in almost 60 years. The average age of fixed assets reached 22 years in 2013, the highest level since 1956 …

Through buybacks, S&P companies have, aided by central banks, and Wall Street, created a hugely perverted idea of what their shares are worth. 'Someone's buying, so there must be value there'. Well, not if the seller poses as the buyer too.

The lack of capital invested in productive undertakings spells even more erosion of the US manufacturing base. And that tells you all you need to know about the future of US industry. If companies don't invest earnings in their own productive futures, who's going to do it, and why should they?

How much closer can you get to not having a functional economy? Beats me. There's nothing there anymore, other than cheap credit and old habits. There's no there there.

“What are CEOs incentivized for? Stock price performance. It’s easier to do stock buybacks or M&A than capex.” — Neeraj Seth, Head of BlackRock Asia Credit

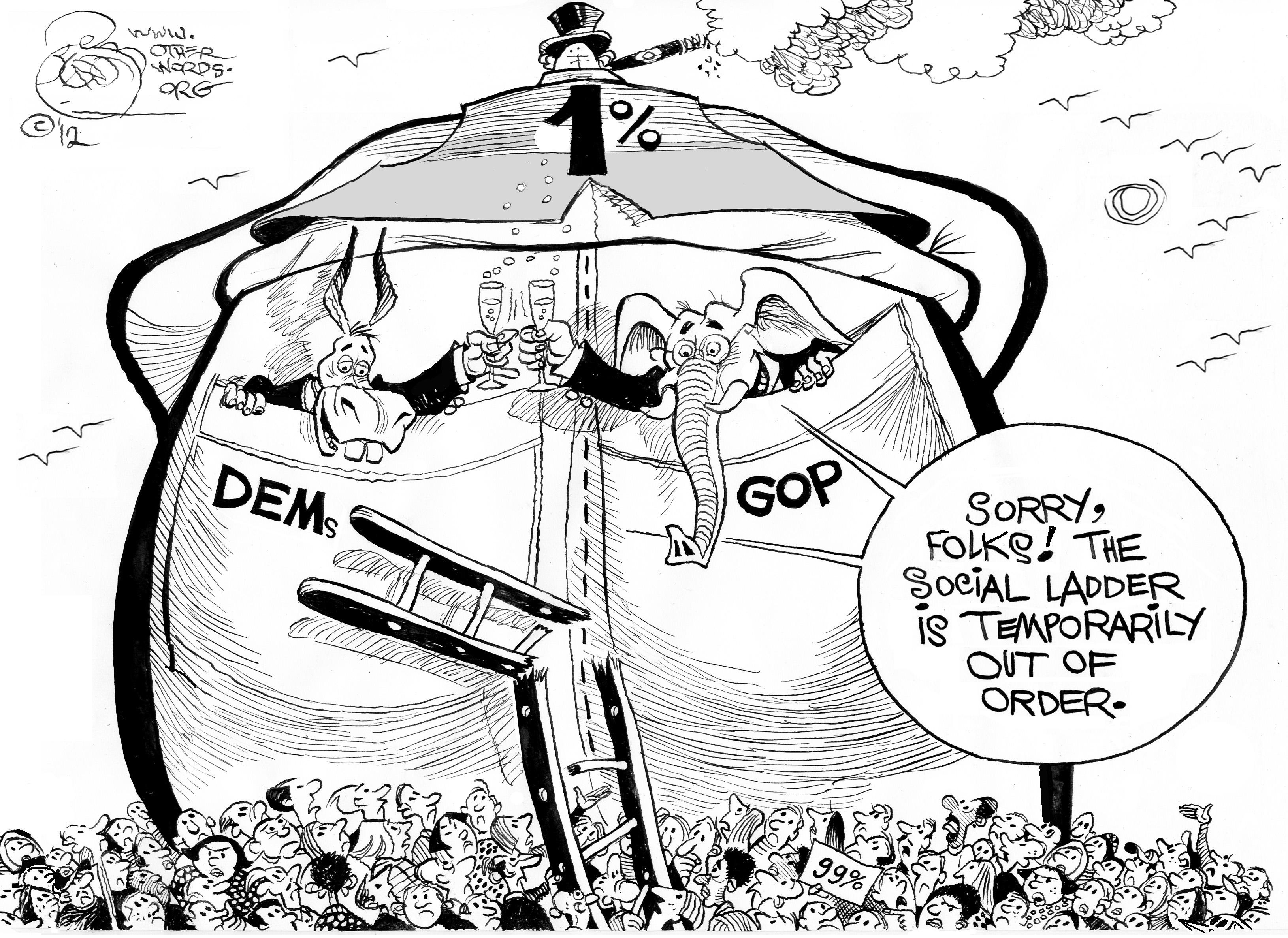

The Nattering One muses... Chasing the bag has taken precedence over more profound socio economic issues. It is easier to borrow easy money for investments that chase yield, which caters to income redistribution in reverse, rather than build a durable economic base for the future, resulting in another side effect - the widening gap in income...

And an ever increasing lowered standard of living through wage deflation and budget crisis slashing of basic services and social programs...

Please watch the following humorous animation from Malekan which helps to explain how the rich get richer, while the poor get poorer.

THE BANKSTATOCRACY

Such is the plight of the poor

The Kleptocrats always want more

A system of greed

Has now been decreed

A system that may lead to war

The Kleptocrats always want more

A system of greed

Has now been decreed

A system that may lead to war

The Limeric King

We've Nattered before about the perversion or misallocation of capital into corporate buybacks, here are some lucid points from IIargi, The Imminent Demise of the American Economy:

I think that what we're looking at here is the imminent demise of the corporate world, and therefore the financial world, and the entire US economy as we know it.

Companies need to invest their earnings into projects that will generate profits, into the development of products and services that they can sell to the world out there. If they instead use their earnings to buy back their own shares, they're on a fast track to oblivion, because they can't keep on buying their own shares over and over again.

Much of what they buy back shares with is borrowed money. Ultra low rates, what can go wrong, right? Well, here's what can: these allegedly rich firms are loading up on debt. While their productive qualities, for lack of a better term, get thrown out with the bathwater.

So at the exact same moment that the companies dilute their value through huge increases in their debt obligations, they get investors to buy huge amounts of additional debt, backed by, yeah, what exactly after a while? Backed by the fact that their shares are supposed to represent a certain value, ONLY because they've used their capital, and then leveraged some, to lift those same shares. Keep that up and nobody ever has to work anymore?!

It's not just the companies themselves that buy their own stock, we know the major central banks, the Fed, Bank of Japan, and People's Bank of China, also have substantial US stock portfolios. And 50% of US public pension funds are now holding the same US stocks. Everyone puts lipstick on the US corporate pig.

Standard & Poor's 500 really love their shareholders. Maybe too much. They're poised to spend $914 billion on share buybacks and dividends this year, or about 95% of earnings... Money returned to stock owners exceeded profits in the first quarter and may again in the third. The proportion of cash flow used for repurchases has almost doubled over the last decade while it's slipped for capital investments… "You can only go so far with financial engineering before you actually have to have a business with real growth," Chris Bouffard at Mutual Fund Store.

Excluding the recession years 2001 and 2008, dividends and stock buybacks have represented, on average, 85% of corporate earnings since 1998. CEOs have increased the proportion of cash flow allocated to stock buybacks to more than 30%, almost double where it was in 2002, data from Barclays show. During the same period, the portion used for capital spending has fallen to about 40% from more than 50%.

The reluctance to raise capital investment has left companies with the oldest plants and equipment in almost 60 years. The average age of fixed assets reached 22 years in 2013, the highest level since 1956 …

Through buybacks, S&P companies have, aided by central banks, and Wall Street, created a hugely perverted idea of what their shares are worth. 'Someone's buying, so there must be value there'. Well, not if the seller poses as the buyer too.

The lack of capital invested in productive undertakings spells even more erosion of the US manufacturing base. And that tells you all you need to know about the future of US industry. If companies don't invest earnings in their own productive futures, who's going to do it, and why should they?

How much closer can you get to not having a functional economy? Beats me. There's nothing there anymore, other than cheap credit and old habits. There's no there there.

“What are CEOs incentivized for? Stock price performance. It’s easier to do stock buybacks or M&A than capex.” — Neeraj Seth, Head of BlackRock Asia Credit

The Nattering One muses... Chasing the bag has taken precedence over more profound socio economic issues. It is easier to borrow easy money for investments that chase yield, which caters to income redistribution in reverse, rather than build a durable economic base for the future, resulting in another side effect - the widening gap in income...

And an ever increasing lowered standard of living through wage deflation and budget crisis slashing of basic services and social programs...

Please watch the following humorous animation from Malekan which helps to explain how the rich get richer, while the poor get poorer.

Comments