Deutsche Bank:The Nutcracker Suite?

Summary

Discussion of the potential effects on equity, bond, commodity, capital and asset markets regarding:

Record foreign TIC liquidation; Eurodollar liquidity.

Deutsche Bank borrowing cost curve; NIM compression.

Working capital compression; Equity and debt valuation convergence.

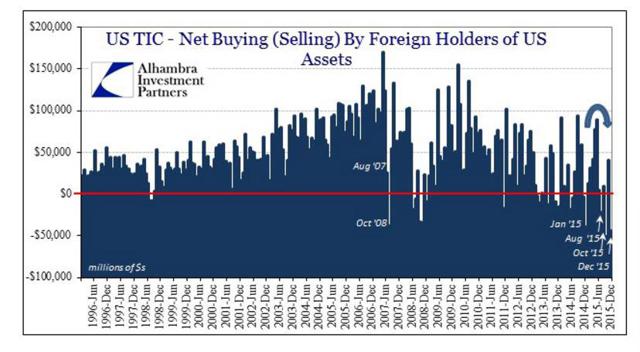

Record TIC Flows

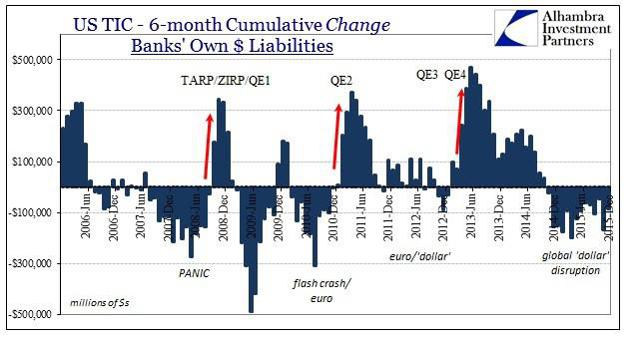

"There was a record monthly amount of "selling USTs" in foreign channels, a dearth of private "dollar" activity and, perhaps most important of all, bank liabilities for the last quarter of 2015 shrinking again at a troubling rate.... If foreign official channels are being forced to respond in such dramatic fashion, such reactivity is clearly due to bank balance sheet reductions..... The sum total of the TIC estimates provides another cumulative confirmation that the "dollar" problem is huge, widespread and originating with banks that no longer wish to act as money dealers." - Jeffrey P. Snider

Above note, the ongoing contraction with December being by far, the largest one month decline on record. Central banks and governments are having to shift dollar assets to fill the gap in market making left by the "disintermediated" banks, while at the same time foreign bank balance sheet dollar liabilities are contracting (read eurodollar).

Above note, since June 2013 a cumulative negative $600B shift in bank dollar liabilities. And what of the other side of the ledger?

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Comments