SP500: 1500 Too High?

Summary

Discussion of the potential effects on equity, bond, commodity, capital and asset markets regarding:

Pinocchio EBITDA Valuations; Forward PE EPS Estimates.

PE and Non Cash Asset Squeeze; FX Considerations.

Pinocchio EBITDA

Warren Buffett in a recent letter to stockholders... "When CEOs or investment bankers tout pre-depreciation figures such as EBITDA as a valuation guide, watch their noses lengthen while they speak."

Above note, art courtesy of the 2015 Pinoccchio Climate Awards.

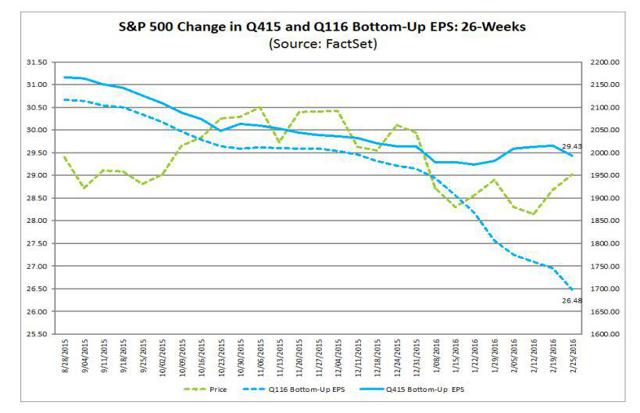

Do you know what the GAAP forward EPS or PE valuation of the S&P 500 actually is? March 2015, estimates of FMV around 1825 were floating around, and the market has since gravitated to confirm those levels.

Above note, Q1 2016 Bottom Up EPS from Factset tracking S&P 500 at 1700.

Given revenue, earnings and profit estimates have disappointed and declined what would Q1 2016 GAAP estimations of the S&P 500 be? One would not want to go ex energy, as that would be like saying the energy sector debt and potential problems did not exist.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Comments