What Did The ECB Do?

Summary

Discussion of the potential effects on equity, bond, commodity, capital and asset markets regarding:

ECB Announcement; The 3 things the ECB Did.

The 4 things the ECB Announced; Market Reactions.

The ECB did three things:

- dropped the main refinancing rate to zero from 0.05%

- cut the deposit rate to -0.4 from -0.3%

- cut the marginal lending facility rate to 0.25 from 0.30%

The ECB announced four things:

- expanded its quantitative easing asset buying to 80 billion euros ($88.7 billion) a month from 60 billion euros

- for the first time, investment grade non bank debt (read euro corporate bonds) are now eligible for purchase

- announced from June 2016 to March 2017 at a quarterly frequency, a new series of four targeted longer term refinancing operations (TLTRO II), each with a maturity of four years with the possibility of repayment after two years.

- Draghi said that further rate cuts would "probably" NOT be necessary.

Market Reactions

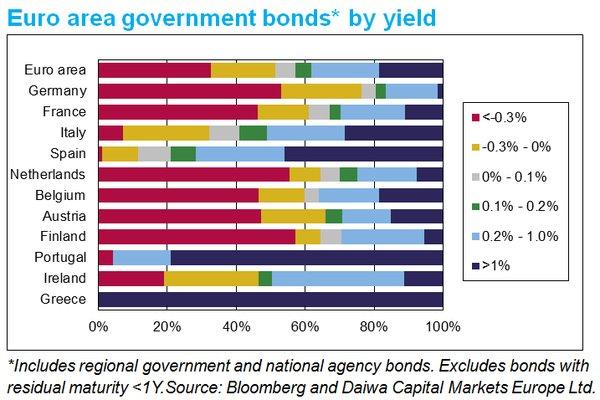

Core ECB government bond yields barely reacted. Upon further review, the deposit rate cut to -0.4% makes 80% of German bunds now eligible for ECB purchase.

Above note, percentage of core ECB bonds in negative territory. Around 50% of government bonds in Europe trade with negative interest rates, which amounts to about $3.5T.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Comments