Housing Bubble Update

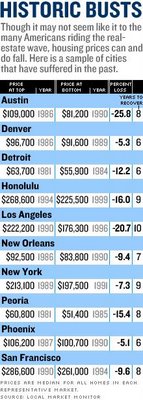

Forwarded by a Naybob of Simian nature. CNN reports The Housing Market Sours. Included in this article is a nifty table of the 10 most overvalued markets in the U.S.

Forwarded by a Naybob of Simian nature. CNN reports The Housing Market Sours. Included in this article is a nifty table of the 10 most overvalued markets in the U.S.In Boston, real-estate investor Matthew Martinez reports recently having spoken to five condo converters. "They all said the party was over," Martinez said.

In Florida, Elena Filipa, vice president of the Corcoron Group in West Palm, said "We've leveled off. I would say prices will go up this year, but not as fast as they have."

None of this surprises the many economists who have been waiting for a downturn.

Richard DeKaser, chief economist for mortgage banker National City, has been reluctant to call the top, but thinks it has finally passed. "We're coming down the other side of the mountain," said DeKaser.

Reasons why: the number of new homes sold have fallen sharply since peaking in July at an annual rate of 1.3 million units.

Supplies of new homes are way up, to nearly 500,000 units, from 350,000 a few months ago. That's an all-time high for new homes.

Sell times are up as Houses are sitting on the market longer. New homes now take about 4.1 months to sell and existing homes 4.7; both figures are up substantially.

Comments

falling in line with inflation

Follow this link to see the data from the last and current real estate cycle in Southern California.

Will The 1992 So Cal Recession Be Repeated?