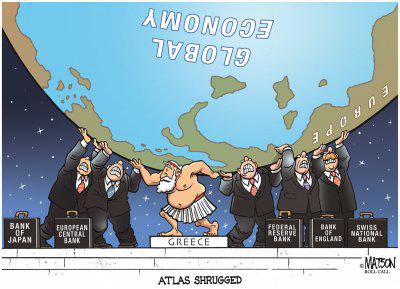

Atla's Shrugged Unnaturally

From the Economist: "To carry out QE central banks create money by buying securities, such as government bonds, from banks, with electronic cash that did not exist before. The new money swells the size of bank reserves in the economy by the quantity of assets purchased...The idea is that banks take the new money and buy assets to replace the ones they have sold to the central bank."

The Nattering One muses... Nice idea on paper, as Cullen Roche would say: another horror story written by economists who have a theoretical narrative that doesn't actually reflect our reality.

More from Cullen Roche: When the economy went into a state of deleveraging the normal process of deposit expansion via loans dried up. In other words, the money supply stopped expanding because the demand for loans dried up. So the Fed implemented QE to try to get more “money” into the system. The loan:deposit ratio is just a sign of the deleveraging we’ve been through and the weak demand for loans.

From Zero Hedge: "when banks do not "create" money from loans (as they clearly don't), [The Fed] has to step in with QE and create money on its own.

Risk assets are bid up to record highs - excess reserves are a perfectly fungible source of margin collateral - even as the actual flow through of the Fed's "wealth effect" is halted precisely due to the complete collapse in new loan creation - the primary "transmission mechanism" of economic growth.

by keeping the pedal to the metal on QE for the past 6 years, the Fed has given the banks all the benefits of money creation (soaring deposits), without any of the risks (loan creation in a record low Net Interest Margin environment).

And if you are JPM you will be perfectly happy with this arrangement and not seek to lend out any money, as the case has been for the past six years.

Which means consumers who wish to take out loans to fund ventures and other growth strategies are fresh out of luck, because the banks that ordinarily supply them with this risk capital have simply shut down the process entirely, and instead are gambling in the stock market."

Six years ago, just prior to QE1 in 2008, we opined that "the Fed should let nature take its course" in The Final Arbiter: "the Fed has one bullet left in its six shooter.

And running out of Ammo is not the ultimate problem, getting the water logged ammo to work is. [Re:QE] And perhaps we are already there and they will.

To date the Fed has not printed, in fact the money supply has contracted... as the capital base has shrunk into the deleveraging vortex of the multiplier effect working in reverse, or economic death spiral. There is another name for this, a liquidity trap.

Not, The Tender Trap... legal tender that is... Look at the 3 month T bill rate of 0.60%, look at 3 month libor 2.60, the TED spread is now at 2%, reflecting banks unwillingness to lend to one another.

The 0.60 rate reflects the real market rate, the market being the final arbiter, not the Fed rate of 2.25%.

Banks and intelligent individuals are already liquidated and hoarding reserves, just let Atlas Shrug and nature take its course.

The Fed's only hope is to free the markets, stop the cutting, stop the bailouts and let the marketplace be the final arbiter."

From Chris Hamilton - Trim Tabs: governments and central banks are attempting to... avoid the pain of free market corrections to supply, production, and price. It is in this light that the centralization and "intervention" of stock, bond, and real estate markets and the manipulation of commodities growing in scale and frequency since '09 should not be shocking.

Free markets are the enemy of fraud, the punisher of bad fiscal and economic behavior and thus free markets will not be allowed to facilitate true price discovery (i.e., REALITY).

The Nattering One muses: After the housing bubble burst, the demand for loans did not dry up. However, the banks did tighten their ultra loose "fog a mirror" underwriting on housing loans and stopped making small business loans.

Bennie and the Fed's QE has been a bailout of the banks caught in a ZIRP liquidity trap. And what type of assets did the banks buy with their margin collateral? And what were the consequences of the misallocation of capital? This was also discussed previously.

QE and ZIRP led to an artificial suppression of interest rates, a prolonged negative interest rate environment, and a complete dislocation (artificial hyper inflation through bid up) of pricing in most asset markets.

In March 2008, we noted... So much for capitalism and Adam Smith's "invisible free hand of the market".

The whole housing debacle demonstrated that at the first sign of failure, capitalism jumps out the window for cronyism and socialism. All the safety nets being thrown about and Barney Frank bailouts are a testimony to this fact.

I have three words for Benny and the Feds, no not, GO F*CK YOURSELF, but the simple fact that there are NO FREE MARKETS.

ALL markets and their asset pricing are to some degree, controlled, contrived and thus, can be and are manipulated.

The existence of a "free market" is just like a yeti sighting, "peak oil", Ancient Astronaut Theorist's (if you need to get laid, call one, they always say "yes") and shape shifting alien lizard conspiracies...

in other words, it's a fairy tale or myth for the consumption of the naive and foolish.

Six years later, QE is winding down? And all the banks that should have failed, got bailed out.

All the ghost inventory or housing stock that under normal circumstances would have been liquidated, at a natural market price, has not. Resulting in artificially reflated housing prices, which is what got us into this mess in the first place.

Nature (Adam Smith's Mythical Free Hand), the Final Arbiter (The Market) was not allowed to take its course. Atlas shrugged unnaturally, Frazier goes down, Darwinism goes down, no survival of the fittest here.

Coming full circle... at the end of the day, we are left with more and more unnatural guvmint ingredients leading to an economic witches brew as in, "There is Something In This More Than Natural" and perhaps we should have Let Nature Take It's Course?

Recommended reading:

Atlas Shrugged or Let Nature Take It's Course?

There is Something In This More Than Natural

There Is Something In This More Than Natural - Part 2

There Is Something In This More Than Natural - Part 3

There Is Something In This More Than Natural - Part 4

There Is Something In This More Than Natural - Epilogue

Atla's Shrugged Unnaturally

Comments