HIBOR, LIBOR and TED, Oh My!!

Summary

Discussion of the potential effects on equity, bond, commodity, capital and asset markets regarding:

Drastic increases in HIBOR, LIBOR and the TED Spread.

Rastic increases in repo costs and reverse repo arbitrage margins; the potential effect on intrabank and corporate unsecured lending.

We noted at the end of our last missive, Is The TED Spread Yellen?

Since the FDIC killed off foreign overnight transfers,interbank flows have been competing with offshore dollar loans for dollar funding. Interbank flows are contracting as TED is "talkin loud" and might be a bit damaged.

What will happen to those interbank flows and the offshore dollar loans they compete with, with a furtherance of contraction in "dollar" liquidity? What affect will that have on the global value of the "dollar"? Especially when TED really starts "Yellen" due to the rate increase and subsequent yield curve flattening?

Our good friend Martin at Macronomic's whose Ghost of Christmas Past spoke to risk reversal trades commented:

Trade du jour, will be once again the US long bond. Because you have a flatter yield curve and trouble brewing in HY with a flatter credit CDX HY curve. On top of that you have a liquidity contraction which is now showing up in our old TED spread friend. The Fed is continuing to unleash the mother of all "US Dollar" margin calls.The trend will be the same as in 2015, currency pegs will break in EM. That's a given.

In brief, this is the sixth in a series of thematically related missives which will attempt to identify the macroeconomic forces with potential to adversely effect capital, commodity, equity, bond and asset markets.

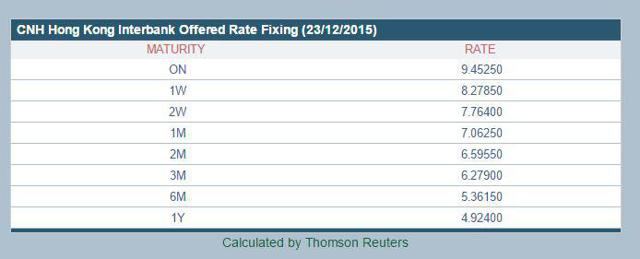

HIBOR - CNH Hong Kong Interbank Offered Rate

Above note, O/N HIBOR: on 12/11 @ 1.626%; as of 12/23 @ 9.452%, for an increase of +782.6bps; the highest reading ever was Aug 24th @ 10%

Above note, 3MO HIBOR: 12/11 @ 4.69%; as of 12/23 @ 6.27%;for an increase of +158bps

HIBOR is a proxy for offshore RMB/USD liquidity. Rising ON HIBOR means increasing offshore RMB/USD ill liquidity.

This missive was published as an exclusive to Seeking Alpha. To access the ENTIRE text for FREE on Seeking Alpha, please click here. The Nattering One does not receive remuneration if you register, only satisfaction.

Summary

Discussion of the potential effects on equity, bond, commodity, capital and asset markets regarding:

Drastic increases in HIBOR, LIBOR and the TED Spread.

Rastic increases in repo costs and reverse repo arbitrage margins; the potential effect on intrabank and corporate unsecured lending.

We noted at the end of our last missive, Is The TED Spread Yellen?

Since the FDIC killed off foreign overnight transfers,interbank flows have been competing with offshore dollar loans for dollar funding. Interbank flows are contracting as TED is "talkin loud" and might be a bit damaged.

What will happen to those interbank flows and the offshore dollar loans they compete with, with a furtherance of contraction in "dollar" liquidity? What affect will that have on the global value of the "dollar"? Especially when TED really starts "Yellen" due to the rate increase and subsequent yield curve flattening?

Our good friend Martin at Macronomic's whose Ghost of Christmas Past spoke to risk reversal trades commented:

Trade du jour, will be once again the US long bond. Because you have a flatter yield curve and trouble brewing in HY with a flatter credit CDX HY curve. On top of that you have a liquidity contraction which is now showing up in our old TED spread friend. The Fed is continuing to unleash the mother of all "US Dollar" margin calls.The trend will be the same as in 2015, currency pegs will break in EM. That's a given.

In brief, this is the sixth in a series of thematically related missives which will attempt to identify the macroeconomic forces with potential to adversely effect capital, commodity, equity, bond and asset markets.

HIBOR - CNH Hong Kong Interbank Offered Rate

Above note, O/N HIBOR: on 12/11 @ 1.626%; as of 12/23 @ 9.452%, for an increase of +782.6bps; the highest reading ever was Aug 24th @ 10%

Above note, 3MO HIBOR: 12/11 @ 4.69%; as of 12/23 @ 6.27%;for an increase of +158bps

HIBOR is a proxy for offshore RMB/USD liquidity. Rising ON HIBOR means increasing offshore RMB/USD ill liquidity.

This missive was published as an exclusive to Seeking Alpha. To access the ENTIRE text for FREE on Seeking Alpha, please click here. The Nattering One does not receive remuneration if you register, only satisfaction.

This missive was published as an exclusive to Seeking Alpha. To access the ENTIRE text for FREE on Seeking Alpha, please click here. The Nattering One does not receive remuneration if you register, only satisfaction.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Comments