Let Janet Do The Heavy Lifting?

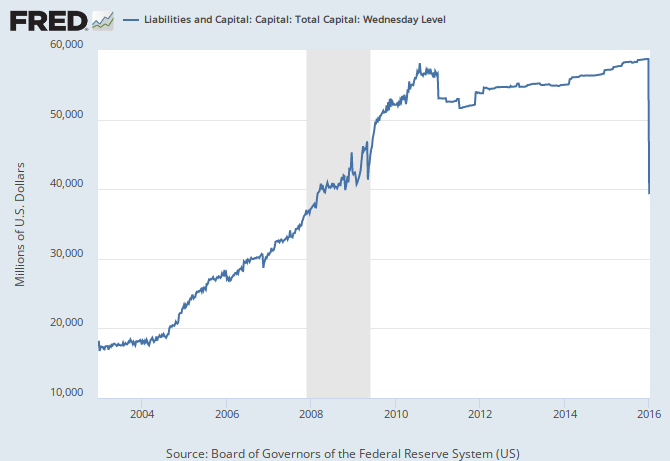

Above chart, since Dec 23rd, the Fed's total capital dropped 33% and went from $58B to $39.5B.

Apparently, last months FAST act (Fixing America’s Surface Transportation) passed by Congress, has a requirement that Federal Reserve bank surpluses above a certain amount must be turned over to the United States Department of Treasury.

With a $4.7T portfolio that has severe liability and asset duration mismatches, what risk is there with on hand capital of $39B? Rates go higher? Short duration liability costs go up and long term duration asset values go down.

That's called getting double ended and Damn-it Janet won't let that happen. Yellen will protect that portfolio at all costs even if it means throwing the SP500 and equities under the bus.

In any event, whatever they need will be debited into being accordingly out of thin air. I say that in an ironic and tragic sense as The Fed is not a government agency, they are a privately held institution owned by the banks. Guess who might be left holding the bag? HELLO!!!!

Goes along with these three charts...

Above, RRP spiking to $572B and...Goes along with these three charts...

Above, RRP to others spiking to $342B.

Above, RRP to foreign official accounts spiking to $230B. Nothing like sucking almost $800B in liquidity out of the markets?

Marketwatcher23 commented: "I am going with the theory that Janet is going to take every speculative yielding security and obliterate it. She, like her predecessor, wants everyone is SPY and TLT from here on out and she will do the heavy lifting."

We Nattered: IMHO, she wants everyone in bonds period. Spooking the herd out of equities benefits the Fed's duration mismatched $4.7T portfolio by forcing UST yields down, keeps the payments low on liabilities, value or price up on assets.

In addition, the central banks have kept a bankrupt banking system afloat with QE/ZIRP/IOER at the expense of the economy. If they intend to rectify that, they should just get off the zero bound and raise, those that fail, fail.

Problematic as higher rates would benefit NIM's and get the multiplier or velocity going, good to incentivize banks back into the lending business vs the savings business they have been forced into, good for the economy.

Downside? All that debt would be harder to service and asset bubbles might get pricked. Somethings gotta give, and I don't think Goldilocks is coming, so baby steps.

Comments