Dollar Chaos or Ran?

Summary

Discussion of the potential effects on equity, bond, commodity, capital and asset markets regarding:

GC Repo Rate; Yen Cross Currency Basis Swaps.

The Dollar Rally; China's Forward Dollar Swaps.

Nikkei Selloff; Japan's Interbank Lending.

Ran (乱?, Chinese and Japanese for "chaos", "rebellion", or "revolt", or to mean "disturbed" or "confused") is a 1985 Japanese-French jidaigeki epic film directed and co-written by Akira Kurosawa. In this cinematic masterpiece, an aging Sengoku-era warlord decides to abdicate as ruler in favor of his three sons. The story is based on legends of the daimyo Mōri Motonari, as well as on the Shakespearean tragedy King Lear. If you have never seen Kurosawa's last epic, you are truly missing something in life. A must see, one of the best films ever made, and should be required higher educational subject matter, IMHO.

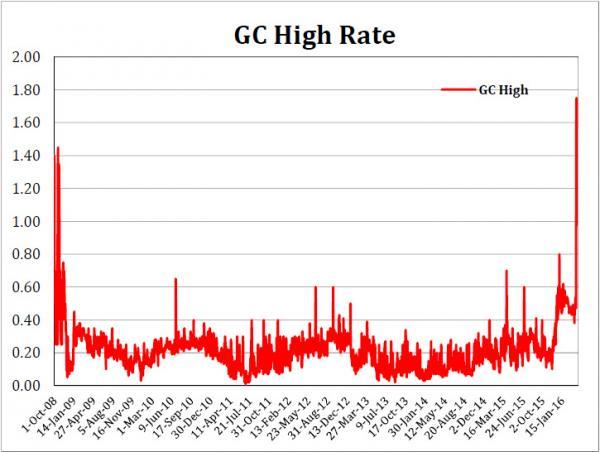

GC Repo Spike

"Despite the below-zero interest rate and the possibility of further easing, investors piled into the yen, continuing the Japanese currency's more than 6.5 percent increase since the day after the rates were announced following its January meeting. Tina Byles Williams, Chief Executive Officer and Chief Investment Officer at FIS Group in Philadelphia. "There's anticipation of a risk-off moment and the yen is the protection against that."" Weak U.S. data, BOJ outlook push dollar down vs. yen - Reuters

Utter MSM nonsense which in the quote "the yen is the protection" is being parroted yet again. We previously discussed this commonly held misconception, the tsunami of dollars being lent into the market, and the perils of Japanese banking in China, in some recommended reading A Yen For Yuan?

Above note, With the banks parking in RRP overnight for Q-end window dressing, GC (general collateral) repo rate spiked to 1.75% on March 31st, the highest since 2008. I suspect next week things might get tight with China possibly rolling over their forward dollar swaps est. $150 - 300B. TBD. Something is wrong and its not just Q-end dollar liquidity related.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Comments