Dollar Hell? Road to Perdition?

Summary

Discussion of the potential effects on equity, bond, commodity, capital and asset markets regarding:

Challenger Job Cuts; Atlanta GDP Estimate; Wages and Spending.

Manufacturing and Services; Money Aggregates and Accords.

Cross Currency Basis Swaps; China's Forward Dollar Swaps.

Perdition - noun - (in Christian theology) a state of eternal punishment and damnation into which a sinful and unrepentant person passes after death. Late Middle English: from Old French perdiciun, from ecclesiastical Latin perditio(n- ), from Latin perdere 'destroy', from per- 'completely, to destruction' + the base of dare 'put'; Complete or utter ruin.

Nominated for six Academy awards in 2002, Road to Perdition stars Tom Hanks, Paul Newman (in his final live-action film role), Jude Law, and Daniel Craig. The plot takes place in 1931, during the Great Depression, following a mob enforcer and his son as they seek vengeance against a mobster who murdered the rest of their family. Themes examined in this "dark" film based on a graphic novel include: the consequence of violence, father-son relationships, and the "uncontrollability" of fate which humans cannot control.

The question of "liquidity" or available "dollars" which we raised yesterday in Dollar Chaos? is nagging the markets. Global markets are down, with the Nikkei selling off big for a 4th straight day, the Yen gaining and the Dollar declining. Uninformed or detached MSM narrative claims that there is a "flight to safety" in the Yen (which we addressed in A Yen for Yuan?) and that none of this has to do with King Dollar. Unfortunately or fortunately,depending how one looks at it, the "dollar" due to its necessity for funding and market liquidity, is front and center at the moment.

Challenger Job Cuts

Challenger and Gray job cut reported the March figure for pink slips was 31.7% higher Yoy making it the fourth consecutive year-over-year increase. Through Q12016, employers announced 184,920 job cuts, up 31.8% Yoy from Q12015; Q12016 vs Q42015 +75.9% job cuts Layoffs are spreading from the energy sector, 90 day total +39.9% Yoy; retail sector +41%; computer sector +148%. Despite the MSM happy daze NAIRU narrative, the employment situation seems to be worsening and accelerating. More good news for our services based economy and spending, right?

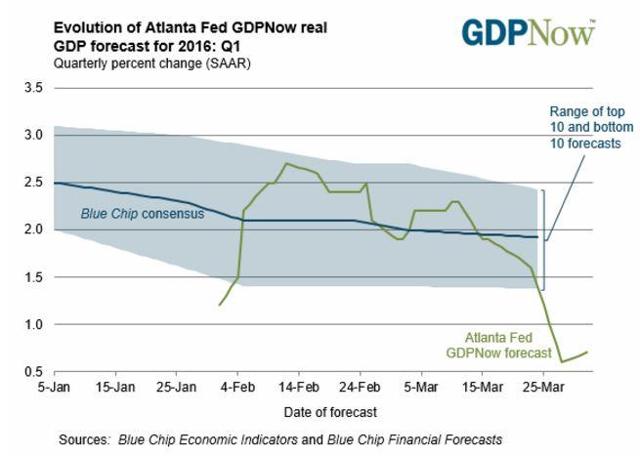

GDP Now

Above note, confirming the job cuts, the Atlanta Fed GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in Q12016 is 0.7 percent on April 1, up from 0.6 percent on March 28. We called for tepid Q4 GDP and got it, then for Q1 to hit recession level. GDP +0.7% is not quite negative as the numbers keep getting juiced to stay in positive territory, justifying the MSM narrative. Remember, it's an election year, keep calm, all is well.

Nominated for six Academy awards in 2002, Road to Perdition stars Tom Hanks, Paul Newman (in his final live-action film role), Jude Law, and Daniel Craig. The plot takes place in 1931, during the Great Depression, following a mob enforcer and his son as they seek vengeance against a mobster who murdered the rest of their family. Themes examined in this "dark" film based on a graphic novel include: the consequence of violence, father-son relationships, and the "uncontrollability" of fate which humans cannot control.

The question of "liquidity" or available "dollars" which we raised yesterday in Dollar Chaos? is nagging the markets. Global markets are down, with the Nikkei selling off big for a 4th straight day, the Yen gaining and the Dollar declining. Uninformed or detached MSM narrative claims that there is a "flight to safety" in the Yen (which we addressed in A Yen for Yuan?) and that none of this has to do with King Dollar. Unfortunately or fortunately,depending how one looks at it, the "dollar" due to its necessity for funding and market liquidity, is front and center at the moment.

Challenger Job Cuts

Challenger and Gray job cut reported the March figure for pink slips was 31.7% higher Yoy making it the fourth consecutive year-over-year increase. Through Q12016, employers announced 184,920 job cuts, up 31.8% Yoy from Q12015; Q12016 vs Q42015 +75.9% job cuts Layoffs are spreading from the energy sector, 90 day total +39.9% Yoy; retail sector +41%; computer sector +148%. Despite the MSM happy daze NAIRU narrative, the employment situation seems to be worsening and accelerating. More good news for our services based economy and spending, right?

GDP Now

Above note, confirming the job cuts, the Atlanta Fed GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in Q12016 is 0.7 percent on April 1, up from 0.6 percent on March 28. We called for tepid Q4 GDP and got it, then for Q1 to hit recession level. GDP +0.7% is not quite negative as the numbers keep getting juiced to stay in positive territory, justifying the MSM narrative. Remember, it's an election year, keep calm, all is well.

This missive was published as an exclusive to Seeking Alpha. To access the ENTIRE text for FREE on Seeking Alpha, please click here. The Nattering One does not receive remuneration if you register, only satisfaction.

Discussion of the potential effects on equity, bond, commodity, capital and asset markets regarding:

Challenger Job Cuts; Atlanta GDP Estimate; Wages and Spending.

Manufacturing and Services; Money Aggregates and Accords.

Cross Currency Basis Swaps; China's Forward Dollar Swaps.

Perdition - noun - (in Christian theology) a state of eternal punishment and damnation into which a sinful and unrepentant person passes after death. Late Middle English: from Old French perdiciun, from ecclesiastical Latin perditio(n- ), from Latin perdere 'destroy', from per- 'completely, to destruction' + the base of dare 'put'; Complete or utter ruin.

Nominated for six Academy awards in 2002, Road to Perdition stars Tom Hanks, Paul Newman (in his final live-action film role), Jude Law, and Daniel Craig. The plot takes place in 1931, during the Great Depression, following a mob enforcer and his son as they seek vengeance against a mobster who murdered the rest of their family. Themes examined in this "dark" film based on a graphic novel include: the consequence of violence, father-son relationships, and the "uncontrollability" of fate which humans cannot control.

The question of "liquidity" or available "dollars" which we raised yesterday in Dollar Chaos? is nagging the markets. Global markets are down, with the Nikkei selling off big for a 4th straight day, the Yen gaining and the Dollar declining. Uninformed or detached MSM narrative claims that there is a "flight to safety" in the Yen (which we addressed in A Yen for Yuan?) and that none of this has to do with King Dollar. Unfortunately or fortunately,depending how one looks at it, the "dollar" due to its necessity for funding and market liquidity, is front and center at the moment.

Challenger Job Cuts

Challenger and Gray job cut reported the March figure for pink slips was 31.7% higher Yoy making it the fourth consecutive year-over-year increase. Through Q12016, employers announced 184,920 job cuts, up 31.8% Yoy from Q12015; Q12016 vs Q42015 +75.9% job cuts Layoffs are spreading from the energy sector, 90 day total +39.9% Yoy; retail sector +41%; computer sector +148%. Despite the MSM happy daze NAIRU narrative, the employment situation seems to be worsening and accelerating. More good news for our services based economy and spending, right?

GDP Now

Above note, confirming the job cuts, the Atlanta Fed GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in Q12016 is 0.7 percent on April 1, up from 0.6 percent on March 28. We called for tepid Q4 GDP and got it, then for Q1 to hit recession level. GDP +0.7% is not quite negative as the numbers keep getting juiced to stay in positive territory, justifying the MSM narrative. Remember, it's an election year, keep calm, all is well.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Comments