The Synthetic Matrix?

Summary

Discussion of the potential effects on equity, bond, commodity, capital and asset markets regarding:

Atlanta GDP Redux; Subject Matter Expertise; World "Money".

Broad Dollars; Synthetic Flows; Interest Rate Swaps vs DXY.

CNY; CNH; Eurodollar; China's Forward Dollar Swaps; Nuances.

The Matrix

The Matrix is a 1999 American-Australian neo-noir science fiction action film written and directed by the Wachowski Brothers. It depicts a dystopian future in which reality as perceived by most humans is actually a simulated reality called "the Matrix", created by sentient machines to subdue the human population, while their bodies' heat and electrical activity are used as an energy source. A computer hacker learns from mysterious rebels about the true nature of his reality and his role in the war against its controllers. Matrix poster art courtesy of Robert Bruno

GDP Redux

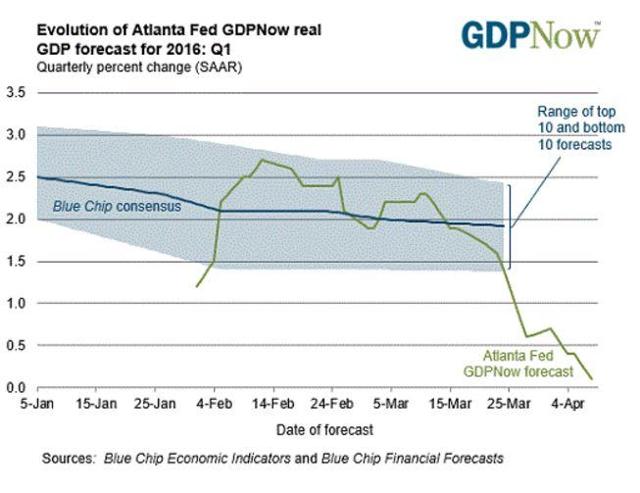

On April 5th, we posted Dollar Hell? (or Road to Perdition?) and used April 2nd Atlanta Fed Now GDP at +0.7%. Rechecking later that very day.. cut to +0.4%

Above note, checking on Friday 8th, another cut down to +0.1% Do I hear negative by next week? Confirmation of our Aug - Oct GDP call for weak Q4 and negative Q1. At +0.1% it might as well be.

The SME

A well intended friend and I often differ on certain subject matter. He once commented, "the Dollar is a VERY complex instrument...There's a reason I stay away from currencies - for me, there's a limit to how many things I can pay attention to and understand well enough to make good decisions.. there's just no room in my limited and aging databanks."

As with most things in life, that is a choice which is founded in your self knowledge and heeding the golden rule. Bandwidth can get narrower as we get older, especially if you are lucky enough to be like Abe and make it to 94. What was the subject at hand?

Back on the right track... given the above noted limitations, that's why I try to stick to the things I somewhat know; banking, monetary policy and the "dollar". I leave the options, futures portfolio hedging, straddles, collars, spreads and capital preservation to my friend. Why? Because that subject matter is in his wheelhouse and thus, he is the SME (subject matter expert) in that field. Long ago in a defensive posture, my friend recommended "go to cash", we concurred and still do, because he is the SME and "Doctor" as it were.

Speaking of which, if one who felt perfectly fine and is not a heart surgeon, yet had a heart surgeon show them evidence their mitral valve was in prolapse (leaking), in need of repair, and explain as to why this condition could be life threatening, would one argue that the surgeon was completely wrong? I'm no heart surgeon, but like my friend, I am what I am, I know what I know, and on occasion when debating with my friend about things that are in my wheelhouse and clearly not in his, I feel like Walter Sobchak. Moving West...

This missive was published as an exclusive to Seeking Alpha. To access the ENTIRE text for FREE on Seeking Alpha, please click here. The Nattering One does not receive remuneration if you register, only satisfaction.

Discussion of the potential effects on equity, bond, commodity, capital and asset markets regarding:

Atlanta GDP Redux; Subject Matter Expertise; World "Money".

Broad Dollars; Synthetic Flows; Interest Rate Swaps vs DXY.

CNY; CNH; Eurodollar; China's Forward Dollar Swaps; Nuances.

The Matrix

The Matrix is a 1999 American-Australian neo-noir science fiction action film written and directed by the Wachowski Brothers. It depicts a dystopian future in which reality as perceived by most humans is actually a simulated reality called "the Matrix", created by sentient machines to subdue the human population, while their bodies' heat and electrical activity are used as an energy source. A computer hacker learns from mysterious rebels about the true nature of his reality and his role in the war against its controllers. Matrix poster art courtesy of Robert Bruno

GDP Redux

On April 5th, we posted Dollar Hell? (or Road to Perdition?) and used April 2nd Atlanta Fed Now GDP at +0.7%. Rechecking later that very day.. cut to +0.4%

Above note, checking on Friday 8th, another cut down to +0.1% Do I hear negative by next week? Confirmation of our Aug - Oct GDP call for weak Q4 and negative Q1. At +0.1% it might as well be.

The SME

A well intended friend and I often differ on certain subject matter. He once commented, "the Dollar is a VERY complex instrument...There's a reason I stay away from currencies - for me, there's a limit to how many things I can pay attention to and understand well enough to make good decisions.. there's just no room in my limited and aging databanks."

As with most things in life, that is a choice which is founded in your self knowledge and heeding the golden rule. Bandwidth can get narrower as we get older, especially if you are lucky enough to be like Abe and make it to 94. What was the subject at hand?

Back on the right track... given the above noted limitations, that's why I try to stick to the things I somewhat know; banking, monetary policy and the "dollar". I leave the options, futures portfolio hedging, straddles, collars, spreads and capital preservation to my friend. Why? Because that subject matter is in his wheelhouse and thus, he is the SME (subject matter expert) in that field. Long ago in a defensive posture, my friend recommended "go to cash", we concurred and still do, because he is the SME and "Doctor" as it were.

Speaking of which, if one who felt perfectly fine and is not a heart surgeon, yet had a heart surgeon show them evidence their mitral valve was in prolapse (leaking), in need of repair, and explain as to why this condition could be life threatening, would one argue that the surgeon was completely wrong? I'm no heart surgeon, but like my friend, I am what I am, I know what I know, and on occasion when debating with my friend about things that are in my wheelhouse and clearly not in his, I feel like Walter Sobchak. Moving West...

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Comments