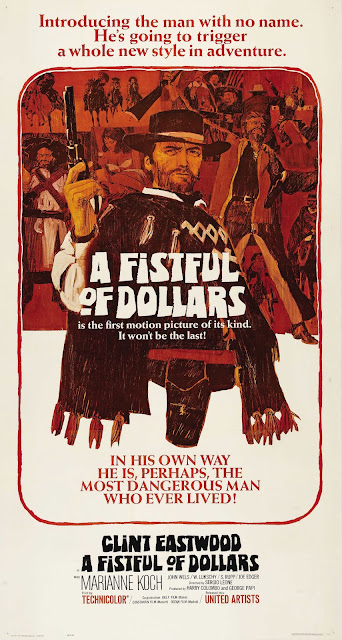

A Fistful Of Dollars?

In Part 1 of this "blood money" series we examine events leading up to September 16th, 2019, as the Man With No Name hopes to trigger many a question. There are many credentialed financial expert MSM opines ignoring market regulatory, seasonal exogenous, and structural issues viz what lies beneath. Regardless, the Nattering One want's to get to the bottom of it. Are you ready to take this ride?

Last weeks headlines REPO-RUCKUS???: $278bln Repo + $33bln RR = $313bln in Fed repo intervention, the 1st (if you don't count multiple QE's) since the GFC as GC repo rates soared to 10%, and the repo market seized all for a Fistful of Dollars...

With a Fistful of Dollars in mind, this weeks UST auctions 91 day bill, 182 day bill, 2 yr FRN, 2yr note, 5yr note, 7yr note = $218 bln x 4 to 1 dealer bid to cover = $880 bln in market liquidity diversion. Moving West...

As noted on August 12th in Fed Cuts: Accommodative? and for good measure repeated on Monday, September 16th...

And now a half dozen important happenings leading up to last weeks "mysterious" Repo-Ruckus...

1. Friday September 13th: money market funds experienced outflows = $20.4 bln. Why? The Monday deadline for corporate tax payments and settlement on coupon bearing UST's.

2. Monday, September 16th was the Federal tax payment deadline for U.S. corporations = est. $100 bln due. Early Edition: Quarter end September 30th settlement volumes of coupon notes and bonds will be approximately the same.

To pay for those UST's and taxes, corporations withdrew cash from banks and money market funds. Hint: cash drawn down from banks, Treasury deposits rise.

3. Monday September 16th UST auctions of 3, 10 and 30 year debt settled and primary dealers had to pay = $78 bln, further depleting bank reserves. In addition, Japan was on holiday, and Saudi Arabia suffered drone attacks, both major UST buyer holders.

4. Above, the Treasury Department’s balance was increased from $183 bln on September 11th to $303 bln by the 18th = $120 bln. Since August 21st from $131 bln, for a $170 bln or 150% delta ROC in less than one month. FYI, restocking the TGFA depletes bank reserves.

5. Above, since late 2015, the Treasury has decided to maintain substantially higher average cash balances on an order of at least 5 to 1. Below since July 2014, bank reserve balances with FRB have been cut in half from 2.8 to 1.4 Trn

6. As noted in many previous Natterings, Dodd-Frank, Basel III and LCR require banks to hold more HQLA capital, reducing their ability to offer repos, or repurchase agreements. Thus, primary dealer balance sheet capacity has shrunk, which constricts absorption of additional UST issuance.

Those half dozen items concomitantly affect: a reduction in money fund cash to be invested in reverse repos; an increase in securities needing to be financed in the repo market; and pressure on and constriction of systemic bank liquidity.

Last week, said triple whammy constituted an exogenous shock on the system. But how? What was the mechanism for this seeming dislocation in supply and demand? Did somebody make "a fistful of dollars"? Be it far from me to not trust the MSM narrative? I know, I know, the mule he just doesn't get it...

More to come when the Man With No Name returns in For A Few Dollars More? In the 2nd part of our "blood money" repo-ruckus series we examine what happened on September 16th. Stay tuned, no flippin.

Last weeks headlines REPO-RUCKUS???: $278bln Repo + $33bln RR = $313bln in Fed repo intervention, the 1st (if you don't count multiple QE's) since the GFC as GC repo rates soared to 10%, and the repo market seized all for a Fistful of Dollars...

With a Fistful of Dollars in mind, this weeks UST auctions 91 day bill, 182 day bill, 2 yr FRN, 2yr note, 5yr note, 7yr note = $218 bln x 4 to 1 dealer bid to cover = $880 bln in market liquidity diversion. Moving West...

As noted on August 12th in Fed Cuts: Accommodative? and for good measure repeated on Monday, September 16th...

"Long term yields should drop further, quarter end rucks will cause short duration funding cost spikes (cost of loan funds), especially in September (think in anticipation of Chinese banks closing for golden week Oct 1st)... Seasonal monetary flow factors were already set to collapse into the 2nd half. Additional liquidity drains: TGA restock, $1T UST issuance by YE."Anyone who takes the time to understand and pay attention to the axiomatic predictable seasonality in monetary flows, knew in advance that the above was going to happen. There's no "mystery" or surprise, and nothing quite like having a copy of the "Early Edition"? Along those lines...

And now a half dozen important happenings leading up to last weeks "mysterious" Repo-Ruckus...

1. Friday September 13th: money market funds experienced outflows = $20.4 bln. Why? The Monday deadline for corporate tax payments and settlement on coupon bearing UST's.

2. Monday, September 16th was the Federal tax payment deadline for U.S. corporations = est. $100 bln due. Early Edition: Quarter end September 30th settlement volumes of coupon notes and bonds will be approximately the same.

To pay for those UST's and taxes, corporations withdrew cash from banks and money market funds. Hint: cash drawn down from banks, Treasury deposits rise.

3. Monday September 16th UST auctions of 3, 10 and 30 year debt settled and primary dealers had to pay = $78 bln, further depleting bank reserves. In addition, Japan was on holiday, and Saudi Arabia suffered drone attacks, both major UST buyer holders.

4. Above, the Treasury Department’s balance was increased from $183 bln on September 11th to $303 bln by the 18th = $120 bln. Since August 21st from $131 bln, for a $170 bln or 150% delta ROC in less than one month. FYI, restocking the TGFA depletes bank reserves.

5. Above, since late 2015, the Treasury has decided to maintain substantially higher average cash balances on an order of at least 5 to 1. Below since July 2014, bank reserve balances with FRB have been cut in half from 2.8 to 1.4 Trn

6. As noted in many previous Natterings, Dodd-Frank, Basel III and LCR require banks to hold more HQLA capital, reducing their ability to offer repos, or repurchase agreements. Thus, primary dealer balance sheet capacity has shrunk, which constricts absorption of additional UST issuance.

Those half dozen items concomitantly affect: a reduction in money fund cash to be invested in reverse repos; an increase in securities needing to be financed in the repo market; and pressure on and constriction of systemic bank liquidity.

Last week, said triple whammy constituted an exogenous shock on the system. But how? What was the mechanism for this seeming dislocation in supply and demand? Did somebody make "a fistful of dollars"? Be it far from me to not trust the MSM narrative? I know, I know, the mule he just doesn't get it...

More to come when the Man With No Name returns in For A Few Dollars More? In the 2nd part of our "blood money" repo-ruckus series we examine what happened on September 16th. Stay tuned, no flippin.

Comments