Soften, Cave, Crater - $4.5 Trillion Reasons Why

Bubbles soften, cave, then crater... Mass, DC, Virginia, Texas & Florida (ground zero) have gone off the deep end - cratered. Most who bought in these areas in the last three years are near or already under water.

Courtesy of Mish's GET. New home buyers in Florida are backing out in droves from $490K new home contracts with Lennar. Lennar in desperation turns around and sells the house's for $315K - 38% off.

Zona & Nevada have softened & caved, they will crater in late 06 early 07. That's right about the time when their extent of their 3 year drought and dustbowl becomes apparent and homeowner water bills skyrocket.

San Diego has softened & caved as they have triple the foreclosures & Reo's of LA/ Orange county while sales are declining for a 3rd straight year. Diego will lead the rest of SoCal into the abyss sometime in 07, after which overrated NoCal will eat it last.

In the last 4 months the Northwest got two years worth of appreciation, apparently they are at the tip of the dogs tail and some are saying this summer is the last swan song.

I think the Northwest will keep getting the refugees from all the other states who are fortunate enough to find a bigger fool and get out at the last minute, especially California. That might keep things going just a while longer considering the lower price points.

It is going to get very ugly with all the low down, no down, interest only ARMS that are resetting.

Below figures courtesy of Mish's Get here and here .

The Nattering One has added the 2nd & 3rd time bumps, which would bring the total to $4.5 Trillion in bumps over the 3 year span.

2006 - $500 billion adjusts 1st time,

2007 - $1 trillion adjusts 1st time, $500 billion 2nd time,

2008 - $1 trillion adjusts 1st time, $1 trillion adjusts 2nd time, $500 billion adjusts 3rd time.....

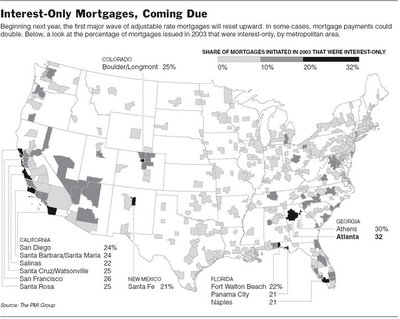

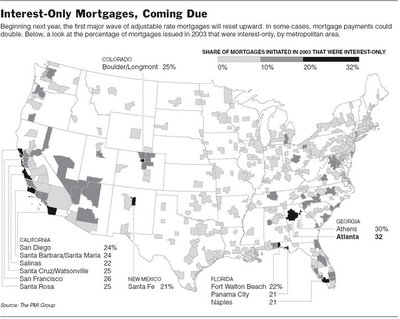

The above graphic courtesy of Big Picture Barry reveals the concentration and exposure of Interest Only ARM's in given bubble areas. I think our call on 2008 as a major fall out in the real estate market is spot on with the bottom of the barrel being 2010.

Courtesy of Mish's GET. New home buyers in Florida are backing out in droves from $490K new home contracts with Lennar. Lennar in desperation turns around and sells the house's for $315K - 38% off.

Zona & Nevada have softened & caved, they will crater in late 06 early 07. That's right about the time when their extent of their 3 year drought and dustbowl becomes apparent and homeowner water bills skyrocket.

San Diego has softened & caved as they have triple the foreclosures & Reo's of LA/ Orange county while sales are declining for a 3rd straight year. Diego will lead the rest of SoCal into the abyss sometime in 07, after which overrated NoCal will eat it last.

In the last 4 months the Northwest got two years worth of appreciation, apparently they are at the tip of the dogs tail and some are saying this summer is the last swan song.

I think the Northwest will keep getting the refugees from all the other states who are fortunate enough to find a bigger fool and get out at the last minute, especially California. That might keep things going just a while longer considering the lower price points.

It is going to get very ugly with all the low down, no down, interest only ARMS that are resetting.

Below figures courtesy of Mish's Get here and here .

The Nattering One has added the 2nd & 3rd time bumps, which would bring the total to $4.5 Trillion in bumps over the 3 year span.

2006 - $500 billion adjusts 1st time,

2007 - $1 trillion adjusts 1st time, $500 billion 2nd time,

2008 - $1 trillion adjusts 1st time, $1 trillion adjusts 2nd time, $500 billion adjusts 3rd time.....

The above graphic courtesy of Big Picture Barry reveals the concentration and exposure of Interest Only ARM's in given bubble areas. I think our call on 2008 as a major fall out in the real estate market is spot on with the bottom of the barrel being 2010.

Comments