The Fallout 2: Lehman, Lynch, The Fed?

Continued From Part 1

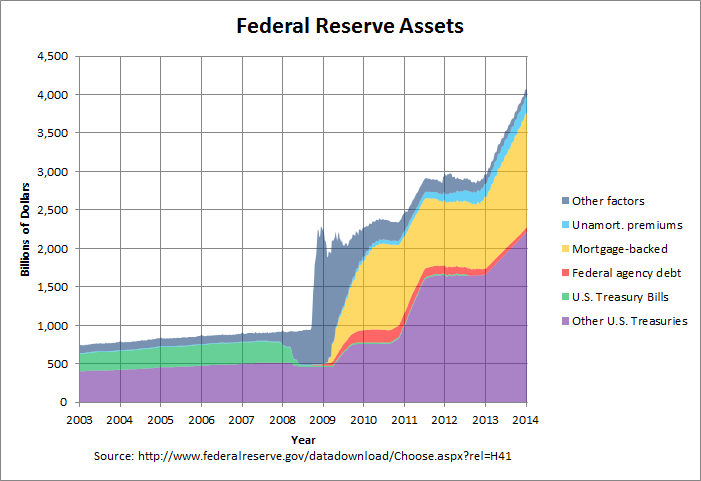

Total Fed Assets

The Nattering One muses... a picture is worth a thousand words. A picture of the Feds total assets is worth, 4.3 Trillion words.

During this six year period, the Fed has printed up, nearly $4 Trillion in monopoly money out of thin air. Coincidence? I think not?

Today, The Fed has equity capital of $56 Billion. No, that is not a typo, therefore, the Fed is leveraged at 77 to 1.

Or in other words, if the Fed were a bank, it would be declared, insolvent. A 1.3% change in the value of the assets which the Fed holds, would wipe out the Fed's equity.

From Grant's Interest Rate Observer: Springtime For Price Discovery

"Low volatility, deep complacency, perverse financial incentives, collapsing credit spreads, unslaked thirst for yield --- the basic preconditions for a financial accident are already in place."

More Fallout to come in Part 3.

Recent Trends in Fed Balance Sheet

Fed Balance Sheet Punctuated By A Big Question Mark

Total Fed Assets

The Nattering One muses... a picture is worth a thousand words. A picture of the Feds total assets is worth, 4.3 Trillion words.

Note: Aug 08 liquidity crisis jump from 800 billion to 2.2 Trillion; then a steady 5.5 year climb from 2.2 Trillion to over 4.3 Trillion; 4.1 Trillion of which are mostly mortgage backed securities held outright.

During this six year period, the Fed has printed up, nearly $4 Trillion in monopoly money out of thin air. Coincidence? I think not?

Historically Fed holdings have averaged 5% of GDP, they are now over 20%. Previously, only during the Great Depression were the Fed's holdings near this level, 23% of GDP.

To put the Fed's holdings in perspective... In 2007, Lehman held $600 Billion in assets, and was leveraged at 31 to 1, a 4% change in the value of those assets wiped them out.

Other notable leverage ratios at the time, Morgan Stanley 30, Goldman Sachs 24.3, and Merrill Lynch was 44.1.

Or in other words, if the Fed were a bank, it would be declared, insolvent. A 1.3% change in the value of the assets which the Fed holds, would wipe out the Fed's equity.

From Grant's Interest Rate Observer: Springtime For Price Discovery

"Low volatility, deep complacency, perverse financial incentives, collapsing credit spreads, unslaked thirst for yield --- the basic preconditions for a financial accident are already in place."

More Fallout to come in Part 3.

Recent Trends in Fed Balance Sheet

Fed Balance Sheet Punctuated By A Big Question Mark

Comments