The Temple Grandin of Shadow Banking Part 3

In Part 1 we examined a most excellent set of missives from Jeffrey P. Snider regarding structural liquidity limitations in the SBS - Shadow Banking System.

In Part 2, in his OFR working paper Zoltan Pozsar Shadow Banking: The Money View, explained his view on: What does the Federal Reserve’s reverse repo facility mean from the perspective of institutional cash pools?

The Nattering One muses... Pete McCulley at Pimco coined the term Shadow Banking, which is said to include entities such as hedge funds, money market funds, structured investment vehicles (SIV), credit investment funds, exchange traded funds, credit hedge funds, private equity funds, securities broker dealers, credit insurance providers, securitization and finance companies.

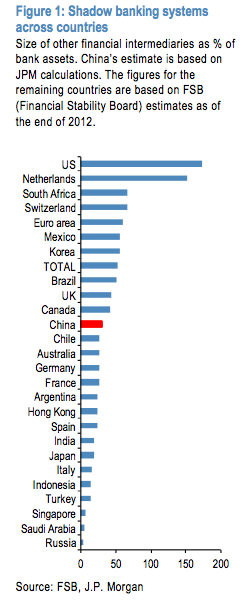

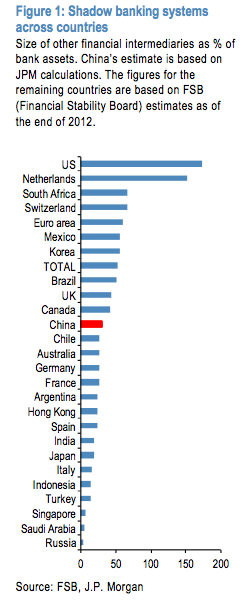

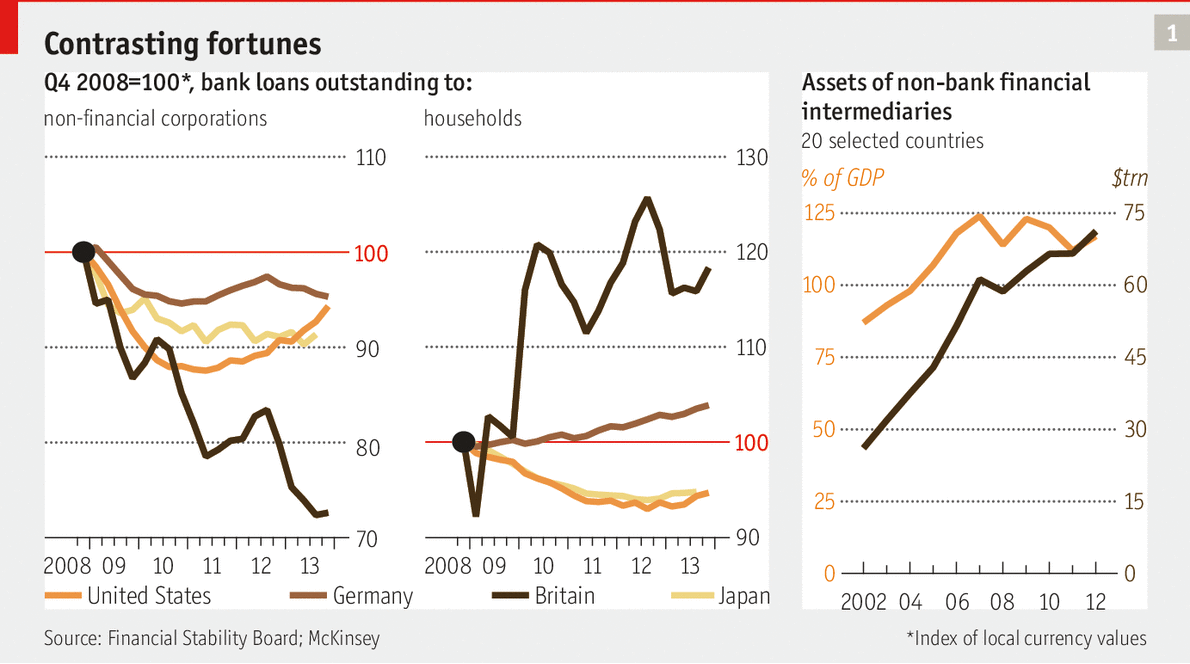

According to the FSB (Financial Stability Board 2013 Global Shadow Banking Report): The size of non-bank financial intermediation was equivalent to 117% of GDP in aggregate at the end of 2012 for 20 jurisdictions and the euro area, which is still well below the peak level of 125% in 2007.

According to the Fed Report Financial Stability Policies for Shadow Banking: Shadow credit intermediation, has grown from less than one percent of GDP in 1960 to over 70 percent today, with a peak close to 80 percent in mid 2007, just before the onset of the global financial crisis.

In 2012 FSB estimated that, shadow banking rose from $26 trillion in 2002 to $71 trillion. In 2013 FSB estimates that shadow lending accounts for 25% of all financial assets, compared with 50% in the banking system.

NOTE: in 2013 FSB narrowed the amount by $20 trillion by excluding insurance and pension funds. Add those in and the shadow banking share equals traditional banking as shown in the graph above.

The US had the largest system of non-bank financial intermediation at the end of 2012 with assets of $26 trillion, followed by the euro area ($22 trillion), the UK ($9 trillion) and Japan ($4 trillion).

Nonbank financial institutions have become an important source of financing in China, doubling since 2010 to 30 to 40% of GDP; or $3 - 4.5 trillion.

The umbrella of the Shadow is even larger than one would think, for the banks are quite involved in these formerly off ledger transactions. From the Fed report:

Some activities take place under the umbrella of bank holding companies or insurance companies, and banks themselves feature prominently in the shadow banking system.

Banks extend backup lines of credit that allow independent or off balance sheet entities to issue short term liabilities. Furthermore, bank holding companies house money market funds, the triparty repo market, and many different types of activities related to securitization.

Amongst his many accurate observations Mr. Poszar posits...

1. To avoid inflated aggregate measures, if it isn't funded in the money market, it should be excluded. Therefore, the amount of influence necessary to control the SBS (in sheer dollar volume $5 trillion vs $70 trillion) is far less than we might suspect.

2. This narrow channel can be effectively controlled through the Fed Reverse Repo program.

3. Minimum reverse repo balances could become the equivalent of minimum reserve requirements for shadow banks.

4. The assets would then be backed at least in part, by the safest of safe assets, the liabilities of the Federal Reserve.

As Mr. Snider eloquently points out in his missives, since the last crash...

1. In the case of both repo and dealers absorption ability, the volume has increased, while the exits have narrowed, substantially in both cases. From the Fed report:

Shadow bank money creation occurs primarily in the commercial paper market and the repo market, and is funded by money market funds and short term investment funds.

One of the shortcomings in the triparty repo market: the lack of a mechanism to ensure that triparty repo investors do not conduct disorderly fire sales immediately following a dealer default. The risk of fire sales in the event of a dealer failure remains an open issue, without any obvious solution.

2. Euro dollar liquidity, another exit that has narrowed and structurally altered the markets ability to handle internal pressure. From the Fed report:

Shadow banks are subject to runs because assets have longer maturities than liabilities and tend to be less liquid as well. While the fundamental reason for commercial bank

runs is the sequential servicing constraint, for shadow banks the effective constraint is the presence of fire sale externalities. In a run, shadow banking entities have to sell assets at a discount, which depresses market pricing. This provides incentives to withdraw funding—before other shadow banking depositors arrive.

3. "Money markets", vis-a-vis in the new paradigm where banks have shrunk their balance sheets and shadow banking has filled the void; ETF mutual funds which are heavily invested in equities, have suffered the same fate as above. From the Fed report:

The largest liquidity transformation is found in mutual funds and ETFs, which have grown significantly. As liquidity is normally robust, investors expect to be able to sell out of positions in market downturns, but may find liquidity is absent when they most need it.

Pozsar, Adrian, Ashcraft, and Boesky (2013) explain the seven steps of shadow bank credit intermediation in detail:

1. Loan origination

2. Loan warehousing ABCP - asset backed commercial paper.

3. Pooling and structuring of loans into term asset-backed securities (ABS).

4. ABS warehousing funded through repos, total return swaps, or hybrid and repo conduits.

5. The pooling and structuring of ABS into CDOs is also conducted by broker-dealers’ ABS.

6.ABS intermediation by limited-purpose finance companies (LPFCs), structured investment vehicles (SIVs), securities arbitrage conduits, and credit hedge funds, which are funded in a variety of ways including, for example, repo, ABCP, MTNs, bonds, and capital notes.

Most important of all:

7. The funding of all the above activities and entities is conducted in wholesale funding markets by money market intermediaries (money market funds, enhanced cash funds) and direct money market investors such as securities lenders.

Money market funding of capital market lending, via funding raised through a money dealer, may take place onshore or offshore, and on at least four different kinds of balance sheets.

1. Funded risk PMs’ (portfolio managers) securities portfolios; typically funded through bilateral repos via dealers.

2. Foreign banks’ U.S. dollar securities portfolios; typically funded via interoffice claims; Eurodollar; FX swap markets.

3. U.S. wholesale banks’ securities portfolios. These include public/private securities issued by U.S. residents and dollar-denominated corporate and sovereign bonds issued globally. Typically funded through money market instruments sold to prime money market funds.

4. Dealers’ securities inventories that are funded in the repo market. Similar to item #3, these include public and private securities issued by U.S. residents and dollar-denominated corporate and sovereign bonds issued globally.

Note #3 and #4 above as bond markets are by far the biggest source of non bank financing. This means that the shadow banking exposure has a huge overhang in the corporate bond market as well. In 2007 the value of all outstanding corporate bonds issued by American firms was 29% of GDP; by 2013 it had risen to over 42%.

Add it all up, the Central banks have created a massive flow of money resulting in an unprecedented increase in the volume involved in corporate bond issuance, repo, dealer, eurodollar and money markets.

We have witnessed a paradigm shift in the transference of "holding vehicles" from traditional banks, pension funds and insurance co's to ETF mutual funds where this tidal wave of "savings" currently lies dormant or passive with a low velocity.

Couple the above circumstances with a substantial reduction in the effective "liquidity" or flow handling mechanisms in these "vehicles of choice", yielding a substantial narrowing of the gates or exits. In the event of a panic liquidation, this type of systemic structural defect could prove to be very problematic.

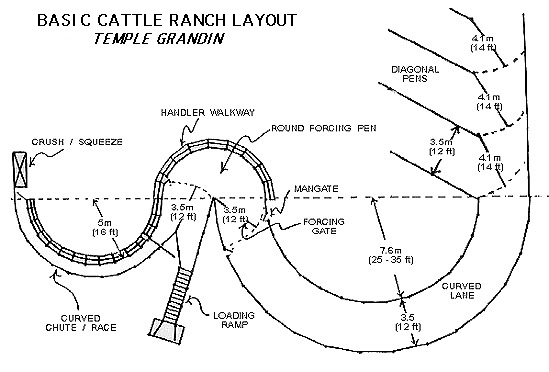

Temple Grandin studied the behavior of cattle, how they react to ranchers, movements, objects and light. Cattle squeeze chutes, such as the portable one pictured above, were Grandin's inspiration for her hug machine.

Temple Grandin invented the hug box, a device to calm those on the autism spectrum. Grandin then focused on the humane treatment of cattle by designing adapted curved corrals, intended to reduce stress in animals being led to slaughter.

In their estimates both the FSB and Fed have disclaimers for incomplete data. What if the FSB and Fed have severely underestimated? Some academics estimate the size of the SBS in 2007, the year before the financial crisis, was worth around $90 trillion. This fell to about $70 trillion in 2008 but has since risen sharply to be worth around $100 trillion in 2012. Which would indicate that in 2014, the number could be on the order of $120 - $140 trillion.

Regardless of the size, you have to ask yourself, this time, when the herd spooks and they all head for the exits at the same time, what kind of slaughter will we witness? Will there be a Temple Grandin of Shadow Banking? Better hope so.

In Part 2, in his OFR working paper Zoltan Pozsar Shadow Banking: The Money View, explained his view on: What does the Federal Reserve’s reverse repo facility mean from the perspective of institutional cash pools?

The Nattering One muses... Pete McCulley at Pimco coined the term Shadow Banking, which is said to include entities such as hedge funds, money market funds, structured investment vehicles (SIV), credit investment funds, exchange traded funds, credit hedge funds, private equity funds, securities broker dealers, credit insurance providers, securitization and finance companies.

According to the FSB (Financial Stability Board 2013 Global Shadow Banking Report): The size of non-bank financial intermediation was equivalent to 117% of GDP in aggregate at the end of 2012 for 20 jurisdictions and the euro area, which is still well below the peak level of 125% in 2007.

According to the Fed Report Financial Stability Policies for Shadow Banking: Shadow credit intermediation, has grown from less than one percent of GDP in 1960 to over 70 percent today, with a peak close to 80 percent in mid 2007, just before the onset of the global financial crisis.

In 2012 FSB estimated that, shadow banking rose from $26 trillion in 2002 to $71 trillion. In 2013 FSB estimates that shadow lending accounts for 25% of all financial assets, compared with 50% in the banking system.

NOTE: in 2013 FSB narrowed the amount by $20 trillion by excluding insurance and pension funds. Add those in and the shadow banking share equals traditional banking as shown in the graph above.

The US had the largest system of non-bank financial intermediation at the end of 2012 with assets of $26 trillion, followed by the euro area ($22 trillion), the UK ($9 trillion) and Japan ($4 trillion).

Nonbank financial institutions have become an important source of financing in China, doubling since 2010 to 30 to 40% of GDP; or $3 - 4.5 trillion.

The umbrella of the Shadow is even larger than one would think, for the banks are quite involved in these formerly off ledger transactions. From the Fed report:

Some activities take place under the umbrella of bank holding companies or insurance companies, and banks themselves feature prominently in the shadow banking system.

Banks extend backup lines of credit that allow independent or off balance sheet entities to issue short term liabilities. Furthermore, bank holding companies house money market funds, the triparty repo market, and many different types of activities related to securitization.

Amongst his many accurate observations Mr. Poszar posits...

1. To avoid inflated aggregate measures, if it isn't funded in the money market, it should be excluded. Therefore, the amount of influence necessary to control the SBS (in sheer dollar volume $5 trillion vs $70 trillion) is far less than we might suspect.

2. This narrow channel can be effectively controlled through the Fed Reverse Repo program.

3. Minimum reverse repo balances could become the equivalent of minimum reserve requirements for shadow banks.

4. The assets would then be backed at least in part, by the safest of safe assets, the liabilities of the Federal Reserve.

As Mr. Snider eloquently points out in his missives, since the last crash...

1. In the case of both repo and dealers absorption ability, the volume has increased, while the exits have narrowed, substantially in both cases. From the Fed report:

Shadow bank money creation occurs primarily in the commercial paper market and the repo market, and is funded by money market funds and short term investment funds.

One of the shortcomings in the triparty repo market: the lack of a mechanism to ensure that triparty repo investors do not conduct disorderly fire sales immediately following a dealer default. The risk of fire sales in the event of a dealer failure remains an open issue, without any obvious solution.

2. Euro dollar liquidity, another exit that has narrowed and structurally altered the markets ability to handle internal pressure. From the Fed report:

Shadow banks are subject to runs because assets have longer maturities than liabilities and tend to be less liquid as well. While the fundamental reason for commercial bank

runs is the sequential servicing constraint, for shadow banks the effective constraint is the presence of fire sale externalities. In a run, shadow banking entities have to sell assets at a discount, which depresses market pricing. This provides incentives to withdraw funding—before other shadow banking depositors arrive.

3. "Money markets", vis-a-vis in the new paradigm where banks have shrunk their balance sheets and shadow banking has filled the void; ETF mutual funds which are heavily invested in equities, have suffered the same fate as above. From the Fed report:

The largest liquidity transformation is found in mutual funds and ETFs, which have grown significantly. As liquidity is normally robust, investors expect to be able to sell out of positions in market downturns, but may find liquidity is absent when they most need it.

Pozsar, Adrian, Ashcraft, and Boesky (2013) explain the seven steps of shadow bank credit intermediation in detail:

1. Loan origination

2. Loan warehousing ABCP - asset backed commercial paper.

3. Pooling and structuring of loans into term asset-backed securities (ABS).

4. ABS warehousing funded through repos, total return swaps, or hybrid and repo conduits.

5. The pooling and structuring of ABS into CDOs is also conducted by broker-dealers’ ABS.

6.ABS intermediation by limited-purpose finance companies (LPFCs), structured investment vehicles (SIVs), securities arbitrage conduits, and credit hedge funds, which are funded in a variety of ways including, for example, repo, ABCP, MTNs, bonds, and capital notes.

7. The funding of all the above activities and entities is conducted in wholesale funding markets by money market intermediaries (money market funds, enhanced cash funds) and direct money market investors such as securities lenders.

Money market funding of capital market lending, via funding raised through a money dealer, may take place onshore or offshore, and on at least four different kinds of balance sheets.

1. Funded risk PMs’ (portfolio managers) securities portfolios; typically funded through bilateral repos via dealers.

2. Foreign banks’ U.S. dollar securities portfolios; typically funded via interoffice claims; Eurodollar; FX swap markets.

3. U.S. wholesale banks’ securities portfolios. These include public/private securities issued by U.S. residents and dollar-denominated corporate and sovereign bonds issued globally. Typically funded through money market instruments sold to prime money market funds.

4. Dealers’ securities inventories that are funded in the repo market. Similar to item #3, these include public and private securities issued by U.S. residents and dollar-denominated corporate and sovereign bonds issued globally.

Note #3 and #4 above as bond markets are by far the biggest source of non bank financing. This means that the shadow banking exposure has a huge overhang in the corporate bond market as well. In 2007 the value of all outstanding corporate bonds issued by American firms was 29% of GDP; by 2013 it had risen to over 42%.

Add it all up, the Central banks have created a massive flow of money resulting in an unprecedented increase in the volume involved in corporate bond issuance, repo, dealer, eurodollar and money markets.

We have witnessed a paradigm shift in the transference of "holding vehicles" from traditional banks, pension funds and insurance co's to ETF mutual funds where this tidal wave of "savings" currently lies dormant or passive with a low velocity.

Couple the above circumstances with a substantial reduction in the effective "liquidity" or flow handling mechanisms in these "vehicles of choice", yielding a substantial narrowing of the gates or exits. In the event of a panic liquidation, this type of systemic structural defect could prove to be very problematic.

Temple Grandin studied the behavior of cattle, how they react to ranchers, movements, objects and light. Cattle squeeze chutes, such as the portable one pictured above, were Grandin's inspiration for her hug machine.

Temple Grandin invented the hug box, a device to calm those on the autism spectrum. Grandin then focused on the humane treatment of cattle by designing adapted curved corrals, intended to reduce stress in animals being led to slaughter.

In their estimates both the FSB and Fed have disclaimers for incomplete data. What if the FSB and Fed have severely underestimated? Some academics estimate the size of the SBS in 2007, the year before the financial crisis, was worth around $90 trillion. This fell to about $70 trillion in 2008 but has since risen sharply to be worth around $100 trillion in 2012. Which would indicate that in 2014, the number could be on the order of $120 - $140 trillion.

Regardless of the size, you have to ask yourself, this time, when the herd spooks and they all head for the exits at the same time, what kind of slaughter will we witness? Will there be a Temple Grandin of Shadow Banking? Better hope so.

Comments