Financially Suspicious Minds

From Paul Krugman, Nobody Understands The Liquidity Trap, Still

Look, the liquidity trap which is basically the same as saying that even a zero short-term interest rate isn't low enough to produce full employment is a situation in which increasing the monetary base has no effect on aggregate demand, because you're substituting one zero (or very low) interest asset - monetary base - for another zero or low interest rate asset, short-term government debt. Conventional monetary policy is completely sterile on all fronts.

I have no idea why Cullen Roche thinks that the TED spread has anything at all to do with the question of whether we're in a liquidity trap.

From Jim Willie CB at Kitco...

From Cullen Roche - Nobody Needs To Understand The Liquidity Trap

Paul Krugman says I don't understand the liquidity trap... Keynes described a liquidity trap as an environment in which short-term debt and cash become near equivalents resulting in the Central Bank's loss of control over interest rates and their ability to stimulate the economy. The Fed clearly hasn't lost control of interest rates and I tried to use the TED spread to express this point.

Dr. Krugman is actually saying that the price of money is too high because interest rates are at 0% and there's still an output short-fall.... I don't think the Fed has the tools at present to get us out of this mess.

The Fed is little more than a clearinghouse that sets a target interest rate on one type of money that impacts the economy and the bank lending rate in a loose fashion. The Fed's inability to control the economy is not something unique to today's environment. It has always been true. It just so happens that the crisis exposed this reality.

The reason I care so much about this is because it has distracted all of us from what could actually be helping us get out of this mess. And so we go through the different iterations of "Quantitative Easing" and all of these other ineffective policies all the while distracting us from doing something that might actually help like tax cuts or public investment. And the economic stagnation continues as we turn to "unconventional" monetary policy to help steer us towards the natural rate of interest. And so it looks like we remain stuck in this permanent "liquidity trap" as economists say that "unconventional" policy just hasn't been unconventional enough. But all we're really trapped in is a horror story written by economists who have a theoretical narrative that doesn't actually reflect our reality.

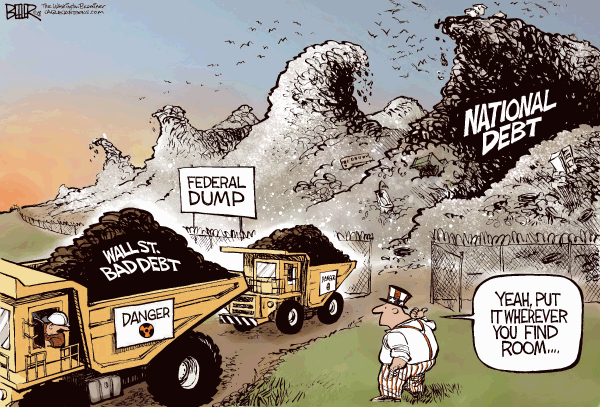

The Nattering One muses... FED QE = house of finance/banking system caught in liquidity trap is bailed out...

FED QE bailout piles bad Wall Street debt onto the public...

Please watch this animation from Malekan which helps explain how the banks got bailed out by the tax payer.

Look, the liquidity trap which is basically the same as saying that even a zero short-term interest rate isn't low enough to produce full employment is a situation in which increasing the monetary base has no effect on aggregate demand, because you're substituting one zero (or very low) interest asset - monetary base - for another zero or low interest rate asset, short-term government debt. Conventional monetary policy is completely sterile on all fronts.

I have no idea why Cullen Roche thinks that the TED spread has anything at all to do with the question of whether we're in a liquidity trap.

From Jim Willie CB at Kitco...

From Cullen Roche - Nobody Needs To Understand The Liquidity Trap

Paul Krugman says I don't understand the liquidity trap... Keynes described a liquidity trap as an environment in which short-term debt and cash become near equivalents resulting in the Central Bank's loss of control over interest rates and their ability to stimulate the economy. The Fed clearly hasn't lost control of interest rates and I tried to use the TED spread to express this point.

Dr. Krugman is actually saying that the price of money is too high because interest rates are at 0% and there's still an output short-fall.... I don't think the Fed has the tools at present to get us out of this mess.

The Fed is little more than a clearinghouse that sets a target interest rate on one type of money that impacts the economy and the bank lending rate in a loose fashion. The Fed's inability to control the economy is not something unique to today's environment. It has always been true. It just so happens that the crisis exposed this reality.

The reason I care so much about this is because it has distracted all of us from what could actually be helping us get out of this mess. And so we go through the different iterations of "Quantitative Easing" and all of these other ineffective policies all the while distracting us from doing something that might actually help like tax cuts or public investment. And the economic stagnation continues as we turn to "unconventional" monetary policy to help steer us towards the natural rate of interest. And so it looks like we remain stuck in this permanent "liquidity trap" as economists say that "unconventional" policy just hasn't been unconventional enough. But all we're really trapped in is a horror story written by economists who have a theoretical narrative that doesn't actually reflect our reality.

The Nattering One muses... FED QE = house of finance/banking system caught in liquidity trap is bailed out...

FED QE bailout piles bad Wall Street debt onto the public...

Please watch this animation from Malekan which helps explain how the banks got bailed out by the tax payer.

Comments