Is The Market Ready To Fall?

Pater Tenebrarum points out in Is The Stock Market Finally Ready To Fall?

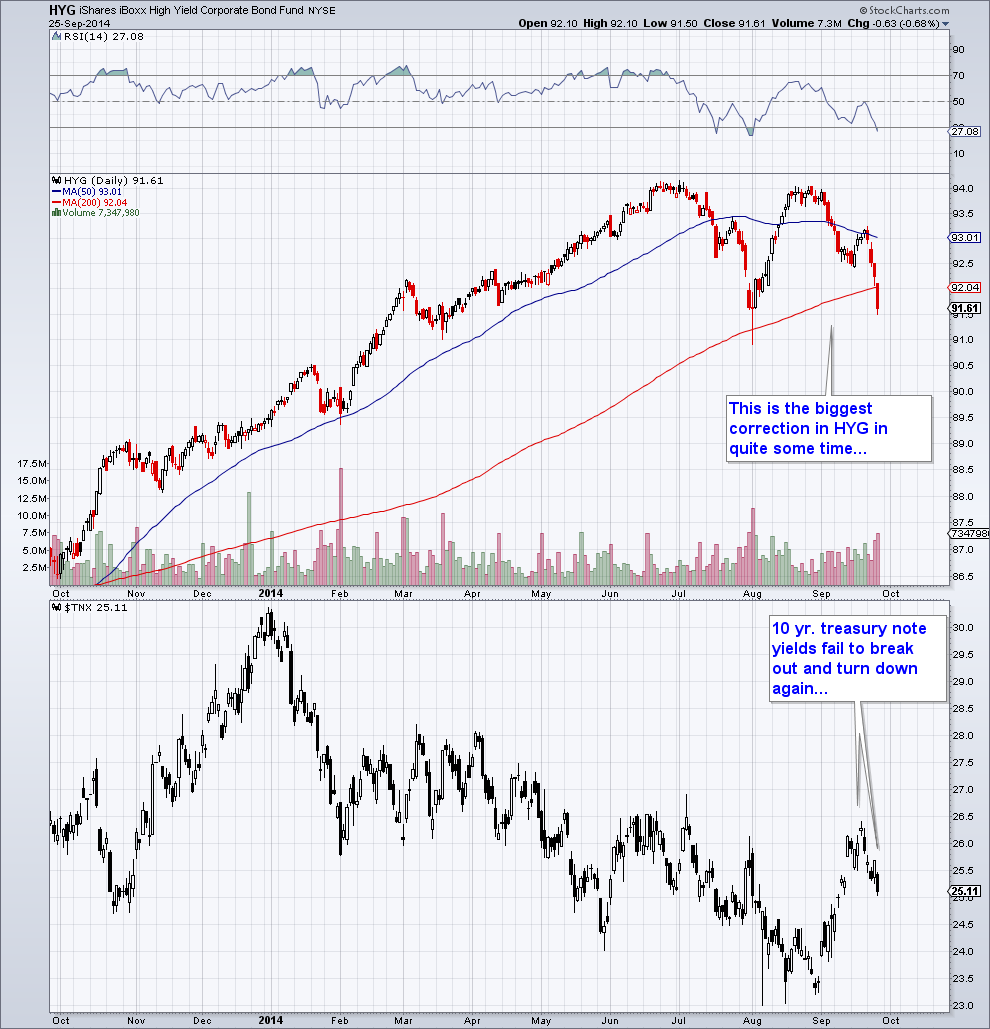

High-yield debt has recently continued to weaken after a rebound rally that appears to have failed at a lower high. Along with this event, an attempt by treasury yields to break higher seems to have failed as well:

HYG (a high yield bond ETF) suffers its biggest correction in a long time, and treasury note yields turn lower again (admittedly this may turn out to be just a brief pullback in t-note yields).

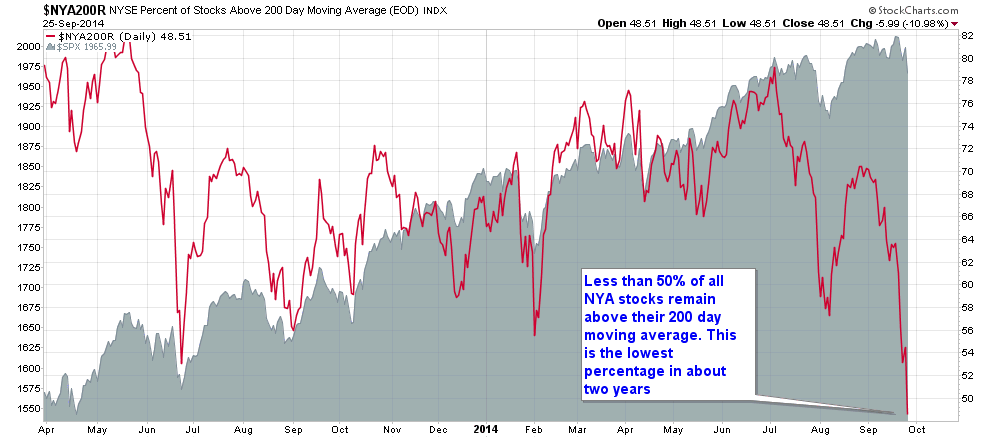

Only slightly more than 48% of all NYSE listed stocks remain above their 200-DMA at present. Note how this indicator produced a glaring divergence at the recent peak, a sign that many stocks have been falling "under the cover" of the strong indexes.

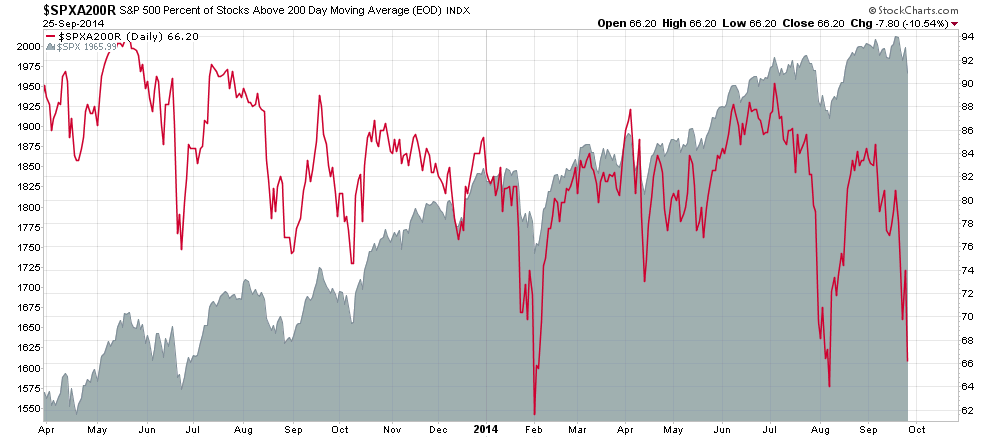

The percentage of SPX stocks above the 200-DMA is much higher at 66%, which underscores that the market's advance has become concentrated in fewer and fewer big-cap stocks.

Percentage of SPX stocks above their 200-DMA. Here we see the same divergence, as well as a subtle long term deterioration.

It should also be added that there has been a sizable surge in put buying in recent days, which is usually relevant as a contrary indicator in shorter term time frames. It is however still far short from the spike in put buying seen in early August.

Note that every sizable move lower has the potential to become unruly, given near record high levels of margin debt and record negative investor net worth. In addition to the margin data we can all observe on a regular basis, there is the fact that numerous hedge funds are leveraged to their proverbial eyebrows. In fact, hedge fund leverage has surpassed its previous record high of 2007 at the beginning of the year already.

"According to Eurekahedge, a global hedge fund monitoring service, hedge funds' gross assets hit 170% of capital in January, which surpasses the previous peak of 168% in 2007. Leverage at many of the largest hedge funds is far higher. For instance, in April, the New York Post noted that Citadel Investment Group, one of the 25 biggest US hedge funds, had implied leverage of about 8.8 times its total investment capital. The Post also noted that Citadel's "leverage last came under scrutiny in 2008, when it had to unwind a leverage of 8.2 times as the financial crisis unfolded."

We can only repeat what we have said before - risk remains extraordinarily high.

The Nattering One muses: The breakdown in emerging markets, high yield junk, small cap, mid cap, oil, gold and commodities continues.

We concur with Tenebrarum as large cap and overall market internals continue to weaken while achieving what appear to be dangerously deceiving new highs.

High-yield debt has recently continued to weaken after a rebound rally that appears to have failed at a lower high. Along with this event, an attempt by treasury yields to break higher seems to have failed as well:

HYG (a high yield bond ETF) suffers its biggest correction in a long time, and treasury note yields turn lower again (admittedly this may turn out to be just a brief pullback in t-note yields).

Only slightly more than 48% of all NYSE listed stocks remain above their 200-DMA at present. Note how this indicator produced a glaring divergence at the recent peak, a sign that many stocks have been falling "under the cover" of the strong indexes.

The percentage of SPX stocks above the 200-DMA is much higher at 66%, which underscores that the market's advance has become concentrated in fewer and fewer big-cap stocks.

Percentage of SPX stocks above their 200-DMA. Here we see the same divergence, as well as a subtle long term deterioration.

It should also be added that there has been a sizable surge in put buying in recent days, which is usually relevant as a contrary indicator in shorter term time frames. It is however still far short from the spike in put buying seen in early August.

Note that every sizable move lower has the potential to become unruly, given near record high levels of margin debt and record negative investor net worth. In addition to the margin data we can all observe on a regular basis, there is the fact that numerous hedge funds are leveraged to their proverbial eyebrows. In fact, hedge fund leverage has surpassed its previous record high of 2007 at the beginning of the year already.

"According to Eurekahedge, a global hedge fund monitoring service, hedge funds' gross assets hit 170% of capital in January, which surpasses the previous peak of 168% in 2007. Leverage at many of the largest hedge funds is far higher. For instance, in April, the New York Post noted that Citadel Investment Group, one of the 25 biggest US hedge funds, had implied leverage of about 8.8 times its total investment capital. The Post also noted that Citadel's "leverage last came under scrutiny in 2008, when it had to unwind a leverage of 8.2 times as the financial crisis unfolded."

We can only repeat what we have said before - risk remains extraordinarily high.

The Nattering One muses: The breakdown in emerging markets, high yield junk, small cap, mid cap, oil, gold and commodities continues.

We concur with Tenebrarum as large cap and overall market internals continue to weaken while achieving what appear to be dangerously deceiving new highs.

Comments