Why? Part 8: The War on Vox Populi

Continuing from Why? Part 7: Rand Paul & Ayn Rand: Nothing in Common

From ThinkProgress, 12 Tax Dodging Corps that spent $1 billion to influence Washington.

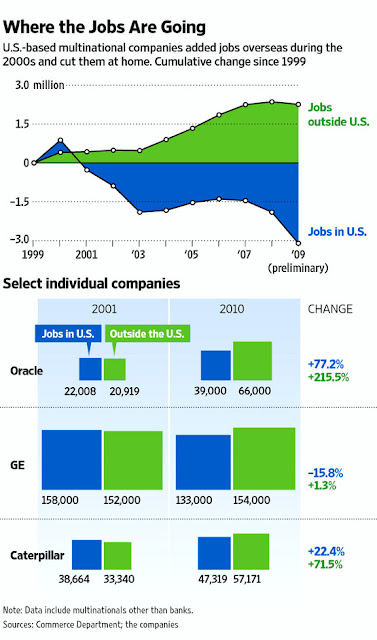

The charts above witnesse how jobs are being outsourced while our economy is expatriated by corporate turncoats?

Meanwhile the teabaggers are crafting the final solution for the new jews... homosexuals, immigrants, non Christians, pensions, unions and public workers...

Quietly, the whores on the hill have set it up so that their rich friends pay no tax while the working stiff gets screwed royally.

This is a classic parliamental misdirect in our governments "War on the Vox Populi" and "War on the Middle Class".

We refer to our tried and true axioms: Adam Smith's Urban Myth AKA: "There are NO free markets" and Globalism: "a euphemism for unfettered corporate rape and pillage"...

and add a new one: Rather than a revolution against "no taxation without representation"...

we need a new revolution against "representation for the ultra rich without taxation" and "taxation without representation" for everyone else.

For the vanishing middle class the river has run dry...

"Is a dream a lie if it don't come true, or is it something worse.

That sends me down to the river, though I know the river is dry

That sends me down to the river tonight

Down to the river, my baby and I

Oh down to the river we ride"

Overhauled & Updated from 05/09/11 for 2014.

From ThinkProgress, 12 Tax Dodging Corps that spent $1 billion to influence Washington.

...while Main Street Americans are having their services gutted and public investment is being slashed, some of the country’s most profitable corporations are getting away with paying little to nothing in taxes.The Nattering One muses... all those profits, all those tax breaks, where are the jobs?

The amount of money that taxpayers are losing from the tax dodging by these major corporations is enormous.

For example, if five of the nation’s biggest banks paid their taxes at the full rate, we could re-hire every single one of the 132,000 teachers laid off during the recession — twice.

A new report by Public Campaign examines how these major corporations have influenced Congress to craft a tax code that lets them get away with making so much money and paying so little taxes in return.

In its report, “The Artful Dodgers,” Public Campaign juxtaposes the limited tax liability of dozen major corporations with the companies’ campaign contributions and lobbying expenditures, which amount to more than a billion dollars over the last decade:

EXXON MOBIL: The oil giant that was the world’s most profitable corporation in 2008 has spent $5.7 million in campaign contributions over the last ten years and $138 million in lobbying expenditures. Its federal corporate income tax liabilities for 2009? Absolutely nothing. Not only did it pay nothing, but it also received a tax rebate the same year of $156 million.

CHEVRON: Chevron spent $4.4 million in campaign contributions and $91 million in lobbying expenditures over the last decade. It received a tax refund of $19 million in 2009 while making $10 billion in profits and $324 million in government contracts in 2008.

CONOCOPHILLIPS: The Texas-based gasoline giant spent $2.5 million in campaign contributions and $63 million in lobbying expenditures over the last decade. It received “$451 million through the oil and gas manufacturing deduction,” a special tax break, between 2007 and 2009, despite $16 billion in profits over the same period of time.

VALERO ENERGY: Valero spent $4.1 million in campaign contributions and $4.8 million in lobbying expenditures from 2001 to 2010. It received a $157 million tax rebate in 2009 despite $68 billion in sales during the same year. It received “$134 million through the oil and gas manufacturing deduction” over the last three years.

BANK OF AMERICA: Bank of America employees contributed $11 million to federal political campaigns from 2001 to 2010 and spent $24 million lobbying over the same period of time. It made $4.4 billion in profits in 2010 while receiving a tax refund of $1.9 billion.

CITIGROUP: Citigroup employees contributed $15 million to federal political campaigns from 2001 to 2010 and spent $62 million lobbying over the same period of time. It made $4 billion in profits in 2010 while paying absolutely nothing in federal corporate income taxes. It also received a $1.9 billion tax refund.

GOLDMAN SACHS: The mega-bank Goldman Sachs, which is often called “Government Sachs” in insider circles because of its clout over Washington, spent $22 million in campaign contributions and $21 million in lobbying over the last decade. It paid an ultra-low tax rate of 1.1 percent in 2008, while also receiving $800 billion in government loans to help weather the financial crisis.

BOEING: The aviation and defense contractor giant gave $10 million in contributions and $115 million in lobbying expenditures over the last decade. It paid a grand total of nothing in federal corporate income taxes in 2010 and received a $124 million tax refund.

FEDEX: FedEx spent $8.7 million in campaign contributions and $71 million in lobbying expenditures from 2001 to 2010. It paid a .0005 percent effective tax rate recently, actually spending 42 times as much on lobbying Congress as it did paying taxes. To do this it utilizes 21 tax havens.

CARNIVAL: The cruise line paid $1.7 million in campaign contributions and $1.6 million in lobbying over the past ten years. Despite the relatively low amount of money it spent influencing Washington, it has gotten away with a super-low tax rate. Over the past five years, its federal corporate income tax rate has been an effective 1.1 percent.

VERIZON: Verizon spent $12 million in campaign contributions and $131 million in lobbying expenditures over the past decade. It paid absolutely nothing in federal corporate income taxes over the past two years and $488 million in government contracts in 2008; in 2010, it made $12 billion in profits.

GENERAL ELECTRIC: General Electric spent $13 million in campaign contributions and $205 million in lobbying expenditures over the last decade while netting a tax refund of $4.1 billion over the past five years. It made $26 billion in profits over the same time period.

The charts above witnesse how jobs are being outsourced while our economy is expatriated by corporate turncoats?

Meanwhile the teabaggers are crafting the final solution for the new jews... homosexuals, immigrants, non Christians, pensions, unions and public workers...

Quietly, the whores on the hill have set it up so that their rich friends pay no tax while the working stiff gets screwed royally.

This is a classic parliamental misdirect in our governments "War on the Vox Populi" and "War on the Middle Class".

We refer to our tried and true axioms: Adam Smith's Urban Myth AKA: "There are NO free markets" and Globalism: "a euphemism for unfettered corporate rape and pillage"...

and add a new one: Rather than a revolution against "no taxation without representation"...

we need a new revolution against "representation for the ultra rich without taxation" and "taxation without representation" for everyone else.

For the vanishing middle class the river has run dry...

"Is a dream a lie if it don't come true, or is it something worse.

That sends me down to the river, though I know the river is dry

That sends me down to the river tonight

Down to the river, my baby and I

Oh down to the river we ride"

Overhauled & Updated from 05/09/11 for 2014.

Comments