Houdini Has Cornered Himself or The Balancing Act

Continued Nattering from "Banks Don't Lend Money and They Shoot Horse's, Don't They"... mea culpa, that is tomorrow's post!!!

Phantom Wealth and Well Being

Chart below showing current market capitalization-to-GDP ratio of 127%

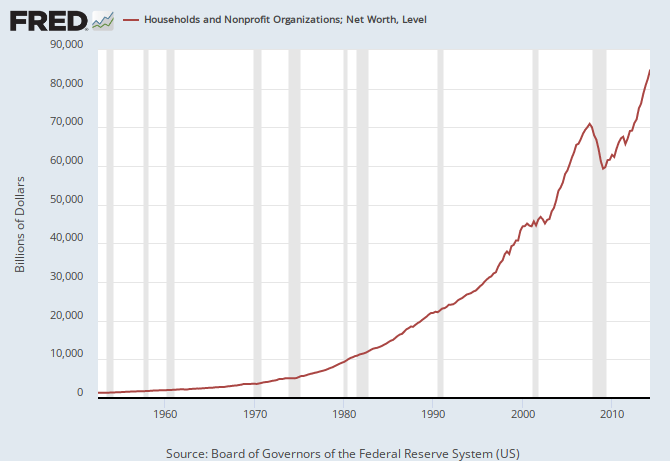

Chart below showing, Net Worth of Households and Non Profit Organizations.

Needless to say, these dramatic gains have occurred not because households are saving and investing more or because the US economy has become dramatically more productive and profitable. In fact, it represents a vast inflation of financial and real estate assets.

Even if the current $83 trillion household wealth figure is adjusted for the GDP deflator, it still means that there has been a 40% gain in aggregate real household net worth since the turn of the century. By contrast, real wage and salary income is only up by only 17% and median real household income is actually down from $57k to $52k or by nearly 10%.

The Risk Disincentive

An SA reader comments "Without risk, there is no reward. Diversity is the key to owning risk"

SPOT ON COMMON SENSE.

Yet, below his post, this comment: "No. That is absolutely not correct. Taking risk does not mean that you are rewarded by it. The stock market is not a casino."

Alrighty then.. apparently somebody never heard of "no pain, no gain" and this is why they later comment: "Since you can take zero risk and match the performance of the SP 500, there is no incentive to take any at all."

And there you have it. This is why in a ZIRP/QE environment, wrought with low risk carry trades, capital becomes misallocated (diverted, inverted, perverted) as in a dearth where it should be going in a normal market, resulting in the durable economic base hopelessly going to seed.

Houdini Has Cornered Himself

If I raise rates in baby step 25 bps bumps up to 2-3%, there would be pain, but there could be gain. Would this "force feed" the appetite for risk from low risk carry and financialism into GDP generating activity? Perhaps.

Would this breathe life back into the stagnant economy and perhaps even return normal price discovery to the market? Perhaps. Would this cause some pain in the bond, equities and other asset markets? Yes, some healthy and necessary pain.

This is going to be a precarious balancing act, the Fed knows it can't kill a zombie economy, but they can slowly chase the ZIRP bond carry and get the misallocated capital back where it belongs, invested in durable economic activity. The problem will be the resulting debt service, and not cratering the bond market.

Go here for a big reason why rates cannot revert to the mean... Higher rates, regardless of how they occur, CB raising or widening of credit spreads, mean higher debt service costs. With all the debt out there, public, private, corporate, HY, EM, dollar based, it won't take much of an increase to cause some serious defaults, deleveraging and market disorder.

On the other hand, if allowed to continue ZIRP and QE could result in domestic terrorism, mass insurrection, civil wars, global chaos and human suffering on a scale heretofore unseen. In order to preserve any hope for the future of mankind by avoiding this potential apocalypse and achieving a return to economic normalcy, ZIRP must end, along with QE.

To navigate out of the corner they are in, with no bullets left in the gun, the central banks will have to pull off a balancing act of Houdini's caliber and of biblical proportion. We are about to witness a man walking a tight rope without any safety net, and one of two things will occur, he will miraculously traverse the chasm against all odds, or he will lose his balance and fall to an untimely death.

Stay tuned as the future of countless billions of lives on this small insignificant green satellite could be decided in your not too distant future. That is, whatever might be left of it.

"They Shoot Horses, Don't They?" would be apropos.

More recommended reading here, here, here and here.

Phantom Wealth and Well Being

Chart below showing current market capitalization-to-GDP ratio of 127%

Chart below showing, Net Worth of Households and Non Profit Organizations.

Needless to say, these dramatic gains have occurred not because households are saving and investing more or because the US economy has become dramatically more productive and profitable. In fact, it represents a vast inflation of financial and real estate assets.

Even if the current $83 trillion household wealth figure is adjusted for the GDP deflator, it still means that there has been a 40% gain in aggregate real household net worth since the turn of the century. By contrast, real wage and salary income is only up by only 17% and median real household income is actually down from $57k to $52k or by nearly 10%.

The Risk Disincentive

An SA reader comments "Without risk, there is no reward. Diversity is the key to owning risk"

SPOT ON COMMON SENSE.

Yet, below his post, this comment: "No. That is absolutely not correct. Taking risk does not mean that you are rewarded by it. The stock market is not a casino."

Alrighty then.. apparently somebody never heard of "no pain, no gain" and this is why they later comment: "Since you can take zero risk and match the performance of the SP 500, there is no incentive to take any at all."

And there you have it. This is why in a ZIRP/QE environment, wrought with low risk carry trades, capital becomes misallocated (diverted, inverted, perverted) as in a dearth where it should be going in a normal market, resulting in the durable economic base hopelessly going to seed.

Houdini Has Cornered Himself

If I raise rates in baby step 25 bps bumps up to 2-3%, there would be pain, but there could be gain. Would this "force feed" the appetite for risk from low risk carry and financialism into GDP generating activity? Perhaps.

Would this breathe life back into the stagnant economy and perhaps even return normal price discovery to the market? Perhaps. Would this cause some pain in the bond, equities and other asset markets? Yes, some healthy and necessary pain.

This is going to be a precarious balancing act, the Fed knows it can't kill a zombie economy, but they can slowly chase the ZIRP bond carry and get the misallocated capital back where it belongs, invested in durable economic activity. The problem will be the resulting debt service, and not cratering the bond market.

Go here for a big reason why rates cannot revert to the mean... Higher rates, regardless of how they occur, CB raising or widening of credit spreads, mean higher debt service costs. With all the debt out there, public, private, corporate, HY, EM, dollar based, it won't take much of an increase to cause some serious defaults, deleveraging and market disorder.

On the other hand, if allowed to continue ZIRP and QE could result in domestic terrorism, mass insurrection, civil wars, global chaos and human suffering on a scale heretofore unseen. In order to preserve any hope for the future of mankind by avoiding this potential apocalypse and achieving a return to economic normalcy, ZIRP must end, along with QE.

To navigate out of the corner they are in, with no bullets left in the gun, the central banks will have to pull off a balancing act of Houdini's caliber and of biblical proportion. We are about to witness a man walking a tight rope without any safety net, and one of two things will occur, he will miraculously traverse the chasm against all odds, or he will lose his balance and fall to an untimely death.

Stay tuned as the future of countless billions of lives on this small insignificant green satellite could be decided in your not too distant future. That is, whatever might be left of it.

"They Shoot Horses, Don't They?" would be apropos.

More recommended reading here, here, here and here.

Comments