In Europe, Banks Are Trembling Again?

Many across the web parroted German newspaper Die Welt's reporting French bank exposure to Italian debt in excess of €250 billion, while few linked to the actual article.

The Nattering One delivers said link and below, a rough Google translation from German to English.

In Europe tremble again the banks

From Anja Ettel , Holger Zschäpitz | Published on 07/07/2016

Italy's financial industry wags. This is also the case for the rest of the euro zone. The banks are closely intertwined. For German institutes alone, 84 billion euros are at stake.

Wolfgang Schäuble has a reputation like once act as schoolmaster Europe. By these standards, the commentary of the Federal Finance Minister to sound Italian banking crisis unusually resilient.

His counterpart Pier Carlo Padoan not want any special treatment, but would strictly adhere to the new rules for bank rescue, let Schäuble announced at the launch of the new budgets of the Federation. And exactly this rules offer also enough flexibility.

The strange, tortuous statement does not come by chance. Not only Italy is at stake. Not four years after the last major European crisis, Europe must once again fear the stability of its financial sector.

A total of 610 billion dollars converted 550 billion euros that have banks borrowed Italy worldwide . French casualties in particular have to shake. After all, they are carrying the list of creditors at 250 billion euros. German institutes have nearly 84 billion euros in the fire, almost as much as the Spanish and US credit institutions.

Bank crises are also state debt crises

This can be seen in the figures for the Bank for International Payments (BIS), which monitors the financial turmoil worldwide. The data also show the extent to which the crisis in one or even several major banks in Italy could be passed on to other institutions and countries.

After years of emergency since the Great Financial Crisis and the Euro debt crisis , the financial strength of European banks in particular is so low that even minor failures can have major consequences.

Although the Italian banks are in the chalk with their foreign competitors only with scarcely 80 billion euro. However one of the lessons from the euro crisis that banking crises usually are also sovereign debt crises, and vice versa. If the banks in Italy tilt, the creditworthiness of the Italian state is likely to be impaired, and there will then be a risk of default for credit institutions worldwide.

Italy could trigger a systemic banking crisis throughout Europe, said Lorenzo Bini Smaghi, Chairman of the Board of Société Générale, Bloomberg. "The entire banking system is under pressure. We have set up rules that might lead to a crisis, "the former Governor of the ECB addressed the new Brussels Banking Directive.

This allows aid only if private owners and creditors of the banks - including the borrowers or the account holders - have accounted for eight percent of the obligations.

This is to prevent that the money of taxpayers is always spent on the rescue of banks. But exactly this liability cascade holds Bini Smaghi fatal. He demands that the States pay the rescue in full. Europe's banking market is facing a crisis as long as the governments do not finally realize that the taxpayer has to raid the banks in doubt. "We have to change the rules," he told Bloomberg.

The ECB is also exerting pressure

Italy banking sector has bad loans in a volume of 360 billion euros in the books. 18 per cent of the total loan portfolio is non-performing. In Germany, the rate is around three percent, the EU average of just over 6 percent.

Particularly dramatic is the Banca Monte dei Paschi. Here, the share of bad loans is about 40 percent of the total credit book. The institute has established its own processing unit, which should sell papers. But the search for buyers is difficult. Especially not according to the Brexit vote of the British, which has further worsened the economic uncertainty and thus the value of the loans.

Meanwhile give ECB pressure. Monte dei Paschi must present a plan for how to fill the capitals. As long as the Italian government does not want to wait and wants to jump in as quickly as possible. However, Rome needs to find a solution that is compatible with the new EU Banking Directive.

EUR 13 million still owes Italy to the German industry

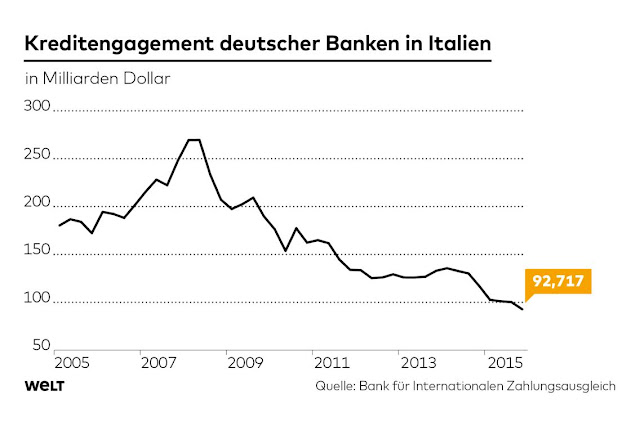

Source: Infografik The World

The crisis in Italy caused heavy losses in bank shares at the middle of the week. Meanwhile, institutes outside Italy are among the biggest losers. For example Deutsche Bank's shares, which fell by almost seven percent.

The German industry primes have more than 13 billion euros in fire in Italy. After all, Italy's commitment has been steadily declining in recent years. In 2012 it amounted to almost 20 billion euros.

Overall, German institutions have reduced their positions in Italy. Currently, claims against the country are $ 92.9 billion. As of 2008, the stock market stood at 270 billion dollars three times as high. With their Italian competitors, they also have a good 11 billion dollars.

Greatest in the French commitment

Source: Infografik The World

Only the French banks are even more exposed, with claims of 40 billion. Finance Minister Schäuble is also aware of the dangers. He can only hope that the Italian crisis will be solved as quickly as possible. Otherwise, he may have to be measured against the rules of the banking directive.

© WeltN24 GmbH 2016. All rights reserved.

The Nattering One delivers said link and below, a rough Google translation from German to English.

In Europe tremble again the banks

From Anja Ettel , Holger Zschäpitz | Published on 07/07/2016

Italy's financial industry wags. This is also the case for the rest of the euro zone. The banks are closely intertwined. For German institutes alone, 84 billion euros are at stake.

Wolfgang Schäuble has a reputation like once act as schoolmaster Europe. By these standards, the commentary of the Federal Finance Minister to sound Italian banking crisis unusually resilient.

His counterpart Pier Carlo Padoan not want any special treatment, but would strictly adhere to the new rules for bank rescue, let Schäuble announced at the launch of the new budgets of the Federation. And exactly this rules offer also enough flexibility.

The strange, tortuous statement does not come by chance. Not only Italy is at stake. Not four years after the last major European crisis, Europe must once again fear the stability of its financial sector.

A total of 610 billion dollars converted 550 billion euros that have banks borrowed Italy worldwide . French casualties in particular have to shake. After all, they are carrying the list of creditors at 250 billion euros. German institutes have nearly 84 billion euros in the fire, almost as much as the Spanish and US credit institutions.

Bank crises are also state debt crises

This can be seen in the figures for the Bank for International Payments (BIS), which monitors the financial turmoil worldwide. The data also show the extent to which the crisis in one or even several major banks in Italy could be passed on to other institutions and countries.

After years of emergency since the Great Financial Crisis and the Euro debt crisis , the financial strength of European banks in particular is so low that even minor failures can have major consequences.

Although the Italian banks are in the chalk with their foreign competitors only with scarcely 80 billion euro. However one of the lessons from the euro crisis that banking crises usually are also sovereign debt crises, and vice versa. If the banks in Italy tilt, the creditworthiness of the Italian state is likely to be impaired, and there will then be a risk of default for credit institutions worldwide.

There are still outstanding receivables amounting to 84 billion euros

Source: Infografik The WorldItaly could trigger a systemic banking crisis throughout Europe, said Lorenzo Bini Smaghi, Chairman of the Board of Société Générale, Bloomberg. "The entire banking system is under pressure. We have set up rules that might lead to a crisis, "the former Governor of the ECB addressed the new Brussels Banking Directive.

This allows aid only if private owners and creditors of the banks - including the borrowers or the account holders - have accounted for eight percent of the obligations.

This is to prevent that the money of taxpayers is always spent on the rescue of banks. But exactly this liability cascade holds Bini Smaghi fatal. He demands that the States pay the rescue in full. Europe's banking market is facing a crisis as long as the governments do not finally realize that the taxpayer has to raid the banks in doubt. "We have to change the rules," he told Bloomberg.

The ECB is also exerting pressure

Italy banking sector has bad loans in a volume of 360 billion euros in the books. 18 per cent of the total loan portfolio is non-performing. In Germany, the rate is around three percent, the EU average of just over 6 percent.

Particularly dramatic is the Banca Monte dei Paschi. Here, the share of bad loans is about 40 percent of the total credit book. The institute has established its own processing unit, which should sell papers. But the search for buyers is difficult. Especially not according to the Brexit vote of the British, which has further worsened the economic uncertainty and thus the value of the loans.

Meanwhile give ECB pressure. Monte dei Paschi must present a plan for how to fill the capitals. As long as the Italian government does not want to wait and wants to jump in as quickly as possible. However, Rome needs to find a solution that is compatible with the new EU Banking Directive.

EUR 13 million still owes Italy to the German industry

Source: Infografik The World

The crisis in Italy caused heavy losses in bank shares at the middle of the week. Meanwhile, institutes outside Italy are among the biggest losers. For example Deutsche Bank's shares, which fell by almost seven percent.

The German industry primes have more than 13 billion euros in fire in Italy. After all, Italy's commitment has been steadily declining in recent years. In 2012 it amounted to almost 20 billion euros.

Overall, German institutions have reduced their positions in Italy. Currently, claims against the country are $ 92.9 billion. As of 2008, the stock market stood at 270 billion dollars three times as high. With their Italian competitors, they also have a good 11 billion dollars.

Greatest in the French commitment

Source: Infografik The World

Only the French banks are even more exposed, with claims of 40 billion. Finance Minister Schäuble is also aware of the dangers. He can only hope that the Italian crisis will be solved as quickly as possible. Otherwise, he may have to be measured against the rules of the banking directive.

© WeltN24 GmbH 2016. All rights reserved.

Comments