An Economic CON-undrum?

Natterings of Note: This is the 18th anniversary of 9/11... Pull up two futures charts daily: NDX and RUT, note the divergence over the last 3 days.

Again, this week with 3.5 to 1 bid to cover, $1T "stalled" in UST auction bids... actual payment is debited from the winners bank accounts on the date of issue, which is usually within 1 to 5 days after auction.

Quad witching and index rebalancing next Friday Sept 20th, which would make Wacky Wednesday, today. If you think options "expire" at 4PM EST on the 3rd Friday of each month, you need to read this.

Final note, last year the Chinese holiday, month end, quarter end liquidity "ruck" affect hit Oct 1st when Fed bond taper was in full effect. Said taper has been halted and the Fed is again rolling over proceeds into purchases, a small QE4?

Not when stacked against $800B in issuance between now and year end, which primary dealers will be eating to restock the TGA. Now there's a balance sheet constraint or liquidity drain? Moving West...

Following up on Jobs and PMI: 18 Month Drought? ...

[IHS Markit PMI] recent peak in March 2018,(remember that) and declining to a 119-month low [August at 49.5], under 50 means in contraction.

[CES employment revisions] rather than 2.5M jobs created between March 2018 and 2019, there were only 2.0M or -20% less jobs than advertised?

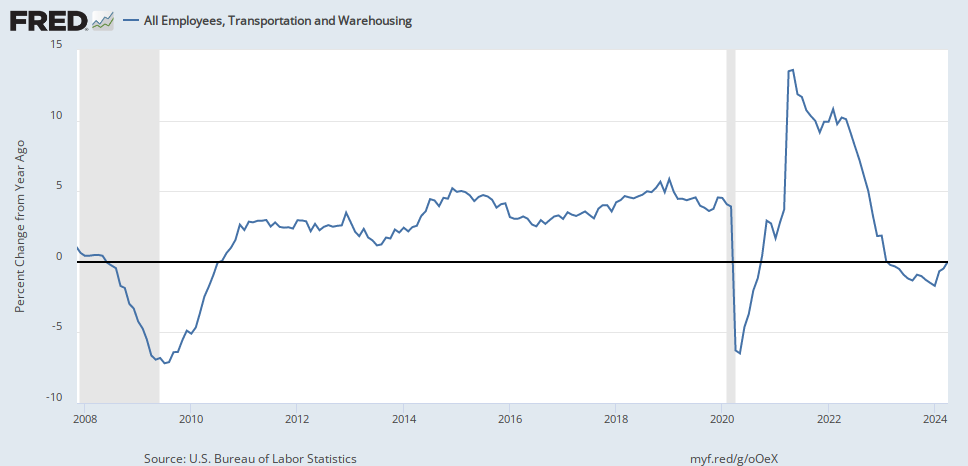

Transportation and warehousing -78.7K (less goods being made and shipped), retail trade -146.4K (less goods selling), cascading downstream...

Professional and business services -163K (less services necessary for those laid off above) and leisure and hospitality -175K (less to spend and fewer good times), rinse and repeat.

IHS PMI and CES employment downtrending since March 2018, shall we update and triangulate? Why not? Friday September 6th, the August non farm payrolls report +130K, boosted by +25K temporary government census workers.

Private payrolls a three month low +96K, and monthly job gains of +158K this year are down sharply from +223K in 2018.

Above, transportation and warehousing, note the decline in ROC delta growth since March 2018.

Above, retail trade, note the decline in growth since January 2013, and especially since March 2018.

Above, leisure and hospitality, note the decline in growth since January 2013. But that's not all you get...

The change in total nonfarm payroll employment for June was revised down by 15K from +193K to +178K, and the change for July was revised down by 5K from +164K to +159K.

With these revisions, employment gains in June and July combined were 20K less than previously reported. After revisions, job gains have averaged 156K per month over the last 3 months. And now this...

It sounds like we should have been more concerned with spending, investment and hiring for quite awhile now, and will need to be moving forward? Good times ahead indeed.

Again, this week with 3.5 to 1 bid to cover, $1T "stalled" in UST auction bids... actual payment is debited from the winners bank accounts on the date of issue, which is usually within 1 to 5 days after auction.

Quad witching and index rebalancing next Friday Sept 20th, which would make Wacky Wednesday, today. If you think options "expire" at 4PM EST on the 3rd Friday of each month, you need to read this.

Final note, last year the Chinese holiday, month end, quarter end liquidity "ruck" affect hit Oct 1st when Fed bond taper was in full effect. Said taper has been halted and the Fed is again rolling over proceeds into purchases, a small QE4?

Not when stacked against $800B in issuance between now and year end, which primary dealers will be eating to restock the TGA. Now there's a balance sheet constraint or liquidity drain? Moving West...

Following up on Jobs and PMI: 18 Month Drought? ...

[IHS Markit PMI] recent peak in March 2018,(remember that) and declining to a 119-month low [August at 49.5], under 50 means in contraction.

[CES employment revisions] rather than 2.5M jobs created between March 2018 and 2019, there were only 2.0M or -20% less jobs than advertised?

Transportation and warehousing -78.7K (less goods being made and shipped), retail trade -146.4K (less goods selling), cascading downstream...

Professional and business services -163K (less services necessary for those laid off above) and leisure and hospitality -175K (less to spend and fewer good times), rinse and repeat.

IHS PMI and CES employment downtrending since March 2018, shall we update and triangulate? Why not? Friday September 6th, the August non farm payrolls report +130K, boosted by +25K temporary government census workers.

Private payrolls a three month low +96K, and monthly job gains of +158K this year are down sharply from +223K in 2018.

Above, transportation and warehousing, note the decline in ROC delta growth since March 2018.

Above, retail trade, note the decline in growth since January 2013, and especially since March 2018.

Above, leisure and hospitality, note the decline in growth since January 2013. But that's not all you get...

The change in total nonfarm payroll employment for June was revised down by 15K from +193K to +178K, and the change for July was revised down by 5K from +164K to +159K.

With these revisions, employment gains in June and July combined were 20K less than previously reported. After revisions, job gains have averaged 156K per month over the last 3 months. And now this...

"[the employment] indicator exploded... virtually unprecedented... blowout numbers... they're coming out of the woodwork...

America's working, America is getting paid well. America is spending and saving and producing.

So I think this is a dynamite report, but you’ve got to look under the hood, many analysts don't. You're lucky to have me on here. I used to do this for a living." - Larry KudlowAnd now this...

No kidding? Depends on whose fake news it is, and the source? and there are no other words than...The Economy is great. The only thing adding to “uncertainty” is the Fake News!— Donald J. Trump (@realDonaldTrump) September 6, 2019

"Nothing in the world is more dangerous than sincere ignorance and conscientious stupidity." A Knock At Midnight - Ch. 4 : Love in action, Sct. 3 - Martin Luther King

Comments