Holiday Hangover?

Looking at today's chart between 8:15 and 9:30AM EST - NQ futures dropped 82 points from 7055 to 6973...

Bonds got the bid, while equities and oil retreated temporarily. What happened to knee jerk investors at 8:30AM EST? Two economic reports were released.

Unemployment increasing with the four week average to a one year high, initial claims to an 18 month high. Unemployment up and hand in hand as we warned (many times in the past) of late on December 5th in Rapture? so goes spending...

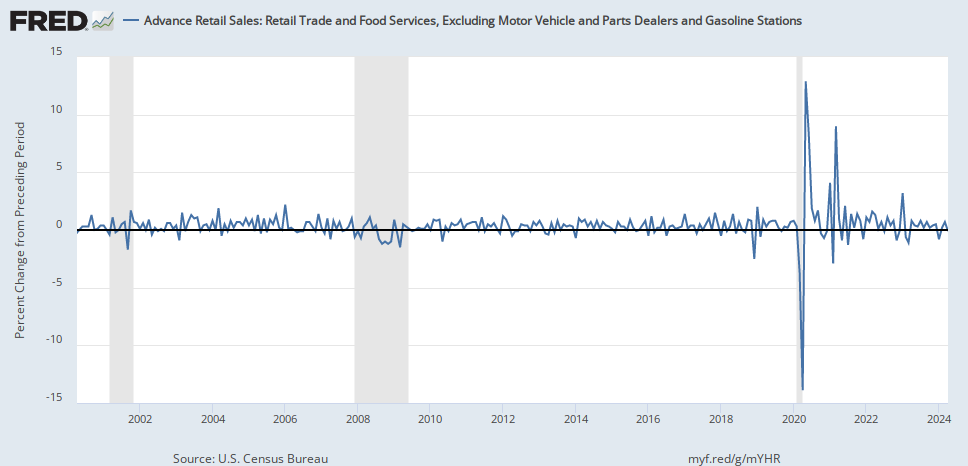

Retail sales plunged 1.2% with core spending (70% of economy) diving 1.8%, the largest decline in nine years.

Core sales or spending excludes automobiles, gasoline, building materials and food services. Above chart does not exclude building materials, hence only -1.4%

The market shook off the knee jerk opening and it was business as usual, up, up and away.

As for this AM's reports, we are proffered the following MSM spins...

Pessimism over the government shutdown and the uncertainty over the economic outlook made consumers cautious. Perhaps consumers are paying off their holiday credit card extravagances? To wit...

Bonds got the bid, while equities and oil retreated temporarily. What happened to knee jerk investors at 8:30AM EST? Two economic reports were released.

Unemployment increasing with the four week average to a one year high, initial claims to an 18 month high. Unemployment up and hand in hand as we warned (many times in the past) of late on December 5th in Rapture? so goes spending...

Retail sales plunged 1.2% with core spending (70% of economy) diving 1.8%, the largest decline in nine years.

Core sales or spending excludes automobiles, gasoline, building materials and food services. Above chart does not exclude building materials, hence only -1.4%

The market shook off the knee jerk opening and it was business as usual, up, up and away.

As for this AM's reports, we are proffered the following MSM spins...

Pessimism over the government shutdown and the uncertainty over the economic outlook made consumers cautious. Perhaps consumers are paying off their holiday credit card extravagances? To wit...

Reviewing the aspects of spending 101: Less spending, less income, less revenues, less latitude for producers to lower prices, less investment in future economic activity, less hiring, lower or stagnated wages, lower production, layoffs ensue, rinse, spin and repeat. - The "Psycho Social" Aspects of Spending?So is it the chicken or the egg? As this can become a vicious cycle, who cares about semantics. What matters looking forward is rinse, spin and repeat? Happy Valentines Day.

Comments