American Graffiti?

Following up on Writing On The Wall? Word to the wise, don't be so eager to drink the "happy daze" econometric falsity kool-aid re: CPI inflation, GDP output, PCE consumer spending and unemployment.

Here's the resulting cycle: lower real wages, stagflation, unhealthy rising PCE squeeze (healthcare, insurance, medicine, housing, utilities), lower consumption of goods and services, followed by lower production and layoffs, rinse and repeat. But that can't happen to this robust economy with record low unemployment?

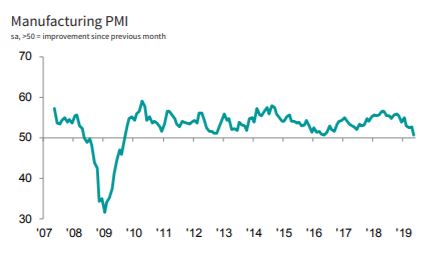

Tell me that graph above and the US intermodal rail graph below which we posted in The 4th Proxy: One Step Beyond? aren't eerily similar since 2010? Whats next? Rinse and repeat.

As outlined in The Sluice Is Down Scoob!!! Ruh-Roh?... Q12019 UK households went into deficit spending (expenses exceed income) for the 1st time since the 80's. Meanwhile, credit demand (commercial RE, mortgage and consumer) is plunging in the US and UK.

Again, "the writing is on the wall so to speak"...and it could be American Graffiti in capitol and capital letters, puns intended. Regarding our long term economic malaise, aka the "new norm" some might say, "must be your Mama's car?"

Here's the resulting cycle: lower real wages, stagflation, unhealthy rising PCE squeeze (healthcare, insurance, medicine, housing, utilities), lower consumption of goods and services, followed by lower production and layoffs, rinse and repeat. But that can't happen to this robust economy with record low unemployment?

"May saw US manufacturers endure the toughest month in nearly ten years... the biggest change since the strong growth seen late last year is a deteriorating performance among larger companies, where surging order book growth just a few months ago has now turned into contraction, the first such decline seen in the series’ ten-year history.

Both producers and their suppliers often reported the need to hold selling prices lower amid lacklustre demand. While this bodes well for inflation, profit margins are clearly being squeezed as a result. New orders are falling at a rate not seen since 2009, causing increasing numbers of firms to cut production and employment." - Chris Williamson, Chief Business Economist at IHS MarkitAbove, the June Markit US Manufacturing PMI hit a low not seen since September 2009. Output expectations dipped to joint-lowest in series history while new orders fell for the 1st time since 2009.

Tell me that graph above and the US intermodal rail graph below which we posted in The 4th Proxy: One Step Beyond? aren't eerily similar since 2010? Whats next? Rinse and repeat.

As outlined in The Sluice Is Down Scoob!!! Ruh-Roh?... Q12019 UK households went into deficit spending (expenses exceed income) for the 1st time since the 80's. Meanwhile, credit demand (commercial RE, mortgage and consumer) is plunging in the US and UK.

Again, "the writing is on the wall so to speak"...and it could be American Graffiti in capitol and capital letters, puns intended. Regarding our long term economic malaise, aka the "new norm" some might say, "must be your Mama's car?"

Comments