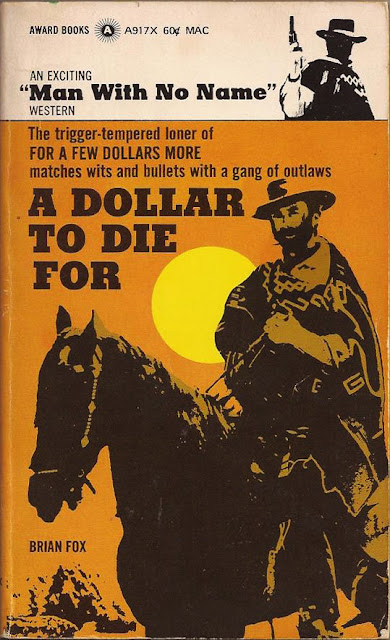

A Dollar To Die For?

The Man With No Name returns, and our unprecedented in depth coverage of the repo ruckus continues, following up on Part 4: A Coffin Full Of Dollars?..

With regard to the repo ruckus of late, so far in the "Man With No Name" series:

A Fistful Of Dollars?

For A Few Dollars More?

The Good, The Bad And The Ugly?

A Coffin Full Of Dollars?

We've explained in no uncertain terms:

1) events (seasonal and one off) which led up to and occurred the week of September 16th;

2) potential causes including chapter and verse;

3) and an explanation of the mechanism or the how and why.

That covers the 5W's: Who, What, Why, When, Where and How? What's next? In Part 5: For lack of market makers outside of the Fed, the repo markets mantra might as well be A Dollar To Die For..

With A Dollar To Die For in mind...

1) cash transmogrifying "liquidity" restrictions which prioritize liabilities, rather than assets, resulting in...

2) dealer UST balance sheet debt over saturation, leading to...

3) constriction of balance sheet uptake capacity for further issuance when it would otherwise be profitable, limiting...

4) balance sheet capacity to provide "liquidity" through market making services in the form of funding for settlement balances.

5) Sprinkle on $1.1 trln annual deficit funding via UST's, return to item 1, rinse and repeat...

To avoid further dislocations from such, and unless the Fed wants to remain as the liquidity or "settlement balance" provider of last resort, changes to LCR requirements as to how CASH is viewed are necessary.

At a minimum, in times of stress let the banks utilize reserves towards HQLA requirements without an additional premium or penalty. That's the long and short of it, maturity transformation pun intended. Or is it?

As Nattered above... per se, there is no paucity or surfeit of reserve or collateral UST... and it would seem there should not have been a paucity of cash either.

Something doesn't smell right? Could there be more than meets the eye? More to come when the Man With No Name returns in Part 6: The Devil's Dollar Sign? Stay tuned, no flippin.

Recommended Reading:

A Fistful Of Dollars?

For A Few Dollars More?

The Good, The Bad And The Ugly?

A Coffin Full Of Dollars?

A Negative Disposition?

A Wayward Italian in Kansas?

First Rule Of Bond Market: You Do Not Talk About Keynes?

Impending Money Market Volatility Prompts Warning Light for LCR Tune-Up

Bank Regulations and Turmoil in Repo Markets

With regard to the repo ruckus of late, so far in the "Man With No Name" series:

A Fistful Of Dollars?

For A Few Dollars More?

The Good, The Bad And The Ugly?

A Coffin Full Of Dollars?

We've explained in no uncertain terms:

1) events (seasonal and one off) which led up to and occurred the week of September 16th;

2) potential causes including chapter and verse;

3) and an explanation of the mechanism or the how and why.

That covers the 5W's: Who, What, Why, When, Where and How? What's next? In Part 5: For lack of market makers outside of the Fed, the repo markets mantra might as well be A Dollar To Die For..

With A Dollar To Die For in mind...

"In the past JPMorgan would have gladly seized the opportunity to lend cash in the repo market, where loans are backed by the best collateral, often U.S. Treasury securities.

But on Sept. 17 even as the majority of repo loans were being made at 5% and above, twice the usual rates, JPMorgan was limited in how much of its remaining cash it could provide because of regulatory and other constraints, a person familiar with the trading said.

The spike in rates reflected extra demand for cash, which was widely anticipated due to corporations requiring cash to make scheduled tax payments and banks and other firms needing it to buy newly-issued U.S. Treasury securities." - ReutersPer se, there is no paucity or surfeit of reserve or collateral UST. At fault for the repo ruckus a combination of:

1) cash transmogrifying "liquidity" restrictions which prioritize liabilities, rather than assets, resulting in...

2) dealer UST balance sheet debt over saturation, leading to...

3) constriction of balance sheet uptake capacity for further issuance when it would otherwise be profitable, limiting...

4) balance sheet capacity to provide "liquidity" through market making services in the form of funding for settlement balances.

5) Sprinkle on $1.1 trln annual deficit funding via UST's, return to item 1, rinse and repeat...

To avoid further dislocations from such, and unless the Fed wants to remain as the liquidity or "settlement balance" provider of last resort, changes to LCR requirements as to how CASH is viewed are necessary.

At a minimum, in times of stress let the banks utilize reserves towards HQLA requirements without an additional premium or penalty. That's the long and short of it, maturity transformation pun intended. Or is it?

"Publicly-filed data shows JPMorgan reduced the cash it has on deposit at the Federal Reserve, from which it might have lent, by $158 billion in the year through June, a 57% decline...

the data shows its switch accounted for about a third of the drop in all banking reserves at the Fed during the period...

Bank of America, the second-biggest U.S. bank by assets, with a $2.4 trillion balance sheet, took down 30% of its deposits, a $29 billion reduction." - ReutersWait a damn minute, let's get this straight, JPM and BofA drew down their cash levels by roughly $190 bln, prior to a widely anticipated surge in the demand for cash?

As Nattered above... per se, there is no paucity or surfeit of reserve or collateral UST... and it would seem there should not have been a paucity of cash either.

Something doesn't smell right? Could there be more than meets the eye? More to come when the Man With No Name returns in Part 6: The Devil's Dollar Sign? Stay tuned, no flippin.

Recommended Reading:

A Fistful Of Dollars?

For A Few Dollars More?

The Good, The Bad And The Ugly?

A Coffin Full Of Dollars?

A Negative Disposition?

A Wayward Italian in Kansas?

First Rule Of Bond Market: You Do Not Talk About Keynes?

Impending Money Market Volatility Prompts Warning Light for LCR Tune-Up

Bank Regulations and Turmoil in Repo Markets

Comments