A Wayward Italian in Kansas?

Our friend David Janny at Morgan Stanley insisted we bark up the NIRP tree. As Dave is a most affable gent, we endeavor to oblige... Continuing from A Negative Disposition?

In the case of the former two, fund foreign currency activities by providing local currency collateral. In the case of the latter two, are balance sheet lite and utilized in short tenor under 2yrs, whereas the CCBS are seen in +2yr tenor.

The trade is dependent upon theoretical covered interest rate parity, which connects interest, spot and FX rates viz. a currency with a lower interest rate (i.e. JPY, EUR) trades at a higher exchange rate (i.e. vs USD) in the future.

There are risks involving asset performance and FX volatility in such a dependency, Nattering for another day. Ceteris paribus...

For a USD investor buying a 10 year German bund say in mid July at -0.25%... the short term floating rate involves a "time machine" derivative which hedges the currency risk by selling the Euro currency forward to convert the proceeds over the hedge's time horizon into USD.

The "time machine" hedge "sells" the forward exchange rate (in the lower rate currency) at a higher price than the current spot exchange rate, generating +3% additional yield. When added to -0.25% yield for the 10 year bund, this time machine yields +2.75% for investing in a "safe" negative yield instrument.

Investors have utilized financial alchemy to turn a low or negative yield bond through a hedged carry (via the FX rate) into a positive yielding asset. Search for yield in a "safer" asset resulted in a crowded "carry" trade, which is only one BIG reason why global sovereign yields have taken a dive, and some are now NIRP negative. It's not a mad, mad world, just a subverted, perverted and inverted QE, ZIRP, NIRP world.

Interest rates are the price of loan funds, and never to be conflated with the price of money which is reflected in FX pairs and indices. Above, we attempted to partially explain the mystery of negative bond yields, and in doing so we witnessed how FX rates, in the form of a synthetic arb (swap), can and do influence bond yields.

In order to limit our Nattering we attempted to explain four causes of NIRP, in particular the latter being motivated by an ARB with maturity transformation facilitated by synthetic derivative viz. think artificial rate suppression, price distortion, the effect on price discovery and risk metrics viz think spreads, TED, EBP.

Those distorted metrics, resulting yield curve perturbations, collateral "specials" (negative repo), and renting the "cash cow" in reverse repo are Nattering for another day.

More to come in First Rule Of Bond Market: You Do Not Talk About Keynes? Stay tuned, no flippin, and in the meantime? Much like our apropos (we think) title would, stay calm and carry on my wayward son?

Recommended reading:

A Negative Disposition?

A Fistful Of Dollars?

For A Few Dollars More?

The Good, The Bad And The Ugly?

A Coffin Full Of Dollars?

NIRP: The Marshmallow Test?

Trading Sardines: The Case Of Currency Hedged Negative Yielding Bonds

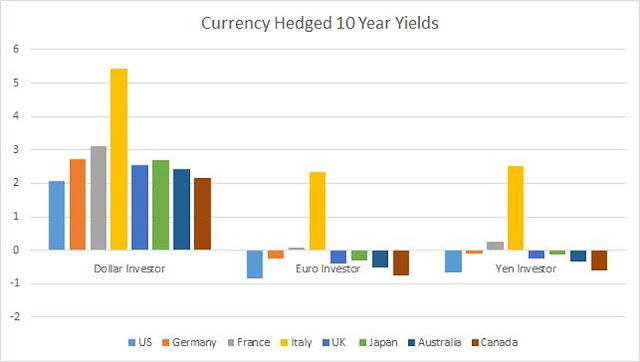

Why would anyone on the planet be buying those Italian 10's like hot cakes?Hopefully one followed the breadcrumbs and found the "negative" clues in That's The Signpost Up Ahead? Moving West... now have a look at the July 19th currency hedged yield on the Italian 10 year bond, especially for USD investors...

Can't say we blame them? And playing that arb or convexity trade, is our fourth cause of negative yields. Moving West...

In simplistic terms, this alchemy for arbitrage involves a "time machine", as the trade is funded at a short term floating rate (derivative), and exposed to a fixed rate instrument (bond) on the asset side.

Even though every country in this list has a much lower un-hedged yield than the US treasury (the lone exception is Italy)... the hedged yield for every country’s bonds is higher than the yield of the US 10 year Treasury. - Vineer Bhansali - ForbesNote: The derivative or synthetic "time machine" involved could be CCB Swap, FX swap or FX fwd. All have different functional nuance, and provide an FX hedge.

In the case of the former two, fund foreign currency activities by providing local currency collateral. In the case of the latter two, are balance sheet lite and utilized in short tenor under 2yrs, whereas the CCBS are seen in +2yr tenor.

The trade is dependent upon theoretical covered interest rate parity, which connects interest, spot and FX rates viz. a currency with a lower interest rate (i.e. JPY, EUR) trades at a higher exchange rate (i.e. vs USD) in the future.

There are risks involving asset performance and FX volatility in such a dependency, Nattering for another day. Ceteris paribus...

For a USD investor buying a 10 year German bund say in mid July at -0.25%... the short term floating rate involves a "time machine" derivative which hedges the currency risk by selling the Euro currency forward to convert the proceeds over the hedge's time horizon into USD.

The "time machine" hedge "sells" the forward exchange rate (in the lower rate currency) at a higher price than the current spot exchange rate, generating +3% additional yield. When added to -0.25% yield for the 10 year bund, this time machine yields +2.75% for investing in a "safe" negative yield instrument.

"by reducing short term interest rates and the consequent application of the covered interest rate parity relationship, the Central Banks are unknowingly encouraging the kind of speculation we discussed previously, i.e. external buying of the negative yielding assets and converting them to positive yielding assets through the exchange rate."Moving West... more so than flight to safety, UST's are coveted bank balance sheet "lite" tools, due to LCR more balance sheet lite than holding cash. But due to FX hedged costs (especially JPY and EUR of late) many foreign investors only want to rent them in reverse repo. Nattering for another day? Indeed and moving West...

Investors have utilized financial alchemy to turn a low or negative yield bond through a hedged carry (via the FX rate) into a positive yielding asset. Search for yield in a "safer" asset resulted in a crowded "carry" trade, which is only one BIG reason why global sovereign yields have taken a dive, and some are now NIRP negative. It's not a mad, mad world, just a subverted, perverted and inverted QE, ZIRP, NIRP world.

Interest rates are the price of loan funds, and never to be conflated with the price of money which is reflected in FX pairs and indices. Above, we attempted to partially explain the mystery of negative bond yields, and in doing so we witnessed how FX rates, in the form of a synthetic arb (swap), can and do influence bond yields.

This is an example of the carry trade at its finest, and perhaps most dangerous. By taking a long term low yielding asset, and by using a derivative contract, the low yield is turned into a high yield, temporarily, and vice versa.... In the case of the global government bond markets, the currency hedging tail is indeed wagging the bond dog.Even after this explanation, we are sure there are those who will still wonder, why rates are negative, why would anyone buy negative yielding instruments. Fear not, at least those negatively challenged, do not wonder where the sun goes at night? Hopefully?

Those distorted metrics, resulting yield curve perturbations, collateral "specials" (negative repo), and renting the "cash cow" in reverse repo are Nattering for another day.

More to come in First Rule Of Bond Market: You Do Not Talk About Keynes? Stay tuned, no flippin, and in the meantime? Much like our apropos (we think) title would, stay calm and carry on my wayward son?

Recommended reading:

A Negative Disposition?

A Fistful Of Dollars?

For A Few Dollars More?

The Good, The Bad And The Ugly?

A Coffin Full Of Dollars?

NIRP: The Marshmallow Test?

Trading Sardines: The Case Of Currency Hedged Negative Yielding Bonds

Comments