Asleep at The Wheel - Part IV

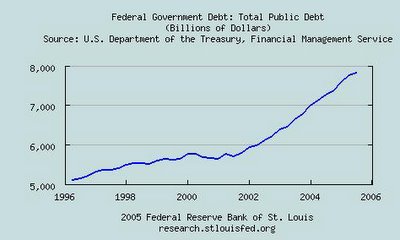

Since 1996, Total Public Debt went from 5 Trillion to 8 Trillion, a 60% increase.

The government sets budgets, spends money and takes in revenue. The debt is the difference between what the government spends and what it takes in.

The government prints up money or issues credits, either way it must sell notes or bonds to finance this debt.

Over 90% of the increase in public debt occured since late 2001 when the Fed began lowering rates and the Treasury cranked up the printing press.

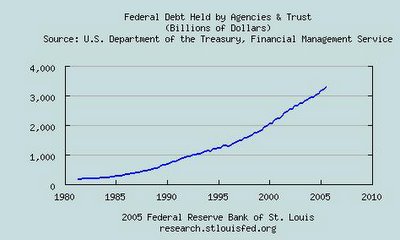

Since 1980 the amount of Federal Debt Held By Agencies & Trusts has grown from 191 Billion to 3.3 Trillion.

Agencies & Trusts of note are Medicare, Social Security and RRTA. Since these are government Agencies & Trusts, the government issues an IOU rather than actually paying itself.

Interestingly enough, our $7.8 Trillion Federal Debt is held by various groups: Federal Reserve = $724 Billion; Foreign Investors = $2.03 Trillion; Agencies & Trusts $3.308 Trillion; Private Investors = $3.803 Trillion; The Public = $4.526 Trillion.

The Foreign Investor total is a subset of the Private Investors total. Private Investors + Federal Reserve = The Public $4.526 Trillion. The Public + Agencies & Trusts = Total Federal Debt.

Since 1996, Federal Debt Held By Agencies & Trusts has grown 153% from $1.3 Trillion to over $3.3 Trillion.

Debt Held by the Public: All Federal debt held by individuals, corporations, state or local governments, foreign governments, and other entities outside of the United States Government less Federal Financing Bank securities.

Net Federal Debt held by Public: $7.8 Trillion less $3.3 Trillion held by Agencies & Trusts = $4.5 Trillion less $724 Billion held by the Federal Reserve = $3.776 Trillion.

Translated this means that if the government elects not to honor the IOU's issued to the Agencies & Trusts (which means stiffing Social Security, Medicare, etc.) and we ignore what the Fed has stashed, the net debt is $3.7 Trillion.

As a percentage of GDP $3.7 Trillion / $15 Trillion = 24.6%.

Sources: St. Louis Fed and US Treasury FMS Federal Debt Bulletin

Comments