The Last Metro?

Summary

Discussion of the potential impacts on equity, bond, commodity, capital and asset markets regarding the following:

- Goldman Sachs? Brexit Scare? Reserves Required

- Safe Haven Yen? A Year End Sandwich?

- Market Conditions; Today, Near Term, Future?

In our June 9th missive The Force Awakens?, with a modified and humorous 90 second Star Wars theme intro crawl video, we provided a glimpse at the MSM's dubious twist on macro news. Today, we follow up on several popular memes where things may not be as they seem...

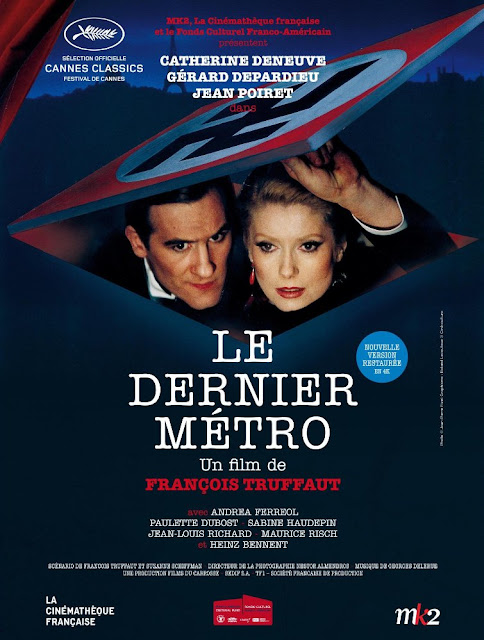

The Last Metro

This French masterpiece was one of Truffaut's last three films, just prior to an unfortunate death from brain cancer at the young age of 52. In Nazi occupied Paris, an actress married to a Jewish theater owner must keep him hidden from the Nazis while doing both of their jobs. The film demonstrates resistance through culture in a story about surviving censorship, antisemitism and material shortages during war time occupation.

Truffaut succeeds in taking the camera backstage in a theater, evoking the climate of the Nazi occupation of France, and giving the ever sexy Catherine Deneuve the role of a responsible woman. With a thought provoking ending that confused many, even those who speak French, this is one of our all time favorites.

Witnessed by Truffaut's triumph in 1981, as the film won ten Césars for: best film, best actor (Depardieu), best actress (Deneuve), best cinematography, best director (Truffaut), best editing, best music, best production design, best sound and best writing. It also received Best Foreign Film nominations in the Academy Awards and Golden Globes.

Goldman Sucks?

Revenue last quarter was $6.34B; weakest since Q4 2011 and you have to go back to 2004 to find a lower start-of-year total $5.93B.

2016 Q1 Yoy revenue from: investment banking -23%; financial advisory -20%; investment mgmt -15%; underwriting -27%; equity underwriting -66%; trading - 37% (last year +46%); debt, currency and commodities (FICC) trading -47% (last year +10%); investments in private and public equities -95%.

Yoy stock price -31%; headcount +6%; employee pay and benefits -40%, aw those poor bankers and finally, drum roll please... NET EARNINGS -60% and OVERALL REVENUE -40%.

On this scintillating news (April 19th, 2016) all commercial banks stocks were up and (GS) +2%, HOORAY!! Since that day -10% OUCH!!

Above note, what a nasty looking chart, the top six banks Yoy Q1 - The really good news? Since banks typically generate at least 33% of their annual revenue during Q1, it is typically the strongest for investment banks. Oh boy!

This missive was published as an exclusive to Seeking Alpha. To access the ENTIRE text for FREE on Seeking Alpha, please click here. The Nattering One does not receive remuneration if you register, only satisfaction.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Comments