Rally Dance?

Summary

Discussion of the potential effects on equity, bond, commodity, capital and asset markets.

Potential Influences of The Recent Dip and Rally; The Fed Announcement.

The BOJ Announcement; Shifts in Liabilities and Preferences.

The Consequences of Central Bank Announcements?

"It looks to us that if indeed Le Chiffre aka Mario Draghi delivers, Bank of Japan and Kuroda will most likely come back again at the QE table. For now it's the "paradox of value" and the continuation of a rally in credit thanks partly to large inflows from Japan and a bubble that keeps growing for sure..." - The Paradox of Value, Martin at Macronomics.

Martin at Macronomics has delivered another excellent "piece" of the puzzle, pun intended. Applying the same logic Martin used in his missive to "Le Chiffre's" (Draghi) ECB move last week and the Fed's raise in Dec., highlights some shifts in liabilities and preferences, which bring forth some explanations for the post-Dec. 16th dip and post-Feb. 11 rally in equities. Let's go dancing down that path...

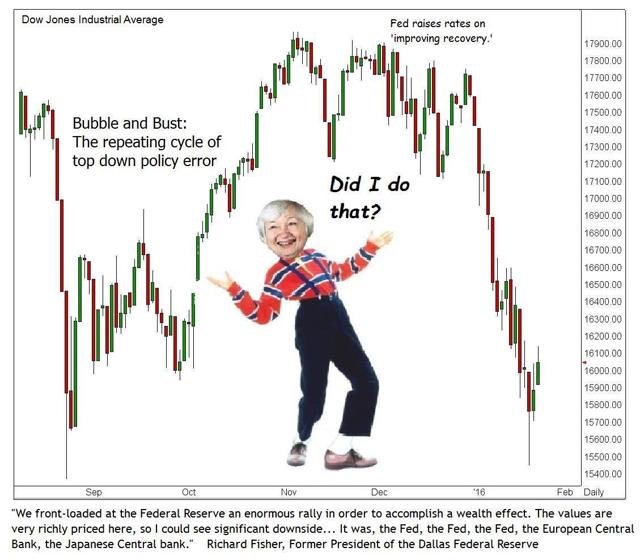

Dammit Janet's Wedding Dance?

Above note, the Dec. 16th Fed raise being castigated for the equities downturn.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Comments