Repo This

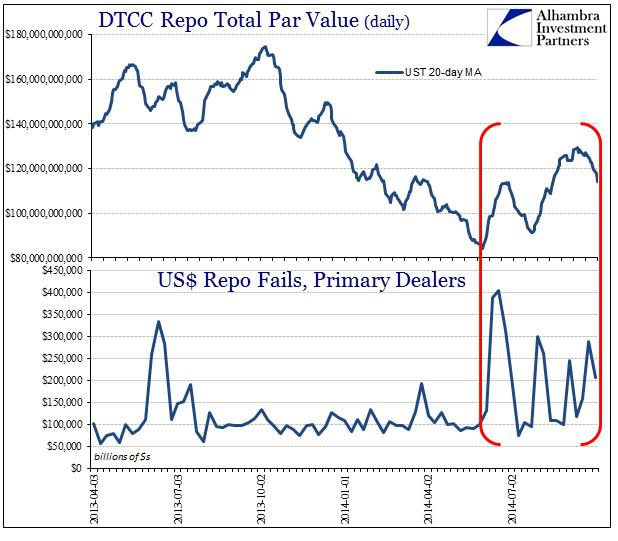

Jeffrey P. Snider makes some keen observations: There is little doubt that repo market problems, that have become far too persistent to be comfortable. Given that since June there has been a rolling surge in repo fails that it pretty much seems a regular feature now. Further, it is even more obvious that there is a relationship between this problem of fails and the volume in the repo markets - even though in general volume in the past few months is far below even last year.

For "some" reason, repo markets don't seem to be able to handle the minor increase in volume off what was a multi-year low point. The surge in fails suggest just how negative effective repo rates were in far too many instances, betraying everything about monetary control right down to the inept and unfortunately inert reverse repo program.

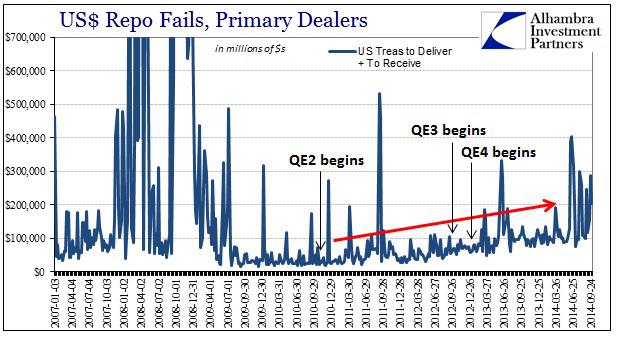

There is a clear and distinct upward bias in the rate of fails tracing back to sometime during the QE2 operation. Now, it is entirely possible that that initial rise was due to dollar disruption resulting from the euro crisis and the third great breakdown in eurodollar flow.

Further in time, however, there can be little argument that repo function, as presented by fails, started to not only rise at the baseline but incur more frequent disruptions almost immediately after QE4's inauguration.

That leads to the final point, the implications of fails. At first glance, especially lately, there doesn't seem to be much to be made of all this. Everything appears fine and orderly in the most prominent asset "markets" despite what looks like to be a persistent liquidity problem. However, repo fails of this type are usually consistent with wider disruption, particularly in wholesale dollar systems.

It is not the size of the fails, particularly now under a 3% fail penalty regime, but the persistence. The period in 2007 prior to the wholesale disruption is like a flatline that suddenly comes to life; almost like a seismograph picking up a sudden geological disturbance. That pattern is evident in late 2007/early 2008, and is also apparent in 2014.

The Nattering One muses... "That pattern is evident"... in both charts one can clearly see the fails from June 1014 on reading like a seismograph at the beginning of a big earthquake. It appears that earthquake may just be starting.

We Nattered here, here and here about the Fed's repo program. We commented here:

Although well intended, and hopefully there will be no panic this time out, I would not count on reverse repo acting as a backstop or PPT...

The Central banks have created a massive flow of money resulting in an unprecedented increase in the volume involved in corporate bond issuance, repo, dealer, eurodollar and money markets.

We have witnessed a paradigm shift in the transference of "holding vehicles" from traditional banks, pension funds and insurance co's to ETF mutual funds where this tidal wave of "savings" currently lies dormant or passive with a low velocity.

Couple the above circumstances with a substantial reduction in the effective "liquidity" or flow handling mechanisms in these "vehicles of choice", yielding a substantial narrowing of the gates or exits.

In the event of a panic liquidation, this type of systemic structural defect could prove to be very problematic.

From FOMC August comments: "Officials plan to use the rate of interest the Fed pays on excess reserves deposited at the central bank as the “primary tool used to move the federal funds rate into its target range” while “temporary use” of the overnight reverse repo facility will be employed to “help set a firmer floor.” Bullard said. “We’ve never done this before, so we don’t know exactly how it will work, but I do think that we are in pretty good shape."

On that last sentence: Wuck??? Are you f-ing kidding?

Mr. Snider hits it spot on: If the system does not function as intended now, under if not ideal circumstances than certainly far from stressed, how is it going to perform under real strain and duress? Might that be a significant factor that is beginning to wind its way into the larger dollar system, the venue of the global dollar short? Liquidity is not what is evident right now, but what is expected when the things are really going wrong. “We don’t know exactly how it will work” is a hell of a liquidity program for that eventuality.

For "some" reason, repo markets don't seem to be able to handle the minor increase in volume off what was a multi-year low point. The surge in fails suggest just how negative effective repo rates were in far too many instances, betraying everything about monetary control right down to the inept and unfortunately inert reverse repo program.

There is a clear and distinct upward bias in the rate of fails tracing back to sometime during the QE2 operation. Now, it is entirely possible that that initial rise was due to dollar disruption resulting from the euro crisis and the third great breakdown in eurodollar flow.

Further in time, however, there can be little argument that repo function, as presented by fails, started to not only rise at the baseline but incur more frequent disruptions almost immediately after QE4's inauguration.

That leads to the final point, the implications of fails. At first glance, especially lately, there doesn't seem to be much to be made of all this. Everything appears fine and orderly in the most prominent asset "markets" despite what looks like to be a persistent liquidity problem. However, repo fails of this type are usually consistent with wider disruption, particularly in wholesale dollar systems.

It is not the size of the fails, particularly now under a 3% fail penalty regime, but the persistence. The period in 2007 prior to the wholesale disruption is like a flatline that suddenly comes to life; almost like a seismograph picking up a sudden geological disturbance. That pattern is evident in late 2007/early 2008, and is also apparent in 2014.

The Nattering One muses... "That pattern is evident"... in both charts one can clearly see the fails from June 1014 on reading like a seismograph at the beginning of a big earthquake. It appears that earthquake may just be starting.

We Nattered here, here and here about the Fed's repo program. We commented here:

Although well intended, and hopefully there will be no panic this time out, I would not count on reverse repo acting as a backstop or PPT...

The Central banks have created a massive flow of money resulting in an unprecedented increase in the volume involved in corporate bond issuance, repo, dealer, eurodollar and money markets.

We have witnessed a paradigm shift in the transference of "holding vehicles" from traditional banks, pension funds and insurance co's to ETF mutual funds where this tidal wave of "savings" currently lies dormant or passive with a low velocity.

Couple the above circumstances with a substantial reduction in the effective "liquidity" or flow handling mechanisms in these "vehicles of choice", yielding a substantial narrowing of the gates or exits.

In the event of a panic liquidation, this type of systemic structural defect could prove to be very problematic.

From FOMC August comments: "Officials plan to use the rate of interest the Fed pays on excess reserves deposited at the central bank as the “primary tool used to move the federal funds rate into its target range” while “temporary use” of the overnight reverse repo facility will be employed to “help set a firmer floor.” Bullard said. “We’ve never done this before, so we don’t know exactly how it will work, but I do think that we are in pretty good shape."

On that last sentence: Wuck??? Are you f-ing kidding?

Mr. Snider hits it spot on: If the system does not function as intended now, under if not ideal circumstances than certainly far from stressed, how is it going to perform under real strain and duress? Might that be a significant factor that is beginning to wind its way into the larger dollar system, the venue of the global dollar short? Liquidity is not what is evident right now, but what is expected when the things are really going wrong. “We don’t know exactly how it will work” is a hell of a liquidity program for that eventuality.

Comments