There Is Something In This More Than Natural - Part 2

Summary

- Of Economic Base Metamorphosis, Capital Misallocation and The McJob Malaise.

- There are unnatural side effects from the interrelationship of QE, ZIRP and Secular Stagnation.

- 35 years of economic deconstruction; the fallacies of central bank policies; and the resulting misallocation of capital; cannot be turned around without a return to the basics.

- An effort must be made to incentivize productive investment and reconstitute a durable domestic economic base.

In Part 1 we examined how it took 25 years of financial deregulation, globalization and outsourcing to labor at the margin to decimate and emasculate our durable domestic economic base.

In Part 2 we examine how this morphing effected household income; and how spending patterns were maintained during the period.

During this 25 year metamorphosis of the economic base, the effects (secular stagnation, lower household income and spending) of the morphing (outsourcing, McJobs, elimination of the middle class) were masked and muted first by the tech bubble, then by the housing bubble.

During the 90's, tech related employment rose along with services. After the dot com post millennium train wreck, housing related employment (construction, lending, mortgages, escrow, title, RE sales) rose, with services in tow.

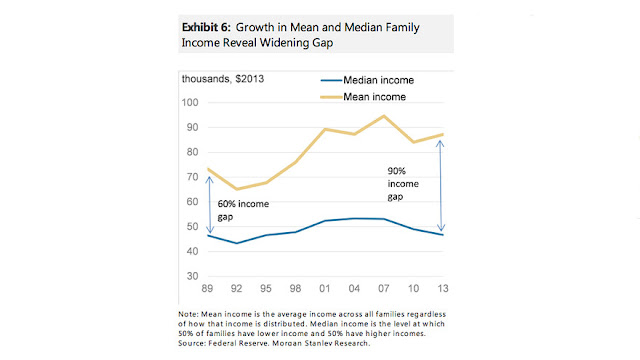

These structural shifts or "musical chairs" helped offset some of the losses in higher paying manufacturing and production jobs with tech or housing jobs. Albeit, aggregate real income was mostly stagnant during the period. This shows the growing disparity between the median family income, the 50th percentile, and the mean, or average, one.

In order to maintain past consumption patterns based upon higher incomes, with a declining job and income base, the majority of the income losses were made up by borrowing against an asset class which was falsely inflated by easy money, i.e. using hyper inflated home equity as an ATM. The chart below demonstrates the hyperinflation of the Home Price Index, rising from 1987 = 67 to mid 2005 = 190

When Greenspan took over the Fed in Aug 1987; household debt was $2.7 trillion, just before 2008, it had ballooned to $14 trillion. At the peak in 2005-2007, households were hitting their equity ATMs for easy money at a $1 trillion annual rate. The chart below shows a peak to trough after crash negative shift of 17% in home equity ATM withdrawal as a percentage of disposable income.

As mass production has to be accompanied by mass consumption, mass consumption, in turn, implies a distribution of wealth - not of existing wealth, but of wealth as it is currently produced - to provide men with buying power equal to the amount of goods and services offered by the nation's economic machinery. Instead of achieving that kind of distribution, a giant suction pump had by 1929-30 drawn into a few hands an increasing portion of currently produced wealth. This served them as capital accumulations. But by taking purchasing power out of the hands of mass consumers, the savers denied to themselves the kind of effective demand for their products that would justify a reinvestment of their capital accumulations in new plants. In consequence, as in a poker game where the chips were concentrated in fewer and fewer hands, the other fellows could stay in the game only by borrowing. When their credit ran out, the game stopped.- Excerpt from "Beckoning Frontiers" by Marriner Eccles, Fed Chairman 1934-1948

An accurate summation from John Hussman: The U.S. Ponzi Economy is one where domestic workers are underemployed and consume beyond their means; household and government debt make up the shortfall; corporate profits expand to a record share of GDP as revenues are sustained by household and government deficits; local employment is replaced by outsourced goods and labor; companies refrain from productive investment, accumulate the debt of other companies and issue new debt of their own, primarily to repurchase their own shares at escalating valuations; our trading partners (particularly China and Japan) become our largest creditors and accumulate trillions of dollars of claims that can effectively be traded for U.S. property and future output; Fed policy encourages the yield-seeking diversion of scarce savings toward speculation in risky securities; and as with every Ponzi scheme, everyone is happy as long as nobody seeks to be repaid.

In essence, lacking an organic economic engine to generate income, our stagnated, stagflated, service based, non durable outsourced economy is now dependent on zero interest rates and the generosity of foreigners willing to lend us money for our profligate spending habits.

This leads to two questions, first, when will the generous suppliers cut off the supply of "easy money" to the ever spending junkies? Answer: When it is no longer profitable to do so and they have the leverage to dictate the terms of the game.

Secondly, is there a way out of the economic malaise created by this misallocation of capital?

In Part 3, we shall endeavor to answer by examining the two requirements for a return to economic normalcy.

Recommended reading:

Atlas Shrugged or Let Nature Take It's Course?

Atla's Shrugged Unnaturally

In Part 3, we shall endeavor to answer by examining the two requirements for a return to economic normalcy.

Recommended reading:

Atlas Shrugged or Let Nature Take It's Course?

Atla's Shrugged Unnaturally

Comments