Oil: Shale Tight Oil Disrupting The Paradigm?

Summary

Discussion of oil futures pricing curve.

Discussion of breakeven, marginal, production and cash cost.

Examination of accounting methods for oil and gas concerns.

Examination of variations in shale and global major project breakeven costs.

In case you missed it, in our last missive, Oil: Price Impact? China's Shanghai Oil Exchange And RMB-Denominated Contracts we discussed:

Oil Futures Pricing Curve

(click to enlarge)

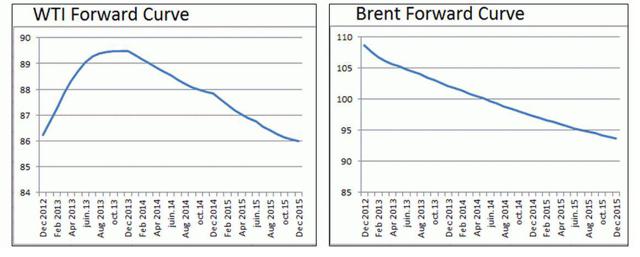

Above note, as estimated in December 2012 by speculative futures markets, the WTI and Brent forward price curves.

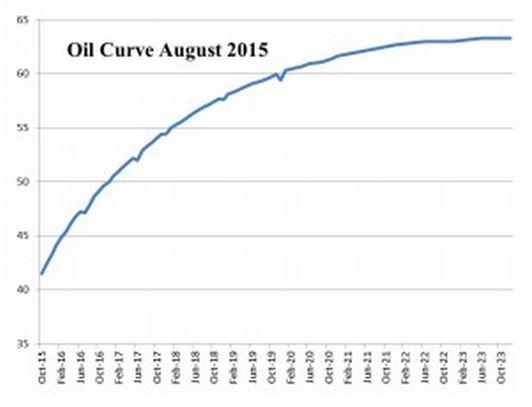

Above note, as of August oil futures price curve eight years out 2015 - 2023, $41 to $64/bbl. Since August, we understand that this curve has slightly modified to $45 - $61/bbl.

Note the difference between the 2012 curve predicted price, Brent $108 - 94; today's market price $45, and today's predicted 2023 price of $61.

This missive was published as an exclusive to Seeking Alpha. To access the ENTIRE text for FREE on Seeking Alpha, please click here. The Nattering One does not receive remuneration if you register, only satisfaction.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

- Examination of China's cornering of the Dubai oil market and its record-setting August oil shopping spree's impact on oil prices.

- Examination of the SHPGX - Shanghai Petroleum and Natural Gas Exchange - and its potential effect on oil prices.

- Examination of China's dollar-denominated purchases and their impact on oil prices.

- Examination of China's RMB-denominated purchases and their impact on oil prices.

Oil Futures Pricing Curve

(click to enlarge)

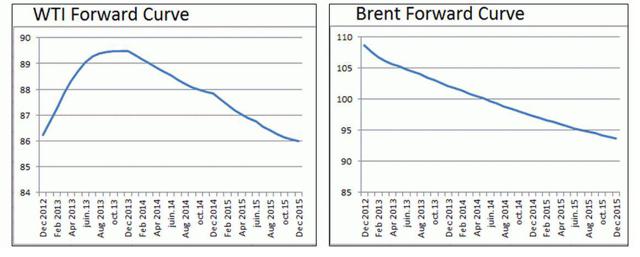

Above note, as estimated in December 2012 by speculative futures markets, the WTI and Brent forward price curves.

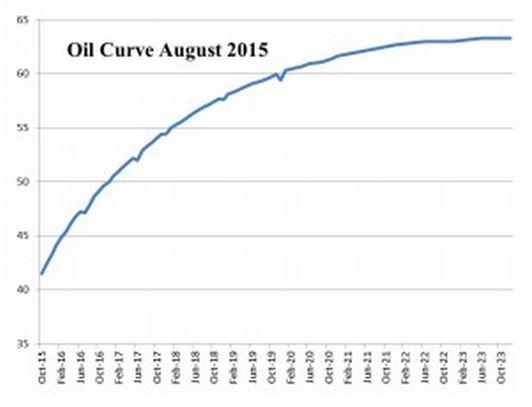

Above note, as of August oil futures price curve eight years out 2015 - 2023, $41 to $64/bbl. Since August, we understand that this curve has slightly modified to $45 - $61/bbl.

Note the difference between the 2012 curve predicted price, Brent $108 - 94; today's market price $45, and today's predicted 2023 price of $61.

This missive was published as an exclusive to Seeking Alpha. To access the ENTIRE text for FREE on Seeking Alpha, please click here. The Nattering One does not receive remuneration if you register, only satisfaction.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Comments