Oil: Shale Tight Oil Disrupting The Paradigm? - Part 2

Summary

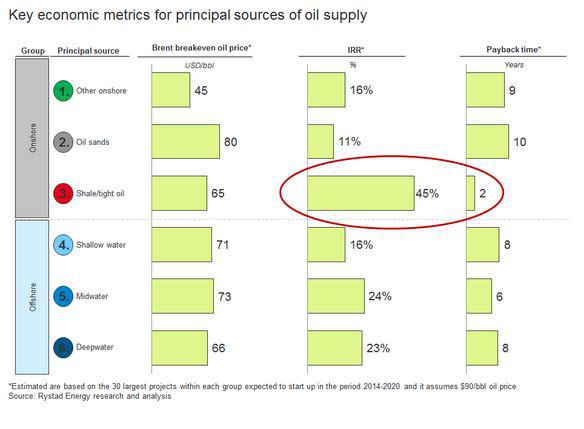

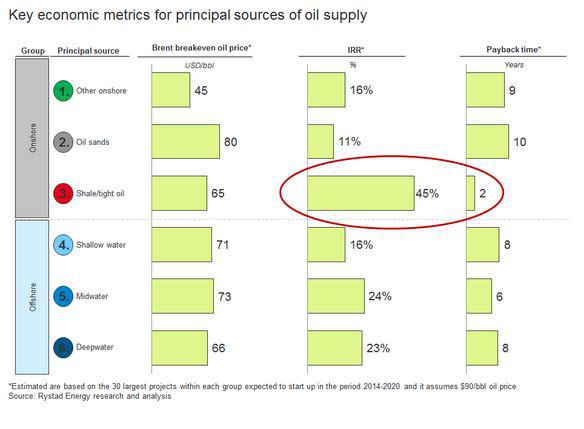

Examination of IRR (internal rate of return) and payback time for various oil sources.

Examination of cash or shut-in costs.

Examination of upstream capital costs.

Discussion of potential disruption in the oil and gas paradigm by shale tight oil.

In case you missed it, in our last missive, Oil: Shale Disrupts The Cost Paradigm?, we discussed:

- Discussion of oil futures pricing curve.

- Discussion of breakeven, marginal, production and cash cost.

- Examination of accounting methods for oil and gas concerns.

- Examination of shale and worldwide breakeven costs.

In today's missive, we examine and discuss: shale tight oil IRR (internal rate of return) and payback time; cash or shut-in costs; upstream capital costs; and potential disruption in the oil and gas paradigm by shale tight oil.

Examination of IRR (internal rate of return) and payback time for various oil sources.

Examination of cash or shut-in costs.

Examination of upstream capital costs.

Discussion of potential disruption in the oil and gas paradigm by shale tight oil.

In case you missed it, in our last missive, Oil: Shale Disrupts The Cost Paradigm?, we discussed:

- Discussion of oil futures pricing curve.

- Discussion of breakeven, marginal, production and cash cost.

- Examination of accounting methods for oil and gas concerns.

- Examination of shale and worldwide breakeven costs.

In today's missive, we examine and discuss: shale tight oil IRR (internal rate of return) and payback time; cash or shut-in costs; upstream capital costs; and potential disruption in the oil and gas paradigm by shale tight oil.

Shale Tight Oil IRR and Payback Time

Above note, shale tight oil has the largest IRR and shortest payback period.

Above note, shale tight oil has the largest IRR and shortest payback period.

This Brent breakeven price ($65) includes the entire lifecycle of an average shale well and such value is among the lowest when compared to other global developments. Only legacy onshore developments have a lower breakeven oil price. Shale and deepwater have a similar Brent breakeven price.

Consequently, shale competes with offshore developments when it comes to breakeven prices; however, there are other parameters to take into account such as IRR and payback time for which shale offers significantly better metrics than other developments.

North American Shale has the largest IRR among other common global oil developments while it also has the shortest payback time. The latter has been the strongest trigger for the steep shale activity increase of recent years and the emergence of small independent players. The latter needed just enough up-front investment in order to obtain an economical return in a timely manner. These companies will most likely either continue developing shale if they are in the core areas of a play or significantly drop activity in a low oil price reality.

However, for bigger players i.e. majors and large independents, the flexibility of shale activity (short payback time) is driving them towards non-shale developments for the allocation of their 2015 budget in the low oil price reality. This is based on the belief that shale activity can be easily turned on and off according to oil demand and that breakeven price for shale is constant, as it normally does for other developments. - Rystad Energy Q1 2015

This missive was published as an exclusive to Seeking Alpha. To access the ENTIRE text for FREE on Seeking Alpha, please click here. The Nattering One does not receive remuneration if you register, only satisfaction.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

As we are now a "contributor" at Seeking Alpha, our published articles, instablog and comments can be found here. Please continue to follow The Nattering Naybob here and at Seeking Alpha. We thank you for your support.

Above note, shale tight oil has the largest IRR and shortest payback period.

This Brent breakeven price ($65) includes the entire lifecycle of an average shale well and such value is among the lowest when compared to other global developments. Only legacy onshore developments have a lower breakeven oil price. Shale and deepwater have a similar Brent breakeven price.Consequently, shale competes with offshore developments when it comes to breakeven prices; however, there are other parameters to take into account such as IRR and payback time for which shale offers significantly better metrics than other developments.North American Shale has the largest IRR among other common global oil developments while it also has the shortest payback time. The latter has been the strongest trigger for the steep shale activity increase of recent years and the emergence of small independent players. The latter needed just enough up-front investment in order to obtain an economical return in a timely manner. These companies will most likely either continue developing shale if they are in the core areas of a play or significantly drop activity in a low oil price reality.However, for bigger players i.e. majors and large independents, the flexibility of shale activity (short payback time) is driving them towards non-shale developments for the allocation of their 2015 budget in the low oil price reality. This is based on the belief that shale activity can be easily turned on and off according to oil demand and that breakeven price for shale is constant, as it normally does for other developments. - Rystad Energy Q1 2015

This missive was published as an exclusive to Seeking Alpha. To access the ENTIRE text for FREE on Seeking Alpha, please click here. The Nattering One does not receive remuneration if you register, only satisfaction.

There is no cost involved and it has been our experience that if you exert control (by unchecking a box of two) over your communications settings in your Seeking Alpha profile, your email inbox will not be polluted with one bit of Spam (not even the cured pork shoulder variety. Tasty even.)

Comments