The Best Is Yet To Come? We've Only Just Begun?

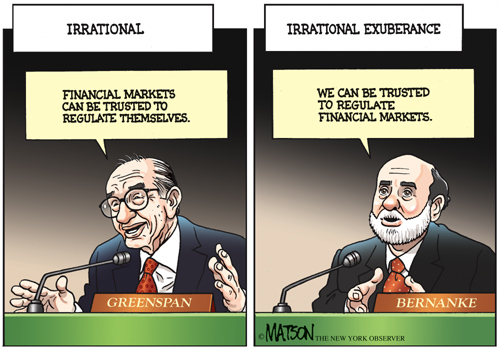

Following up on Greenspan's Short Coming? Something sounding familiar and worthy from a Naybob of IT....

The Fed has over 300 Phd's on research staff, the best quantitative and qualitative analysis toolsets and no lack of funding, yet they have NEVER predicted a recession in advance. Why?

This is demonstrative that central bank monetary policy is predicated upon:

1. false doctrine i.e. a single rate of interbank exchange FFR (federal funds rate) cannot control an entire economy. Interest rates are the price of loan funds, not the price of money.

2. inaccurate econometrics based in falsity and the false assumptions thereof. i.e. employment, GDP and inflation PCE/CPI are all calculated with cherry picked data and less than accurate business death models.

To wit, at the height of the Dot.com stock market bubble, Greenspan initiated a contractionary or "tight" monetary policy for 31 of 34 months. Prior to the MBS contagion, Bernanke tightened for 29 consecutive months.

To disambiguate, a “tight” money policy is defined as one where the ROC (rate of change) in monetary flows (our means of payment money times its transactions rate of turnover) is LESS THAN 2-3% above the rate of change in the real output of goods and services. The above describes exactly what we have been enduring leading up to and since the 2008 crisis.

These "misguided" policies; which were affected by previous central bank monetary policies, which incentivized capital market makers and participants to "behave badly", which effected serial asset bubbles; have all resulted in economic disasters. i.e, dot.com 2000, mbs 2008 and now QE/ZIRP 2016-17.

Currently, and contrary to popular belief based in false economic doctrine and expectations which are "firmly anchored" by media narrative, QE/IOER/ZIRP (Quantitative Easing, Interest On Excess Reserves, Zero Interest Rate Policy) are all proven contractionary policies which have caused the "secular stagnation" of media narrative and despite rampant market manipulation, through negative bond yields, negative swap spreads and systemic ill-liquidity, the final arbiter is telling us something. As in, this is an economic witches brew and there is something in this more than natural.

Witness, as a result of these policies, capital development and monetary flows have been sequestered (i.e. velocity in MVt is dormant), while Yoy growth rates in "means of payment" (i.e. Roc in MVT) in the last seven years since the crisis, have contracted on a magnitude of 97% . i.e. Jan 2009 = 57; as of 11-25-2015 = 2.

This is a massive ongoing contraction that has global implications i.e. we catch cold, they get the flu. To wit the ongoing global economic contraction which has pulled every country into "recession", and if you believe China's GDP numbers, at least halving their double digit growth rate, and cratered the commodities, high yield, junk bond and energy sectors. i.e. the bulk of good paying jobs and responsible for our "recovery" from the last crisis.

Since the 2008 crisis, junk and HY debt markets were the main source of leveraged stock buyback, MA, dividends, small cap and 20% of all energy sector funding. Due to ZIRP, market participants stretching for yield had junk risk debt selling at investment grade prices. With this dysfunction meeting risk off reality since mid 2014, and growing uglier by the day, it is only natural, as has happened many times in the past, for equity valuations to follow the downward junk bond vortex.

The Fed happily drinks its own econometric falsity punch, and with an unfortunately necessary (to get off the zero bound) rate hike coming, the "robust" American economy is about to be exposed for the smoke and mirrors it truly is: the fog a mirror loans of the sub prime auto sector, a rebate check to spend (i.e. low commodities, energy, oil and gasoline prices), coupled with the new sub prime agency mortgages i.e. no source down, 97% LTV, 60%+ DTI ratios. Deja Vu, all over again?

With the cheap funding for record leveraged stock buybacks that has propped stock market prices gone, with corporate revenues and profits plunging, amidst global economic contraction, and the emasculated (outsourced to labor at the margin; who cannot afford to buy the iphones they make for us) American economy being anything but the statistically proclaimed "robust", you can bet, the best is yet to come...

Bottom line: Witness all the dysfunction... it is called capitalism for a reason, and without the ability for capital to grow and flow, it cannot, will not and does not function properly. Solutions?

Given the situation we are in, with limited upward and downward price and wage flexibility, unless monetary flows EXCEED the rate of change in real output (or at least the rate of change of asked prices) by GREATER THAN 2-3%, output can't be sold, production will be cut back, incomes will decline, and layoffs will ensue... and we've only just begun.

Comments