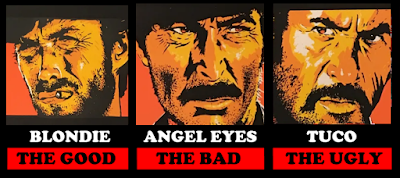

The Sad Hill Trio Ride Again?

Our unprecedented in depth coverage of the repo ruckus finishes, following up on Part 11: Sad Hill Unearthed?

Above, note when the tide rises above the line... since June 1st SOFR (repo) costing MORE than BOTH unsecured FX synthetic repo (USD 1yr dollar swaps) AND thirty day LIBOR. For most of 2017 and 2018 those costs were at, near or less, depending on the terms or size of the entity involved. Take away: With IOER getting cut below those levels, if secured costs more than unsecured, where might the risque dancers go?

Aside from MMF's and broker dealers, who is one of the largest suppliers of cash (holding collateral asset) in repo? Private and Chartered banks are, and the repo market is full of smaller dealers who make markets in UST and Agency while financing the non banks to the tune of $2.2 trln. Hedge funds and MREIT's come to mind. Moving West...

The repo process flow graphic in Sad Hill Unearthed?; as well as the two in Pale Rider?; Leave out a not so small detail or extra leg between the banks and MMF's...

MMFs are also one of the main cash lenders in the repo market. Government MMF funds lend cash to primary dealers via tri-party repos. Nearly all the funds lent by government MMF's to primary dealers via repos are overnight. Primary dealers then lend these o/n balances either o/n or term in the GCF repo market to other primary dealers or in the bilateral repo market to customers.

1) prime MMFs invest in unsecured and secured private debt as well as Treasuries

and Agency debt; 2) government MMFs invest in Treasuries, Agency debt, and repurchase agreements (repos) collateralized by Treasuries or Agency debt.

Government MMF's cannot hold liabilities issued by the banks. Instead, government MMF's hold securities issued by the UST and agencies, which exempts them from floating NAV requirements. Said MMF "reform" shifted $1.2 trln from prime to government money market funds.

As of September 30, 2019 US Government and Treasury MMF holdings in blns. WAM = 30 - 35 days; Total 2650; Agency 1820 (69%); FHLB 500 (19%). Repo counter party foreign bank 648 (24%). Take aways: Heavily short term, agency - FHLB paper, foreign repo.

Government MMF funds lend cash either o/n or term to the FHLBs via the purchase of unsecured FHLB agency discount notes and floating rate securities. The FHLBs then lend those MMF funds to foreign banks via o/n fed funds trades (FHLB liquidity portfolio) and to U.S. banks via secured advances (FHLB loan portfolio), which fund the banks HQLA portfolios. The missing leg described and depicted above make the FHLB a huge, and anything but trivial intermediary between the banks, foreign banks and the MMF pipeline.

For the three month horizon, FHLB advances fund U.S. banks lending via FX swaps to foreign entities viz from Japan or Europe (negative rate zones) without access to other funding markets. While most lenders in the Eurodollar market are MMFs and non financial corporations, the biggest lender (90%) in the fed funds (FF) market are the FHLB's. Although secured repo and SOFR based upon it (stable as a pissed off three legged horse) have replaced unsecured FF and LIBOR respectively, there are flows that FF still serves.

The FHLB's lend in the o/n fed funds (FF) market to foreign banks, who then park the proceeds at the Fed to collect IOER. In irony, the GSE's such as FHLB cannot park in the remunerated IOER zone, but can park at the Fed in zero interest on demand deposits (negative carry) OR o/n RRP if they can wait until 3:30 for their cash. Note: this intraday ill liquidity applies to all parties utilizing RRP.

Distinction: FHLBs trade with foreign banks only through their $149 bln liquidity portfolio (50% fed funds; 39% RRP). Thus, the foreign bank trade in o/n FF and RRP are key components of FHLB HQLA (liquidity) portfolio.

Foreign bank FX USD swap and o/n FF funding, on FF/RRP income, FHLB lending to larger banks (GSib) via notes, liquidity in FICC, FHLB o/n liquidity, income and ability to roll over their short term debt. If the FHLB gets in trouble, they can tap an internally mandated $100 bln portfolio to pay off maturing liabilities, before having to call in advances extended to member banks, which could start a systemic cascade. Speaking of which...

Banks can use relatively ill-liquid assets, like whole loans (residential, commercial, mortgages, auto, student) as collateral against FHLB cash advances of +30 days. Bank collateral is cheerfully accepted in three types of pledges each with a nominally increasing haircut or collateralization: actual delivery, or specifically listed as on this here sheet, or just put it unlisted under a wrapped blanket lien and tell me what you think its worth. We are not making this up...

Banks can then use those FHLB advances to purchase HQLA (FHLB bonds = Agency and in the case of Government MMF = UST) which will improve the bank's LCR. FHLB advances less than 30 days: the bank must hold government bonds (and convenient FHLB bonds) or reserves equal to 25% of the loan amount.

By borrowing from the FHLBs to purchase longer duration FHLB bonds, which asset side count toward the LCR with only a 15% haircut, a bank could improve its LCR further. Bonus, liability side when a bank gets an advance of +30 days, it doesn’t count since it is longer than the LCR stress period. Excluding deposits, those pledged pigs in a blanket with no FHLB recourse, account for 25% of all long term funding at the nation’s largest commercial banks. Whoa boy!

Tuco purturbed, perplexed and peeved... let me get this straight, you avoided a larger haircut, dodged the unencumbered 30 day bouncer, and danced the night away at the repo club, all by Slim handing you some cash and/or his magical chit, in exchange for holding two pigs in a poke overnight. Which he then collateralized to the MMF investors? You gotta be kiddin.

As of June 30, 2019: outstanding advances 686.5 bln. Commercial banks are the largest FHLB member borrowers with $433 bln or 63.1% of advances outstanding. For those secured advances, the banks pledged Whole Loan collateral: multi family, heloc, agency CMO 19%; others student, auto, ag. etc. 9% and commercial RE 19%. Considering the CRE downturn (WeWork) 47% bottom of the barrel repo collateral.

Angel Eye's grinning from ear to ear: Pure magical transmogrification I tell ya. You just can't make chit or sh*t like this up. In the case where one wants to fund HQLA, short (FHLB advances) or long (bond) for just "good ol times" in the repo club... Slim's is da place my man.

Tuco demystified: whole loan encumbered pork became cash for chaos, and/or instant HQLA from the MMF via Slim's pawn shop, magical maturity and collateral transformation. Laughing loudly: So there is something in this more than natural. But that's not all you get because there's a distinct odor in the air, and something is rotten in Denmark.

More to come, with Tuco and Angel Eye's help, the Man With No Name finally pins down the infamous Slim in the apropos named epic finale Part 13: The Man With No Name? Stay tuned, no flippin.

Recommended Reading:

A Fistful Of Dollars?

For A Few Dollars More?

The Good, The Bad And The Ugly?

A Coffin Full Of Dollars?

A Dollar To Die For?

The Devil's Dollar Sign?

The Million Dollar Bloodhunt?

Blood For a Dirty Dollar?

High Plains Drifter?

Pale Rider?

Sad Hill Unearthed?

A Negative Disposition?

A Wayward Italian in Kansas?

First Rule Of Bond Market: You Do Not Talk About Keynes?

I smelled somethin rotten, things are never quite what they seem. - Angel Eye'sTuco, Angel Eyes and The Man With No Name are hot on the trail of the infamous Slim in Part 12: The Sad Hill Trio Ride Again? and discuss: UST negative carry, unsecured vs secured funding cost, MMF's, banks and the hidden pawn shop in repo.

Since the GFC, interbank lending and the asset backed commercial paper (ABCP) market have disappeared, repo volumes have declined, and banks have generally shied away from unstable (volatile) unsecured lending. However...

Above, as if the negative carry for holding short duration UST (less than 1yr yields have been below IOER since the GFC) wasn't bad enough for market actors, remember... it costs more to fund a UST in repo than the instrument returns on yield - The Million Dollar Bloodhunt?Moving West... HQLA assets (reserves, UST, substitutes) held against money market liabilities that mature in less than 30 days cannot be encumbered, and thus can only be funded unsecured. At least that's what they say. Hence, the HQLA lament: If only we had a way to cheaply fund unsecured...

Above, note when the tide rises above the line... since June 1st SOFR (repo) costing MORE than BOTH unsecured FX synthetic repo (USD 1yr dollar swaps) AND thirty day LIBOR. For most of 2017 and 2018 those costs were at, near or less, depending on the terms or size of the entity involved. Take away: With IOER getting cut below those levels, if secured costs more than unsecured, where might the risque dancers go?

Imagine financial institutions dabbling in unstable alternatives to deposits or repo such as FX swaps or synthetic repo? - Pale Rider?A bank faced with NIM compression can 1) raise their lending rates 2) lower their deposit rate and/or charge negative rates for deposits 3) seek margin in assets other than deposits. Re: the latter, some have substituted less stable wholesale funding for deposits. Careful where you dance? Along those lines...

Aside from MMF's and broker dealers, who is one of the largest suppliers of cash (holding collateral asset) in repo? Private and Chartered banks are, and the repo market is full of smaller dealers who make markets in UST and Agency while financing the non banks to the tune of $2.2 trln. Hedge funds and MREIT's come to mind. Moving West...

The repo process flow graphic in Sad Hill Unearthed?; as well as the two in Pale Rider?; Leave out a not so small detail or extra leg between the banks and MMF's...

MMFs are also one of the main cash lenders in the repo market. Government MMF funds lend cash to primary dealers via tri-party repos. Nearly all the funds lent by government MMF's to primary dealers via repos are overnight. Primary dealers then lend these o/n balances either o/n or term in the GCF repo market to other primary dealers or in the bilateral repo market to customers.

1) prime MMFs invest in unsecured and secured private debt as well as Treasuries

and Agency debt; 2) government MMFs invest in Treasuries, Agency debt, and repurchase agreements (repos) collateralized by Treasuries or Agency debt.

Government MMF's cannot hold liabilities issued by the banks. Instead, government MMF's hold securities issued by the UST and agencies, which exempts them from floating NAV requirements. Said MMF "reform" shifted $1.2 trln from prime to government money market funds.

As of September 30, 2019 US Government and Treasury MMF holdings in blns. WAM = 30 - 35 days; Total 2650; Agency 1820 (69%); FHLB 500 (19%). Repo counter party foreign bank 648 (24%). Take aways: Heavily short term, agency - FHLB paper, foreign repo.

Government MMF funds lend cash either o/n or term to the FHLBs via the purchase of unsecured FHLB agency discount notes and floating rate securities. The FHLBs then lend those MMF funds to foreign banks via o/n fed funds trades (FHLB liquidity portfolio) and to U.S. banks via secured advances (FHLB loan portfolio), which fund the banks HQLA portfolios. The missing leg described and depicted above make the FHLB a huge, and anything but trivial intermediary between the banks, foreign banks and the MMF pipeline.

For the three month horizon, FHLB advances fund U.S. banks lending via FX swaps to foreign entities viz from Japan or Europe (negative rate zones) without access to other funding markets. While most lenders in the Eurodollar market are MMFs and non financial corporations, the biggest lender (90%) in the fed funds (FF) market are the FHLB's. Although secured repo and SOFR based upon it (stable as a pissed off three legged horse) have replaced unsecured FF and LIBOR respectively, there are flows that FF still serves.

The FHLB's lend in the o/n fed funds (FF) market to foreign banks, who then park the proceeds at the Fed to collect IOER. In irony, the GSE's such as FHLB cannot park in the remunerated IOER zone, but can park at the Fed in zero interest on demand deposits (negative carry) OR o/n RRP if they can wait until 3:30 for their cash. Note: this intraday ill liquidity applies to all parties utilizing RRP.

Distinction: FHLBs trade with foreign banks only through their $149 bln liquidity portfolio (50% fed funds; 39% RRP). Thus, the foreign bank trade in o/n FF and RRP are key components of FHLB HQLA (liquidity) portfolio.

Any contraction in the o/n FF channel would impact reserves raised in o/n FF, which get lent in the FICC cleared o/n GC repo market to help absorb excess collateral in the system. Volume in o/n GC repo dwarfs o/n FF, an aggressive bid for o/n FF from arbs could eliminate the spread between o/n FF and GC rates. - Pale Rider?Distinction: FHLBs trade with U.S. banks only through advances or loan portfolio. Any contraction in either of the above two channels could result in LESS of all the following:

Foreign bank FX USD swap and o/n FF funding, on FF/RRP income, FHLB lending to larger banks (GSib) via notes, liquidity in FICC, FHLB o/n liquidity, income and ability to roll over their short term debt. If the FHLB gets in trouble, they can tap an internally mandated $100 bln portfolio to pay off maturing liabilities, before having to call in advances extended to member banks, which could start a systemic cascade. Speaking of which...

Are there not enough participants willing to part with their UST (HQLA) to accommodate the transformation of an over abundance of lesser grade and junk collateral? - Blood For a Dirty Dollar?Angel Eye's slowly toked on his pipe while waxing nostalgic... Magical I tell ya, just two pigs in a blanket, didn't want to get cleaned up too much, or deal with the bouncer, and wanted to dance in the repo club, which only took cash money or special chit. Tuco asked, whatever did you do to get in? Angel Eye's toked hard: I went to Big Slim's pawn shop and they hooked me up right...

Banks can use relatively ill-liquid assets, like whole loans (residential, commercial, mortgages, auto, student) as collateral against FHLB cash advances of +30 days. Bank collateral is cheerfully accepted in three types of pledges each with a nominally increasing haircut or collateralization: actual delivery, or specifically listed as on this here sheet, or just put it unlisted under a wrapped blanket lien and tell me what you think its worth. We are not making this up...

Banks can then use those FHLB advances to purchase HQLA (FHLB bonds = Agency and in the case of Government MMF = UST) which will improve the bank's LCR. FHLB advances less than 30 days: the bank must hold government bonds (and convenient FHLB bonds) or reserves equal to 25% of the loan amount.

By borrowing from the FHLBs to purchase longer duration FHLB bonds, which asset side count toward the LCR with only a 15% haircut, a bank could improve its LCR further. Bonus, liability side when a bank gets an advance of +30 days, it doesn’t count since it is longer than the LCR stress period. Excluding deposits, those pledged pigs in a blanket with no FHLB recourse, account for 25% of all long term funding at the nation’s largest commercial banks. Whoa boy!

Tuco purturbed, perplexed and peeved... let me get this straight, you avoided a larger haircut, dodged the unencumbered 30 day bouncer, and danced the night away at the repo club, all by Slim handing you some cash and/or his magical chit, in exchange for holding two pigs in a poke overnight. Which he then collateralized to the MMF investors? You gotta be kiddin.

As of June 30, 2019: outstanding advances 686.5 bln. Commercial banks are the largest FHLB member borrowers with $433 bln or 63.1% of advances outstanding. For those secured advances, the banks pledged Whole Loan collateral: multi family, heloc, agency CMO 19%; others student, auto, ag. etc. 9% and commercial RE 19%. Considering the CRE downturn (WeWork) 47% bottom of the barrel repo collateral.

Angel Eye's grinning from ear to ear: Pure magical transmogrification I tell ya. You just can't make chit or sh*t like this up. In the case where one wants to fund HQLA, short (FHLB advances) or long (bond) for just "good ol times" in the repo club... Slim's is da place my man.

Tuco demystified: whole loan encumbered pork became cash for chaos, and/or instant HQLA from the MMF via Slim's pawn shop, magical maturity and collateral transformation. Laughing loudly: So there is something in this more than natural. But that's not all you get because there's a distinct odor in the air, and something is rotten in Denmark.

More to come, with Tuco and Angel Eye's help, the Man With No Name finally pins down the infamous Slim in the apropos named epic finale Part 13: The Man With No Name? Stay tuned, no flippin.

Recommended Reading:

A Fistful Of Dollars?

For A Few Dollars More?

The Good, The Bad And The Ugly?

A Coffin Full Of Dollars?

A Dollar To Die For?

The Devil's Dollar Sign?

The Million Dollar Bloodhunt?

Blood For a Dirty Dollar?

High Plains Drifter?

Pale Rider?

Sad Hill Unearthed?

A Negative Disposition?

A Wayward Italian in Kansas?

First Rule Of Bond Market: You Do Not Talk About Keynes?

Comments