Nice Recovery, Not! - 2

A followup to last weeks post regarding a US Conference of Mayors report...

A short video regarding "the recovery" U.S. Jobs Rose Since '08 Crisis, But Pay Is 23% Less

A report by an organization representing U.S. cities said on Monday, jobs growth in the U.S. since the 2008 recession has been undermined by lower wages, with workers earning an average 23 percent less than earnings from jobs which were lost.

According to the report by the United States Conference of Mayors, which represents cities with populations of more than 30,000, the average annual salary in sectors where jobs were lost - particularly manufacturing and construction - during the 2008-9 financial crisis was $61,637.

The report said, job gains through the second quarter of 2014 in comparative sectors showed average wages of $47,171, implying $93 billion in lower wage income.

The report also showed that the majority of metro areas - 73 percent - had households earning salaries of less than $35,000 a year.The Nattering One muses... This is a real house of cards in which, many pundits wonder what will be the trigger to the next down cycle or collapse?

In a report, the Fed admitted that were it not for rallies around their policy announcement days, the current stock market value would be cut in half.

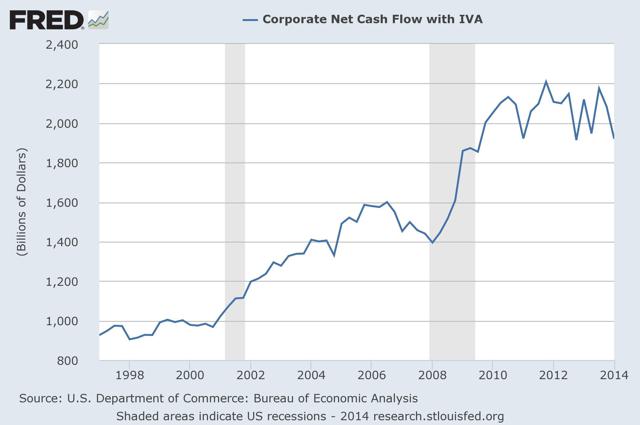

On the surface, corporate net cash flows appear to be high. However, since 2010 they have painted a sideways flag waving pattern, and are currently on the downswing.

Due to double digit stagflation, consumer spending in seasonally adjusted dollars gives the illusion of being at an all time high.

Yet with 1 billion sqft in retail space sitting vacant, and major US and global chains announcing a large number of further store closings and layoffs, it appears that we are heading for a retail apocalypse.

With declining wages and chronic underemployment consumer spending will pull back. What happens then: The cheap money well dries up? Corporate net cash flow declines? EPS gets negatively impacted?

Lower sales, lower cash flow, higher rates, less money to buy back shares and prop up stock prices, something resembling real financial results get reported...

leading to less support at the artificially inflated price levels, resulting in liquidation into weakness and a thinly traded market. Food for thought.

Comments