The Fallout 7: More Negative Signs

Continued from Part 6. After our trip to the Diner, we ordered up some more negative signs.

Baltic Dry Index:

Click for a short video on this leading indicators crash.

The summer brought no relief as the Baltic Dry Index (BDI) is breaking down to new lows. The BDI suggests demand in the global economy is reaching multiyear lows - since the beginning of the year, the BDI is down 65%.

Bond markets:

US Treasuries: purchases from July 1, 2013, through June 30, 2014 increased the US gross national debt +$864 billion.

Who bought? Foreigners +$418 billion in Treasuries; the Fed +$446 billion.

What happens when the Fed tapers their purchases? What if foreigners also taper their purchases?

Global 10 Year Yields: These are all at recession levels, what is the bond market saying? Are equities listening?

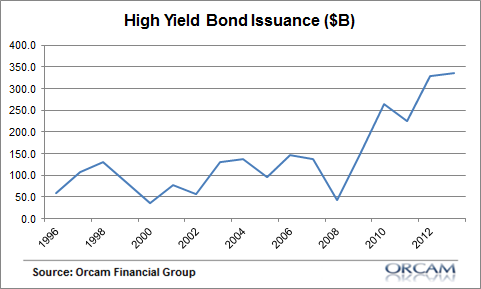

High Yield Bonds: yields for spec grade credit issuers are near all time lows.

Yet issuance has been at an all time high.

When high yield bond funds start making that whooshing and sucking sound, like the surf going out before a tidal wave, beware...

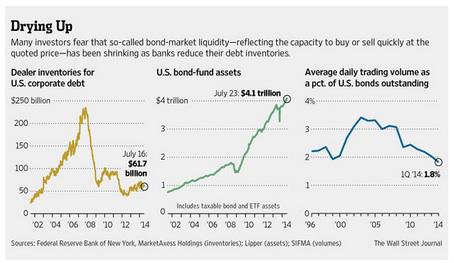

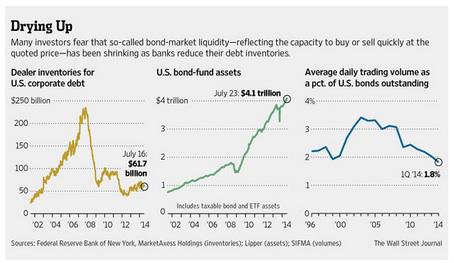

Since 2008, bond fund assets went from $1.6 trillion to $4.1 trillion. Conversely, dealer inventories of corporate bonds have shrunk 75% and daily trading volumes have shrunk 50%.

Translated, the liquidity in this market has gone up in smoke, like Jeannie trying to avoid Major's Nelson & Healy.

Junk and high yield bonds go down first, as no one wants to hold on to highly leveraged, under insured, depreciating paper. Hint, watch the high yield bond ETF outflows.

Prices will rise, yields will fall, participants will attempt to liquidate, credit spreads will surge (junk vs Treasury yields).

Since the "higher grade" paper gets liquidated first, now the holders attempt to liquidate their less desirable paper into the teeth of a buyers markets, then the dominoes start falling, and it deja vu, all over again.

Who's on the hook for the underfunded swap that "backs" that paper? How much of that "backing" has been used as collateral to leverage other deals? You get the picture.

In our next installment, I think we're going to dig up even more negative signs than Colonel Nathan Jessup. Why? I want the Truth & You can't handle the Truth! More to come in Part 8.

Baltic Dry Index:

Click for a short video on this leading indicators crash.

The summer brought no relief as the Baltic Dry Index (BDI) is breaking down to new lows. The BDI suggests demand in the global economy is reaching multiyear lows - since the beginning of the year, the BDI is down 65%.

US Treasuries: purchases from July 1, 2013, through June 30, 2014 increased the US gross national debt +$864 billion.

Who bought? Foreigners +$418 billion in Treasuries; the Fed +$446 billion.

What happens when the Fed tapers their purchases? What if foreigners also taper their purchases?

Global 10 Year Yields: These are all at recession levels, what is the bond market saying? Are equities listening?

High Yield Bonds: yields for spec grade credit issuers are near all time lows.

Yet issuance has been at an all time high.

When high yield bond funds start making that whooshing and sucking sound, like the surf going out before a tidal wave, beware...

Since 2008, bond fund assets went from $1.6 trillion to $4.1 trillion. Conversely, dealer inventories of corporate bonds have shrunk 75% and daily trading volumes have shrunk 50%.

Translated, the liquidity in this market has gone up in smoke, like Jeannie trying to avoid Major's Nelson & Healy.

With a larger $ value market and thinner liquidity, when all the elephants try to squeeze out the door at the same time, this will result in panic and a huge gap down.

Junk and high yield bonds go down first, as no one wants to hold on to highly leveraged, under insured, depreciating paper. Hint, watch the high yield bond ETF outflows.

Prices will rise, yields will fall, participants will attempt to liquidate, credit spreads will surge (junk vs Treasury yields).

Since the "higher grade" paper gets liquidated first, now the holders attempt to liquidate their less desirable paper into the teeth of a buyers markets, then the dominoes start falling, and it deja vu, all over again.

Who's on the hook for the underfunded swap that "backs" that paper? How much of that "backing" has been used as collateral to leverage other deals? You get the picture.

In our next installment, I think we're going to dig up even more negative signs than Colonel Nathan Jessup. Why? I want the Truth & You can't handle the Truth! More to come in Part 8.

Comments